#14 Episode - LPA Terms for Emerging Fund Managers

Market Terms for Emerging VC Funds Exist, But There's No Such Thing as a Standard LPA Term Sheet

Raising a venture capital fund is one of the hardest jobs a VC can do. Just like running for public office or enlisting in special forces, it takes an unusual amount of hard work. But even hard work won’t necessarily get you to closing. Within the VC community, there are surprising elements at play that might catch you off-guard if you’re not aware of them.

This article is for emerging managers—a term that has no clear definition, but it means to me, VCs with funds (i) under $100M, and (ii) either in Fund I, Fund II, or Fund III.

I broke down this article into three parts:

Five Reasons Why Raising a Venture Capital Fund is So Difficult

Market Terms for Emerging Fund Managers

LPA Term Sheet Template

Five Reasons Why Raising a VC Fund is So Difficult

Samir Kaji, Senior Managing Director of First Republic Bank, provided five excellent reasons why raising a venture fund is difficult for emerging managers (quoting him):

The opacity of the Limited Partner (LP) landscape

Reliance on family offices

Limited Partners generally prefer to invest in proven managers, placing much more weight on access than discovery

The amount of competition for LP capital is high

The current environment

Let’s go over each one of these in more detail:

Lack of Transparency + Traditional Biases

“Although transparency has improved through efforts such as the #OpenLP efforts, it remains challenging for fund managers to assess which investors are genuinely active, the authenticity of LP interest, and the continuous shifting of investing mindsets due to variables external to the fund manager.”

The LP investing space is a traditional, closed-network bunch. It’s old power values relying on exclusivity, discretion & loyalty. That’s also true for one of the most common limited partners investing in emerging fund managers—the family office.

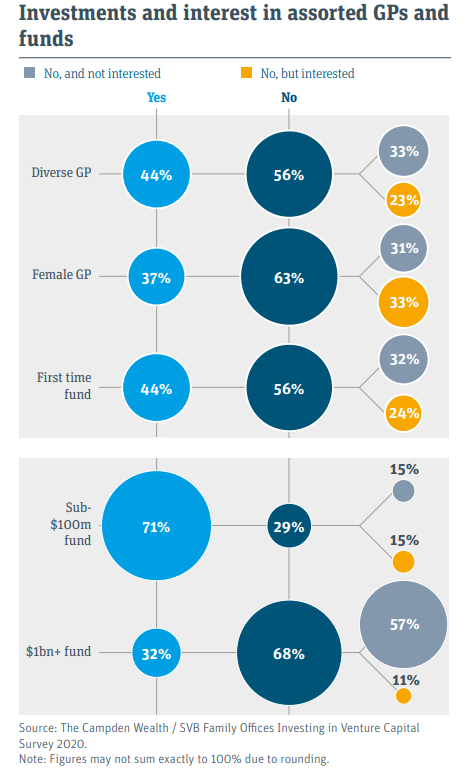

About two thirds of Family Offices surveyed said they had not backed a female GP (56% had not backed a diverse GP)—and a full third of family offices said they weren’t even interested (the same number was also not interested in backing first time fund managers):

Reliance on Two Types of LPs

“From [First Republic Bank’s] 2018 report, nearly 70% of capital going into Fund 1 offerings are from family offices and high net worth individuals.”

Even though family offices are very active in venture capital, it takes a good understanding of how their relationships and power dynamics actually work. The VC industry is rife with principal/agency issues. Family offices are no different:

Single family offices (SFOs) with 1st and 2nd generation family offices make up 72% of family office VC activity. Plus, the average SFO invests in 2 venture capital funds per year. But as Trevor Loy alluded to below, there’s a big difference between an SFO whose family anchor is still alive and one who’s not:

@Samirkaji Also, big diff between SFOs where person who generated the wealth is still alive/active vs SFOs where that person is passed/no longer active. The former are often more risk-friendly/see advantages in investing in EMs whereas latter are caretakers for beneficiaries/risk-averse

@Samirkaji Also, big diff between SFOs where person who generated the wealth is still alive/active vs SFOs where that person is passed/no longer active. The former are often more risk-friendly/see advantages in investing in EMs whereas latter are caretakers for beneficiaries/risk-averseFirst Republic Bank provides a chart showing the risk appetite for VC funds drops off significantly (<12% invest) after a third generation family office:

Risk Aversion & Credibility

“[Institutional Limited Partners] generally prefer to invest in proven fund managers, placing much more weight on access than discovery. The appetite for untested entrants is typically lukewarm at best, and managers must cast a vast net to successfully raise a fund (generally 200–500+ LPs during a Fund 1 process).”

Typically it takes at least one fund cycle, before institutional LPs are ready to commit. Unless you are Barry Eggers, don’t expect a lot of love from institutions on Fund I or II. This is also true for a third of family offices that don’t invest in Fund I GPs, at all.

Recognizing the barriers to entry in VC, some states like Maryland have early-stage venture fund programs.

For example, Mac Conwell is an emerging fund manager who participated in one of those programs from TEDCO, Maryland’s venture capital arm:

Competition

In 2019, the number of emerging fund managers in the US was ~1,200. Rolling venture funds, syndicates, and non-flagship vehicles have certainly increased that number. But the open window for closing an emerging fund is still between 18–24 months.

Covid-19 Pandemic

“The pandemic has halted travel, leaving pitch meetings with LP’s limited solely to video and phone conversations. While this does result in a more efficient process, there are many LP’s that still place high weight on meeting a partnership or individual before allocating.”

Even fund managers who have excellent credentials on paper, Fund I is never easy. There are exceptions, of course—great institutional track record, successfully exited founder or operator (while at a unicorn), or some other compelling factor. But for the vast majority of emerging fund managers, raising your first fund is the most difficult one. It can get easier, but it’s never that easy to raise a venture fund.

Market Terms for Emerging Venture Funds

About a year and a half ago, I set out to finally determine what terms were market for emerging fund managers. Here was my opening call:

Samir Kaji kindly responded with two valuable insights:

Samir’s two key insights were:

A reference to the State of Terms for Emerging VC Funds (a 2018 report)*

Expert commentary on my list of market terms for emerging managers

The 2018 report was prepared by an agency called Different, which works with emerging fund managers. Different’s report provides an in-depth benchmark of market terms that venture capital funds are offering to prospective LPs.

There are three main reference points that I used for determining what’s “market”:

Different’s 2018 VC Survey (December 2018)

Carta’s definitive guide to the LPA (September 2020)

VC Twitter + Personal Observations

There are two main touch points that I will use to reference as LP-friendly terms:

Institutional Limited Partners Association (ILPA) Term Sheets (July 2020)

ILPA Principles v3.0 (2019)

We will explore market terms, trends and LP-friendly terms for the following:

Management Fees, Performance Fees, Distributions

Fund Expenses

GP Commitments

Hurdle Rates (Preferred Return)

Clawbacks, Key Person Clauses, GP Removal

Reporting

For a good explanation of LPA terms, please open the ILPA Principles v3.0.

Management Fees, Performance Fees, Distributions

Market Terms:

“2 and 20”—2% management fees per year & 20% carried interest

@VCStarterKit published an excellent post on this topic: How VCs Make Money

Trending:

2.5% initial mgmt fee/yr., tapering down to average ~1.8-2%/yr over the life of fund

Vast majority (66%) of emerging fund managers front load their mgmt fees

52% of emerging funds have an initial annual mgmt fee of 2.5%

45% of funds use 2% initial mgmt fee

30% carried interest is being charged by a lot of rolling venture fund managers, and a small portion of top performing VC funds; typically, only if the fund manager performs at least 2x to 3x returns.

While emerging fund managers are attracted to this alternative fee model, and many high performing GPs ask for it, please note that less than 5% of all venture capital funds return more than 3x net and 20% is industry standard, so don’t waste a lot of time negotiating a complicated carry.

Don’t reduce your carry to 10-15% because that can have a ‘deleterious effect.’

“If you do your job well, 20% will make you a bundle.” —Fred Wilson

LP-Friendly:

Fund Expenses

Market Terms:

$150,000 median cap on formation expenses

$222,000 average cap

What expenses are paid by the fund and what expenses are paid by the GPs are often heavily negotiated

Trending:

$50,000 to $250,000+ in fund formation legal fees plus related organizational costs

While a $500,000 cap seems reasonable, with Covid-19 here, LPs are putting downward pressure on GPs to get fund formation costs under control.

Pre-pandemic, 69% of LPs reported seeing organizational expense caps increase from 0.5% to above 1.5% of capital raised.

LP-Friendly:

GP counsel has incentive to conduct a less efficient process, resulting in higher legal costs. LPs ultimately foot the bill. A small number of law firms represent the majority of GPs—so it means market forces do little to keep costs in check for everyone.

LPs also have noted that negotiations are sometimes used against them in separate fund negotiations, where the same external GP counsel is engaged.

GP Commitments

Market Terms:

1-2% of total capital commitments to the fund

In 2018, the median number of GPs in sub-$100M venture funds was 2 partners, which means 2% in a $50M fund would result in $500K GP commit per partner

Trending:

Management fee offsets against the GP commit are becoming more prominent:

Many rolling fund managers are using a significant portion of their management fees (80%) to offset their GP commits. Some LPs have questioned whether this practice adds skin in the game, as it functions more like as a transfer of fees by LPs to the GPs with tax advantages rather than an after-tax payment by GPs.

Other ways to offset mgmt fees include bank loans, self-directed IRAs, or even transfers of equity from prior investments through “warehoused deals”—previous angel investments transferred from the GP into the Fund’s name.

As Samir Kaji said: “The GP commitment as a % of personal liquidity is more telling.” Related to this concept, Chamath Palihapitiya asks GPs three questions:

LP-Friendly:

2-3% cash-money

From the ILPA:

“The GP commitment should be contributed in cash as opposed to contributed through the waiver of management fees or via specialized financing facilities.”

Hurdle Rates (“Preferred Return”)

Market Terms:

No hurdle rate or preferred return

Trending:

~33% of emerging VC funds have a hurdle rate

8% is the median hurdle rate of those funds that have one

LP-Friendly:

8%/year hurdle. According to the ILPA, hurdles appear to be industry standard (they’re not for emerging funds):

“Nearly 90% of respondents indicated that hurdle rates had not moved over the last 12 months, belying an oft-cited trend evidenced by only a small number of managers that have decreased or removed hurdles in recent funds.”

Clawbacks, Key Person Clauses, GP Removal

Market Terms:

In 2018, about 55% of funds had a Key Person Clause in their legal agreements, while ~65% of funds had some form of a GP Clawback.

GP Clawbacks:

In funds without a hurdle rate, a “cushion” is typically required before Carried Interest distributions may be made—for example, the value of the Fund’s portfolio should be equal to 120% of unreturned capital.

In funds with a hurdle, the most common approach has been to have a single clawback calculation at the time of the fund’s closing or liquidation.

Discretionary by GP: “As much time devoted to the fund as is necessary”.

Trending:

Interim clawbacks occurring become increasingly common in recent years (e.g., at the end of the Fund’s lifecycle).

75% of funds reported a gross negligence standard of care, which implies a high standard for establishing cause in the case of a removal

LP-Friendly:

Avoid GP clawbacks at all cost:

30% of carried interest distributions to be deposited into escrow

ILPA strongly encourages joint and several liability of GP members

In absence of escrow, GPs may enter into personal guarantees for carried interest

No Fault Removal—LPs vote out GPs anytime with a threshold vote (80%+)

Haircut on carried interest and zero management fees for GP removal

“Key Person Event” defined as either (i) GPs ceasing to devote substantially all of their time to the fund, or (ii) transferring 25%+ of the GP’s total carried interest to third parties. Triggering this clause results in automatic suspension of fees other than to pay fund expenses, wrap up portfolio legal commitments, or repay debt.

“Over 71% of LPs reported that no-fault removal provisions were in place in at least half the funds in which they invested over the past year. While only 25% of respondents have experienced a GP removal within the last five years, ILPA members consider no-fault removal provisions to be an essential investor protection worth fighting for.”

Reporting

Market Terms:

Quarterly capital account statements

Annual financial statements (GAAP)

Tax information necessary for returns IRS Form 1065, Schedule K-1, etc.

Trending:

Generally audited financials are waived in first funds and non-institutional funds

Everyone agrees audits are administratively painful, costly and burdensome, but with institutional investors, audited financial statements are a must.

Some GPs prefer to get in audit-ready shape early so they will actually agree to annual audits ahead of an institutional raise (e.g., in Fund II, looking at Fund III)—alternatively, “reviewed” financial statements is a step below “audited”.

LP-Friendly:

ILPA Standardized Reporting and Information Access with Audited Financial Statements:

Audited annual financial statements

ILPA Reporting Template for Fees, Expenses and Carried Interest (2016)

LPAC members should have access to the management letter provided by the fund auditor and the ability to pose questions to the auditor directly

“LPs generally reported a high degree of success in receiving ILPA standardized reporting when an explicit request was made of the GP, regardless of whether fee and expense disclosures were cited as an LP “must have” during fund negotiations. However, respondents that prioritize fee and expense disclosures as a “must have” during negotiations were more likely to receive ILPA standardized reporting than those who did not. With a priority on the ILPA Reporting Template, 50% of LPs who requested an ILPA template received it more than 50% of the time.”

LPA Term Sheet (Draft)

Emerging managers often ask me to draft a “standard” venture capital fund term sheet.

The problem is that this assumes there is a one-size-fits-all term sheet for LPs. Many investors are not familiar with term sheets for venture capital funds. And with institutional LPs, not having the proper terms can be perceived as a bad sign.

During your first fund raise, you can anticipate the following:

Outreach to 500+ LPs to secure your first fund

It can take anywhere between 3–6 months to secure a meeting with a specific LP

It often takes at least one to two additional fund cycles before an LP commits

So, find out who’s your most likely target for investing in your fund and then tailor your key terms to them.

Understand Your Target Audience

The most likely target for emerging managers on Fund 1 or Fund 2 is, in order*:

High net worth individuals (HNW)

Family Offices

Emerging Manager Focused Fund of Funds

Large Fund of Funds

Registered Investment Advisers/Strategics

Endowments

Pensions

*Source: Samir Kaji

As mentioned above, the most likely targets for emerging fund managers are High Net Worth individuals (HNWs) and family offices. Between those two types of LPs, they make up 70%+ of the market for emerging fund managers.

LPA Term Sheet Template

Attached is a draft summary of key terms for an emerging manager’s venture fund. The writing style is more informal than most term sheets. The style should match the kind of writing expected by HNWs and family offices. This is not meant to be a comprehensive set of terms nor is it meant to be relied upon. It hasn’t undergone review or scrutiny beyond a first draft and is only being provided for commentary and educational purposes. It will be updated and improved over time.

If you have any suggestions to modify, remove or add to the key terms, please reach out below. I will take all feedback into account.

Subscribing to the Law of VC newsletter is free and simple. 🙌

If you've already subscribed, thank you so much—I appreciate it! 🙏

As always, if you'd like to drop me a note, you can email me at chris@harveyesq.com, reach me at my law firm’s website or find me on Twitter at @chrisharveyesq.

Thanks,

Chris Harvey

Thanks, Chris. Opacity - on all fronts - is definitely creating drag in the market, so I appreciate your making it more transparent.