Happy New Year!

The last Law of VC shipped on September 30, 2022. It was entitled “Everything is a Security.”

This happened in the intervening three and a half months:

Oct. 2022: Kim Kardashian settles for $1.3m with the SEC for violating securities laws by crypto shilling on Instagram without disclosing said shilling.

Nov. 2022: FTX, Alameda Research, and Tenacious Wonderboy SBF embroiled in Enron-like scandal; SBF shifts blame to lawyers & market forces (which—if anyone has seen The Smartest Guys in the Room—knows it is a winning strategy. For the lawyers).

Dec. 2022: The SEC releases an annual report showing it brought 760 total enforcement actions in 2022 (a 9% YoY increase) raking in $6.4 billion in civil penalties, disgorgement fines, and pre-judgment interest, the most on record in the SEC’s history—up 1.7x from $3.6 billion in 2021.

Jan. 2023: An ex-Coinbase employee sentenced to 10 months in jail for sharing insider information to his brother and friend (although this was a criminal prosecution, the SEC sued civilly based on the theory of securities laws violations).

Yesterday: The SEC charged both Gemini and Genesis with unregistered offering and sale of securities to retail investors, some of whom were in the U.S.

Not that I could have predicted any of this, buuuut…

Which brings us to the matter at hand.

The main takeaway in law from 2022 was that everything really is a security; at least, in the eyes of U.S. regulators tracking the flow of venture capital dollars.

As we look ahead to 2023, it’s clear that the intersection of technology and regulation will continue to play a critical role for fund managers, including those in crypto.

The crypto world will need to adapt to the new reality of being considered securities by regulators, and to ensure compliance with the laws and regulations are in place. But this is not just a burden for startups and funds, it also presents opportunities for innovation and growth. Clear and effective regulatory compliance can attract more mainstream investors and customers and provide a level of legitimacy and trust. Something that has clearly been lost after 2022.

As Fred Wilson and Katie Haun recently wrote in Taking A Long Term View Of Web3:

The lesson of these recent events for policymakers should not be that web3 is bad and must be constrained. It should be that pushing innovation offshore is bad.

We need trusted and well-regulated centralized entities to survive and thrive and we also need decentralized web3 protocols to flourish and provide a path to a fully decentralized web. Both are possible and the good news is we are already on a path toward both. We need to stay that course, provide for a healthy web3 sector in the US, and stop pushing US users to risky/shady offshore entities with unclear, uneven, and unfair policy actions.

—

This was just a short post to let you all know (a) how much I missed you, and (b) to expect a higher rate of publication from me this year. Please plan accordingly.

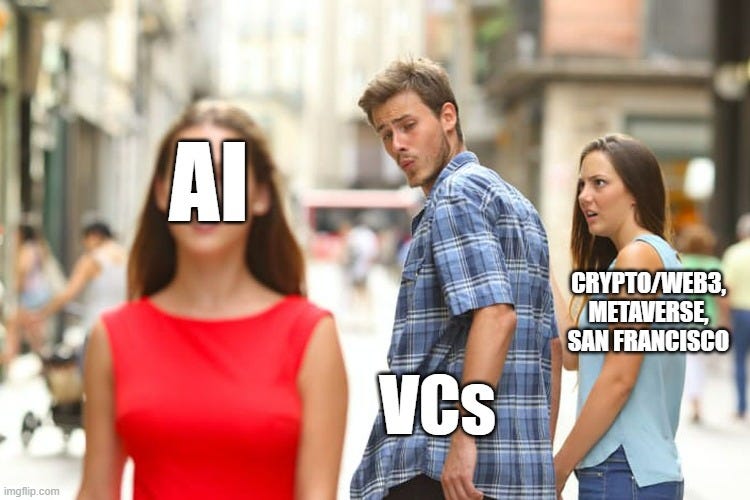

I leave you, as 2023 left me in 2022, thinking about this soul-crushing meme:

Subscribing to the Law of VC newsletter is free and simple. 🙌

If you've already subscribed, thank you so much—I appreciate it! 🙏

As always, if you'd like to drop me a note, you can email me at chris@harveyesq.com, reach me at my law firm’s website or find me on Twitter @chrisharveyesq.

Thanks,

Chris Harvey

Well done as always! Cross-posting now on @TheFundCFO blog for my #VC, #GP, #LP audience! Talk soon!

Love the subtitle!