#4 Episode - Follow-On Strategy: Punt or Go For It

NFL Football Coaching is Like Your Follow-On Strategy

Pro rata rights are the second most important term in any venture capital deal—price being the first.

Pro rata is the ability for investors to maintain their ownership position in a company by investing in future rounds. Pro rata rights protect investors against dilution.

Fred Wilson (@avc) provides a great example here:

“You invest $50k in a seed round at a $5M cap and own 1% of the company. The next round is a $3M round at $9M pre, $12M post. If you don’t participate, you will be diluted 25% and will then own 0.75% of the company. On the other hand, if you buy 1% of the round, a $30k investment, you will continue to own 1% of the company. Your ‘pro-rata right’ in this situation is a $30k allocation in the next round.”

@avc also explains why pro rata rights are so important:

“The ability to follow your winners and defend your position is absolutely critical to producing top tier returns."

There’s conflicting information on VC Twitter about follow-on strategies and pro rata rights. Ultimately, it comes down to one factor:

Portfolio Construction

Your initial strategy starts with your fund size but is built on portfolio construction. This involves modeling your fund’s average initial check size, target ownership percentage, number of investments, recycling strategy, and follow-on strategy.

Semil Shah (@semil) offers three heuristics to return (1x) a micro VC fund:

$100M fund: +15% ownership of your best portfolio company at exit;

$50M fund: ~10% at exit; and,

$25M fund: ~5% at exit.

If you expect to raise money from institutional LPs, you’ll need to dig deeper into these concepts. Too many lumpy checks and an undisciplined approach to VC investing is a recipe for failing to close your Fund II or Fund III. As @semil said:

Follow-On Strategy

A big part of your fund model will depend on your follow-on strategy and how you approach “reserve ratios”. For example, a $60M fund with a 1:2 (initial check-to-reserves) will use $20M for its initial investment and save $40M for future investment in the same company.

Reserve ratios generally fall into three buckets:

Never follow—1:0 (initial check-to-reserves)

Follow your winners—3:1, 2:1

Always follow—1:1, 1:2+

Put simply, is your reserve strategy one that operates horizontally or vertically?

Horizontal: Spread capital in more companies—lower ownership targets

Vertical: Concentrated portfolio—increase ownership targets

But underlying these follow-on strategies is a key assumption: That you can even get into the next round.

Respecting the Pro Rata Right

Few articles discuss the behind-the-scenes negotiations that happen during follow-on rounds. It’s not pretty. Emerging fund managers with portfolio companies in a hot round have all seen or experienced this feeling before:

It’s the same kind of power dynamics at play that Jason Calacanis (@jason) wrote about in his book Angel: How to Invest in Technology Startups:

“When I got in this industry, I [was told I] had to eat a bunch of shit from other investors, it’s part of the game.”

The Game

In 2013, Y Combinator introduced the first version of its Safe. Inside this simple, 5 page agreement was a hidden gem for investors: Default pro rata rights. Since then, almost every angel investor and VC knows this by heart:

“Pro rata rights are a must and you should never do a deal without them.”

—@jason

Today, pro rata rights sit outside of the YC Safe in the form of an optional side letter. While YC removed pro rata rights in the new Safe, the horse had already left the barn. Andy Sparks summed it up nicely in his book, Holloway Guide to Raising Venture Capital:

“In the 2018–2019 fundraising climate, it’s safe to say we’re at 'peak pro rata.' Everybody wants pro rata, even those who don’t entirely understand how it works or affects companies.”

However, lead VCs will have ownership targets for their own portfolio math to work out. The easiest route to their goal is to cut out early investor’s pro-rata rights.

The Solution

So, how do you fix these conflicts? @semil offered some good solutions:

@avc also offered some ways to get around an inability to honor early pro-rata rights:

Offer secondary sales to founders, employees & investors

Change the price of an earlier round for the affected investor

Offer warrants in the new round.

Larsen Jensen, Managing Director at Harpoon Ventures, an early stage fund that co-invests alongside top-tier VC funds, offered the best piece of advice:

Pro rata rights essentially don’t matter in a competitive environment. It comes down to how strong your relationship is with the founders. If a large, multi-stage firm is unwilling to budge, the pro rata contract is worthless. That being said, we obviously fight for pro rata in all cases, but recognize that practically our rights have no teeth with competitive deal dynamics and without the founders willing to go to bat for us.

Here’s a snapshot of the funding environment in 2020 and why it’s so competitive (Source: Wilson Sonsini The Entrepreneur’s Report, 1H 2020):

Why couldn’t you just threaten to sue or litigate the issues in court?

It’s not really an option unless you’re willing to pull the nuclear trigger—which could kill your portfolio company and ruin your reputation as an investor;

Early investors may not even want this as it often means leveraging up multiple times the initial investment just to have the same seat on the cap table.

Never Follow-On

One theory holds that while pro rata rights may be important for some institutional, later stage funds, they should be avoided at early Seed stage funds.

For example, AngelList's data science team crunched the data from their investment platform ($1.8 billion in AUM over 10+ years) and ran 10,000 Monte Carlo simulations to determine the benefit of following on. Three scenarios were analyzed:

Never Follow On

Only Follow When You Can Double Down on Your Winners

Always Exercise Pro Rata for Next Round

What is the best follow-on strategy for Seed stage investors, according to AngelList?

As contrarian as it may sound, the optimal strategy AngelList found is Never Follow. In other words, reject any follow-on opportunities and opt instead to balance your portfolio with new investments, as @Naval himself advocates for:

Follow-On Strategy is Like NFL Football Coaching Strategy

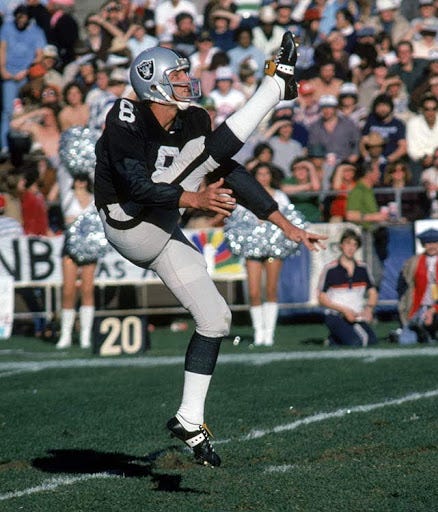

As a former collegiate football punter, the logic of purposely rejecting follow-on investments strikes me as the same kind of logic that some Sabermetricians advocate for in American football: Always go for it on 4th down, Never kick or punt the ball.

Punting in American football is the voluntary act of kicking the ball to your opponent on 4th down, the last chance before involuntarily turning the ball over. The purpose of a punt is to force your opponents farther down the field into their territory, making it harder for them to score any points.

Every NFL team has a punter. And while every team may mock its punter, if the offense turns the ball over on 4th down deep within its territory, as an NFL football coach, you face more than mere mockery: Your job is on the line.

However, there is some evidence to suggest that punting on 4th down is actually a weak coaching strategy. According to Berkeley professor David H. Romer, after studying punt data from 1998 to 2004, football teams should rarely, if ever, punt or kick the ball on 4th down. But this flies in the face of conventional wisdom. And even if there is not a body of evidence to suggest otherwise, using a strategy like this may get you fired from the front office.

For example, in 2009, New England Patriots Coach Bill Belichick made a call that was dubbed the "worst coaching decision" of his career. Late in the game against the Indianapolis Colts, quarterback Tom Brady was kept on the field on 4th down, with 2 yards to go, deep inside the Patriots territory. Coach Belichick ordered his quarterback to pass the ball instead of punting it. The play didn't work. Peyton Manning took over inside the 30-yard line and sealed a win for the Colts.

Conclusion

So, what follow-on/reserve strategy is right for you?

In some cases, taking an aggressive investing strategy actually makes sense. For example, if you manage a small fund (<$50M) or you are an angel investor like @naval who writes a lot of smaller checks, taking extra risk by backing more early stage companies actually plays out to your competitive advantage over time.

But if you have institutional LPs, the table stakes are too high not to have a follow-on strategy. If you miss out on an opportunity because you rejected pro rata rights, it’s kind of like Coach Belichick going for it on 4th down—your decision might have been the technically accurate one, but it might also have cost you your job if you come up short.

Special thanks to Dave McClure, Larsen Jensen, Andy Sparks, @VCStarterKit, Jeff Mund, and my father Dave Harvey for reviewing early copies of this draft 🙏

Subscribing to the Law of VC newsletter is free and simple. 🙌

As always, if you'd like to drop me a note, you can email me at chris@harveyesq.com, reach me at my law firm’s website or find me on Twitter at @chrisharveyesq.

Thanks,

Chris Harvey