#19 Episode - Venturing in Taxes

43.4% Capital Gains May Be Coming, But Probably Not For Emerging Managers & LPs

Taxes have been on a lot of people’s minds since President Joe Biden unveiled the American Families Plan and his proposed tax policy last week:

39.6%—top marginal income tax rate

43.4%—long term capital gains rate for households earning $1+ million

We don't know how the President’s plans or tax policy will play out in Congress, but when has that ever stopped us from weighing in on social media?

Not that tweeting ever makes good tax policy, but there seem to be two primary responses on Twitter:

“Tax the damn rich” and “socialists are hijacking our democracy.”1

However, this tweet seems to be most on-point:

A lot of Beltway insiders think Biden’s original tax plan will not get passed. But for the sake of argument, let’s assume it passes as proposed and QSBS goes untouched.

Will this statement hold true, then?

I think it will. Early-stage venture will become more attractive because of QSBS.

Wait, what is QSBS?

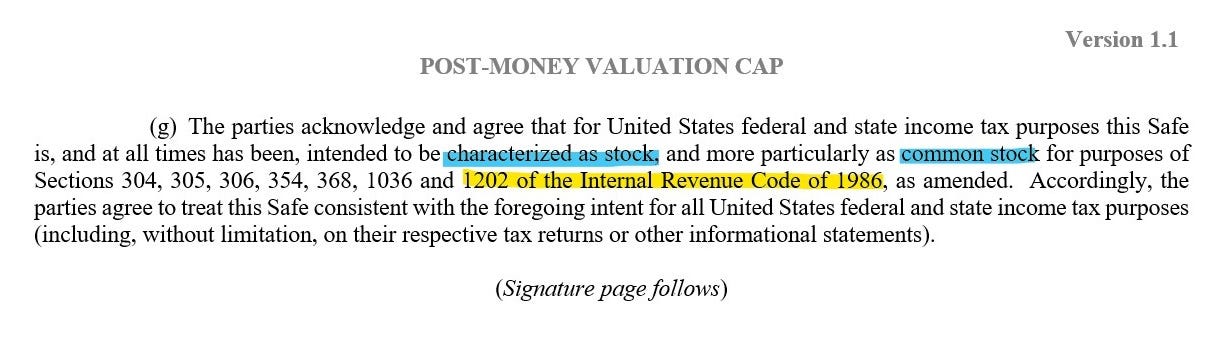

QSBS stands for “Qualified Small Business Stock,” which is a tax exemption found in Section 1202 of the US tax code:

With QSBS, each taxpayer is eligible to receive tax-free gains from the sale of their stock, up to the greater of (i) $10 million, or (ii) 10x one’s investment in a company.

1. Benefit of QSBS

To give you a macro-level idea of this tax exemption, here are some stats:

In 2019, Congress estimated federal taxpayers saved $1.2 billion from QSBS. That doesn’t include the 46 states that recognize it (California is a notable exception).2

The average QSBS savings was ~$430,000 per taxpayer from 2003-2016.3

If the long term capital gains rates increase to 43.4%, then each taxpayer with qualifying stock on a sale of $10+ million will save $4.34+ million.

For venture funds, QSBS applies per portfolio company based on each limited partner.

QSBS applies to each owner of a pass-thru entity, and because venture capital funds are taxed as such, QSBS applies to each limited partner.4 If a venture capital fund returns five portfolio companies for $10 million each, each taxpayer will have the potential to earn 100% of tax-free federal income, up to $50 million.

It is hard to convey how powerful this law is or will become. Professionally written articles from lawyers and accountants rarely do it justice. We turn to memes instead:

Elizabeth Yin offers a simple example in the context of startup employees:

But QSBS is often not that simple or easy. One of my clients learned this the hard way.

My client’s lead investor, who sat on the company’s board, forced her to take stock options (no early exercise) instead of restricted stock at low fair market value. At the same time, the board issued the investor restricted shares as a board member. His cronies on the board approved it. The same law firm represented the company and investors.

At exit, my client owned ~1.5% of the company she co-founded. The bulk of her equity was tied to stock options, which were valued at over $1 million.

The $1+ million she thought she was receiving ended up being worth substantially less because all of her gains were taxed as ordinary income.

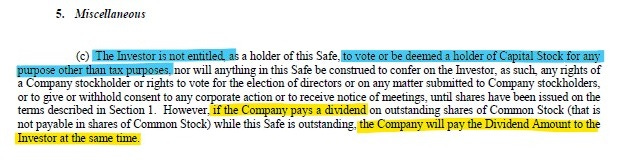

QSBS didn’t apply because—like convertible notes or warrants—options don’t qualify as “stock” until exercised (Safes will be addressed later in this article).

Meanwhile, the investor with significant preferred stock holdings, plus restricted common stock, timely filed his Section 83(b) notice and enjoyed a tax-free exit.

2. Who Qualifies?

QSBS has been labeled a “tax-free boon,” “the angel investor loophole” and a “quiet windfall.”

But the heaviest jab at VCs has come from Scott Galloway:

“[QSBS] is nothing but a transfer of wealth from other taxpayers to venture capitalists”.

QSBS is a tax exemption for everyone, not just VCs, but Scott is directionally accurate. It’s perfectly aligned to the early-stage VC model. Plus, emerging managers and limited partners benefit the most from QSBS because it applies to them individually.

Here’s who qualifies and who doesn’t:

Essentially, everyone qualifies except for corporations and retirement accounts (watch out for Alt-IRAs!)

3. How to Qualify?

To qualify for QSBS, simply follow these three steps:

QSBS is a complex area of tax law. There are many nuances to it and taxpayers often fail to meet the criteria. But emerging managers would rather not spend a ton of money just to ask their lawyers and tax accountants if each portfolio company qualifies for QSBS. Instead, they want a general understanding of how it works, what questions to ask, and what they should watch out for.

General Understanding

QSBS is like parking validation. Taxes are like parking fees. Why pay to park?

To qualify your stock as QSBS, you don’t need a government stamp of approval. Instead, you must timely report your QSBS gains on Schedule D (1040) and Form 8949 on your tax return of the tax year the stock is sold. It’s up to you to support your claim. If the IRS asks for documents and information during an audit, you may not be able to prove your shares qualify as QSBS without proper information (more on that below).

At a high level, QSBS is a function of four elements:

Time

Size of Company

Nature of the Transaction; and,

Type of Business

Here is a quick summary of the QSBS elements in more detail:

The key element in venture capital typically falls on whether the company had “aggregate gross assets” of $50 million or less around the time of qualifying investment. Most people wrongly assume valuation is important. It’s not—unicorns can qualify. The key is the cash invested in a round plus the company’s balance sheet assets “at all times,” including before and immediately after the investment.

An emerging fund client recently called me to ask about whether they would still qualify for QSBS if they invested $5 million in a portfolio company’s Series B. The company had $45 million in gross assets. My client shaved off $100,000 from its investment and was issued a tax opinion to make certain it would invest in the at less than $50 million in aggregate gross assets. That call may save the LPs up to $11.6 million in federal taxes ($4.9 million x 10 limitation tax basis x 23.8% = $11.6m), but over $21 million if Biden’s tax policy is passed ($4.9 million x 10 x 43.4% = $21m).

What Questions Should You Ask?

Here are some key questions that you should ask about your eligibility for QSBS:

Does the company meet the QSBS qualifications (C-corp, gross assets under $50 million, active business within the US)?

Have you reviewed the standard QSBS checklist from the NVCA (see below)?

Do you have all evidence & financial statements to prove there’s $50 million or less in “aggregate gross assets” both before and immediately after your investment?

Have you added standard QSBS representations and warranties and QSBS covenants to your equity financing documents?

What Should You Watch Out For?

Here are five key things to watch out for with QSBS:

If you held your shares for at least 6 months but not yet 5 years, have you looked at rolling your gains into a replacement QSBS company within 60 days of exit?5

Does the transaction qualify as “stock”* that will start the 5-year clock?6

Have you avoided disqualifying actions like significant redemptions or transfers that could affect QSBS eligibility?

Did your LPs invest early enough to benefit from QSBS on all fund investments, confirming their admission to the fund before it made any portfolio investments?

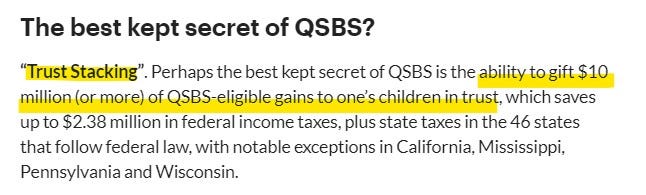

Have you looked into “trust stacking”?7

Trust stacking:

Also discussed this secret on LinkedIn:

Qualifying Safes as QSBS

Safes are a hybrid security and there’s some debate whether Safes are “equity” for tax purposes. It depends on several factors including what type of Safe (original YC Safe vs. Post-Money YC Safe, plus an unbounded number of “SAFEs” out in the wild). An analysis of this issue merits its own article, but here are the basics:

Asking for a friend: Are SAFEs equity for tax purposes—or are they something else? Specifically, in context of QSBS.

Asking for a friend: Are SAFEs equity for tax purposes—or are they something else? Specifically, in context of QSBS.

Argument Pre-Money Safes are Forward Contracts, not Equity

Arguments that Pre-Money Safes are Equity, not “Forward Contracts”

@ChrisHarveyEsq Nope. Forward contract is paying today a set price for set commodity tomorrow. A safe (and a properly designed "convertible note" are purchasing equity today. It's not a variable amount -- there is NO algorithim that changes amount. It is just not a known amount.

@ChrisHarveyEsq Nope. Forward contract is paying today a set price for set commodity tomorrow. A safe (and a properly designed "convertible note" are purchasing equity today. It's not a variable amount -- there is NO algorithim that changes amount. It is just not a known amount. @mowheeler Playing devil's advocate (the only advocate on social media): Aren't prepaid forward contracts variable in terms of shares delivered? And doesn't IRS consider certain elements of Safes to be "open transactions"? —Cash —Variable Shares —No Voting/Dividends frostbrowntodd.com/can-convertibl…

@mowheeler Playing devil's advocate (the only advocate on social media): Aren't prepaid forward contracts variable in terms of shares delivered? And doesn't IRS consider certain elements of Safes to be "open transactions"? —Cash —Variable Shares —No Voting/Dividends frostbrowntodd.com/can-convertibl…

@ChrisHarveyEsq We invest only in SAFEs and Convertible Debt that are equity. There are voting rights and a prohibition on payment of dividends to anyone. As for variable, conversion shares are not variable, they are unknown and unknowable. Big distinction

@ChrisHarveyEsq We invest only in SAFEs and Convertible Debt that are equity. There are voting rights and a prohibition on payment of dividends to anyone. As for variable, conversion shares are not variable, they are unknown and unknowable. Big distinction @iamjakestream @andrewparker @IanRountree 3/ I believe as an industry we should argue both are QSBS. CNs being aggressive and SAFE being less aggressive. As its inline with the intent of QSBS and the market has shifted to SAFEs and CNs. It might take a SAFE2 new script to become very clear that its QSBS friendly

@iamjakestream @andrewparker @IanRountree 3/ I believe as an industry we should argue both are QSBS. CNs being aggressive and SAFE being less aggressive. As its inline with the intent of QSBS and the market has shifted to SAFEs and CNs. It might take a SAFE2 new script to become very clear that its QSBS friendly

My conclusion:

Frankly, the IRS hasn’t provided solid guidance on this issue and it won’t likely be resolved for several years to come, but you can further read up on the legal analysis now (see footnote 6). For professional advice you can rely on, you should speak to a qualified tax specialist. They can help you draft an opinion letter or provide other written guidance to meet any qualified small business criteria.

For more detail on QSBS, here’s a 5 minute read from an article I drafted for Aumni

Top three mistakes VCs make with QSBS*

*Thank you to my writing group Foster for providing early comments, advice and ideas on this article! Ergest Xheblati, Stew Fortier, Roxine Kee, Halle Kaplan-Allen 🙌

If you've already subscribed, thank you so much—I appreciate it! 🙏

As always, if you'd like to drop me a note, you can email me at chris@harveyesq.com, reach me at my law firm’s website or find me on Twitter at @chrisharveyesq.

Thanks,

Chris Harvey

About 65% of Americans would support tax hikes for the wealthy, but this is split largely on party lines, with 8 out of 10 Democrats in support compared to less than half of Republicans (Source: Ipsos poll, Apr. 29, 2021).

Manoj Viswanathan, The Qualified Small Business Stock Exclusion: How Startup Shareholders Get $10 Million (Or More) Tax-Free, 120 Colum. L. Rev. 1 (2020).

Id. Section 1202 was amended in 2010 by the Creating Small Business Jobs Act of 2010 (Pub. L. No. 111-240, 124 Stat. 2504.) QSBS gain from stock acquired after September 27, 2010 had an effective tax rate of zero. In 2015, this law became permanent and 100% excluded from both capital gains and AMT preference. (14 Protecting Americans from Tax Hikes Act of 2015, Pub. L. No. 114-113, 129 Stat. 3040, 3054.) A taxpayer with QSBS gains from stock acquired after September 27, 2010 and sold after September 27, 2015 now enjoys a tax savings of 23.8% relative to normal long-term capital gains—but with Biden’s proposal, it could end up being as much as 43.4% in tax savings.

See Chris Harvey’s LinkedIn Post (2024) here. Limited partners must invest in a fund before it makes a portfolio investment to benefit from QSBS under §1202 of the Tax Code. If you join a fund after it has already made investments, you will miss out on the QSBS-eligible gains from those earlier investments. If you enter a fund after its initial closing, QSBS benefits will only apply to investments the fund makes after your entry. That's because QSBS applies on a per-taxpayer basis and venture capital funds are pass-through entities. This ineligibility is also true of warehoused investments.

See The Best Kept Secret of QSBS, Spoiler Alert: The secret is “Trust Stacking.”

See Frost Brown, Can Convertible Debt or SAFEs Qualify as QSBS for Section 1202’s Gain Exclusion? (2021).

Don't forget QSBS Sec. 1244. Even fewer folks know that their losses (if an early investor and the company fails) can be deducted against ordinary income.

I completely agree with this opinion: "50% of gross receipts must be from income other than royalties, rents, dividends, interest, annuities, and gains from sales and trades of stocks or securities during the past five tax years before the loss."