#27 Episode - Essential Checklists for VC Fund Formation ✅

A Master Set of Legal Checklists for Forming a Venture Capital Fund in the US

Key Takeaways: Today’s article is a set of fund formation checklists:

Fund Structure ➡️ Forming the Fund

Fund Mechanics ➡️ Closing the Fund

Regulatory Compliance ➡️ Post-Closing Obligations

This article provides a basic understanding of the key decisions and material terms for forming and closing a venture capital fund.

Fund Formation Checklist

Part I: Fund Structure ➡️ Forming the Fund

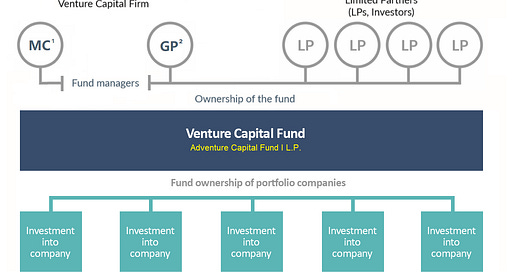

Under the traditional US fund model, a venture capital fund is formed as a limited partnership by the venture capitalists (VCs) who manage it. To shield themselves from personal liability, the VCs form a limited liability company as the General Partner. Separately, a Management Company is formed for tax and liability purposes.1

So, to structure a traditional VC fund, three entities are typically formed:2

The General Partner (LLC)

The Management Company

The Venture Fund

The Three Key Entities

The General Partner

Entity Type

LLC

Taxed as partnership (carry is a profits interest)3

Entity Naming Convention

[Fund Name] + [Fund Number] + GP[,] + LLC

—Example 1: Adventure Capital I GP LLC

—Example 2: Adventure Capital II GP, LLC

Delaware

Certificate of Formation

LLC Agreement (Operating Agreement)

Ownership Rights: Capital Interests, Carried Interests, Voting Interests

The Management Company

Entity Type

LLC

Taxed as partnership or S-corporation

Entity Naming Convention

[Fund Name] + Management + [Company][,] + LLC

—Example 1: Adventure Capital Management LLC

—Example 2: Adventure Capital Management Company, LLC

Delaware

Certificate of Formation

LLC Agreement (Operating Agreement)

Management Agreement with GP

The Management Company is often utilized for multiple vintages

—Fund I, Fund II, etc. often have the same MC.

The Venture Fund

Entity Type

Limited partnership, LLC or Series

Taxed as a partnership

Entity Naming Convention

[Fund Name] + [Fund] + [Fund Number] + [Parallel Fund][,] [L.P.]

—Example 1: Adventure Capital Fund I L.P.

—Example 2: Adventure Capital I-A, LP

The Structure (Diagram)

Part II: Fund Mechanics ➡️ Closing the Fund

The next step after formation is to proceed with an eye towards closing investors.

Most fund managers kick off this process by sending potential LPs a non-binding term sheet, pitch deck, LP due diligence and fund subscription materials.

In Law of VC #24, we went over the key terms of a venture capital fund, but in brief, here is a good place to start your review process:4

Most Important Key Terms

Fund Size

Targeted

Minimum

Cap

LP Commitments

Minimum/Maximum Subscriptions

GP Commit (%)

Fund Economics

Management Fees (%)

Frontloaded

Step Down

Carried Interest (%)

Hurdle (%)

Carry Catch-up (%)

Other Factors

Fund Term

Target First Close

Investment/Follow-on Periods

Term Extensions

Investment Thesis

Stage

Geographic Focus

Industry

Before closing, it’s important to prepare your LP due diligence materials. These may include:

LP Due Diligence Questionnaire—see e.g., ILPA DDQ v2.0 (2021)

Pitch Deck with Legal Disclaimers

Term Sheet

Limited Partnership Agreement (LPA)

Subscription Agreement and Investor Questionnaire

Due Diligence Folders

Fund Economics:

LPs invest in venture funds with a capital commitment upfront and expecting a return of at least three times their capital (3x+). With 100% of the money returned first, the remaining 80% of profits will be split among the LPs;

Furthermore, the GP will get 20% of the profits in the form of carried interest; and,

the Management Company will get 2.5% of the LP’s capital commitment each year the fund operates (often tapering down to 1-2% per year after the initial term of the Fund).

Part III: Compliance ➡️ Post-Closing Obligations

The 3 Laws That Support 80%+ of Venture Fund Law

It took me over a decade of practicing law to finally realize that venture capital fund law is primarily supported by only three laws:

The Securities Act (LPs): Regulation D offers a safe harbor for fund managers to raise a fund without registering with Securities & Exchange Commission (SEC).

Rule 506(b) (private placements) and Rule 506(c) (general solicitation offerings) allow venture capital funds to raise an unlimited amount of capital.

While Rule 506(b) remains the leading framework for private capital funds because it loosens LP verification rules, Rule 506(c) permits public advertising with a requirement to take reasonable steps to verify investor accreditation.5

Investment Company Act (Funds): A fund must register with the SEC as an “investment company” unless an exemption exists under the Investment Company Act of 1940. The two exemptions available for VC funds are:

Section 3(c)(1) exemption—100 “beneficial owner” LP limit,6 which increases to 250 for venture capital funds with $10 million or less in fund size.

Section 3(c)(7) exemption—Only for “qualified purchasers”.7 A 3(c)(1) fund can be formed together with a 3(c)(7) fund to raise the beneficial owner count from 100/250 LPs to an additional 1,999 LPs, provided that all LPs in the larger fund are qualified purchasers. This is called a parallel fund structure.

Advisers Act (GPs): Exempt reporting advisers (ERAs) can avoid the regulatory requirements associated with being a registered investment adviser (RIA), which is costly and time-consuming. To qualify as an ERA, you must meet either the venture capital adviser exemption or the private fund adviser exemption:

Venture capital adviser exemption—§203(l): Advise “venture capital funds”.8

Private fund adviser exemption—§203(m): Advise non-VC “private funds” (crypto, secondaries, etc.) with <$150 million in assets under management.

Post-Closing Matters

LP Subscription Packet

Limited Partnership Agreement (LPA)

Subscription Agreement and Investor Questionnaire

Privacy Policy

Side Letters

MFN

Information Rights

Co-Investment Rights

Confidentiality / Press Release

Government Compliance and Securities Disclosures

Form ID + Form D

Blue Sky Notices (NASAA)

All states in which LPs have invested in the fund

Form ADV

FINRA application

State Adviser Regulation Notices/Disclosures

Advisers with less than $25M in AUM remain subject to state law

Ongoing Investment Adviser Disclosures and Submissions

KYC/AML/PATRIOT Act compliance

Venture capital firms, like other financial institutions, are required to comply with various anti-money laundering (AML) and counter-terrorism financing (CTF) regulations, including the Know Your Customer (KYC) guidelines and the USA PATRIOT Act.

Here are some of the key obligations for VC firms in this regard:

KYC/AML Compliance (sometimes optional or outsourced):

Establish a comprehensive AML compliance program that includes internal policies, procedures, and controls to identify, manage, and mitigate risks.

Perform due diligence on all LPs, including verifying their identity, understanding their business activities, and assessing their risk profiles.

Maintain records of all transactions and investor information as required by relevant regulations.

Implement ongoing monitoring processes to detect suspicious activities or red flags and ensure that risk profiles are up-to-date.

USA PATRIOT Act Compliance

Develop and implement a risk-based AML program that includes the designation of an AML compliance officer, ongoing employee training, and periodic independent audits.

Comply with the requirement to verify the identity of investors, including beneficial owners of legal entity customers, as part of the KYC/CDD process.

Screen investors and other relevant parties against government watchlists, including the Specially Designated Nationals (SDN) list and other relevant lists maintained by the Office of Foreign Assets Control (OFAC).

Report suspicious activities to the Financial Crimes Enforcement Network (FinCEN) by filing Suspicious Activity Reports (SARs) when required.

Comply with any applicable recordkeeping and reporting requirements, such as Currency Transaction Reports (CTRs) for transactions exceeding a specific threshold.

ERISA Status

The Employee Retirement Income Security Act (ERISA) is a U.S. federal law that sets minimum standards for pension and health plans to invest in the private industry. ERISA has implications for venture capital funds that accept investments from pension plans, as these funds may become subject to various regulations and fiduciary responsibilities under the act. Here’s a high-level overview of ERISA as it relates to venture capital funds:

25% test for significant participation

Under ERISA, if the aggregate investment from benefit plan investors (such as pension funds) in a venture capital fund exceeds 25% of the total value of any class of equity interests in the fund, the fund becomes subject to ERISA’s fiduciary rules and prohibited transaction restrictions. To avoid being subject to ERISA, many venture capital funds limit the participation of benefit plan investors to less than 25%.

Venture capital operating company (VCOC) exemption

VCOC is an exemption that allows venture capital funds to accept investments from ERISA-governed benefit plan investors without becoming subject to ERISA's fiduciary rules. To qualify as a VCOC, a fund must meet certain criteria, including investing at least 50% of its assets in "venture capital investments" and having management rights over those investments.

Management rights letter

A management rights letter is an agreement between a venture capital fund and a portfolio company that grants the fund certain rights to manage, advise, or influence the company’s operations. This is an essential requirement for a fund to qualify as a VCOC, as it demonstrates the fund’s active involvement in the management of its investments.

QPAM exemption

Qualified Professional Asset Manager (QPAM) Exemption: Essentially, the QPAM exemption allows an investment fund that is managed by a QPAM to engage in a wide range of transactions that would otherwise be prohibited by ERISA, including venture capital funds.

The QPAM exemption is another way for venture capital funds to avoid being subject to ERISA's prohibited transaction rules when dealing with benefit plan investors. To qualify for the QPAM exemption, a fund must be managed by an independent, professional asset manager that meets specific criteria, such as having a minimum level of assets under management and being subject to various regulatory oversight.

CFIUS

Committee on Foreign Investments in the United States

Inter-government agency committee evaluates certain foreign investments into U.S. businesses and can enforce divestiture.

Scope

2018 enactment of FIRRMA greatly expanded CFIUS

CFIUS now reviews “covered transactions,” including M&A deals, joint ventures, and non-controlling investments involving a “foreign person’s” control or access to critical technology, critical infrastructure, or sensitive personal data.

“Foreign Person”: An entity may be considered a foreign person if a foreign individual has control, access to material non-public technical information, or substantial decision-making authority, even if the entity is U.S.-based.

CFIUS concerns can influence a VC’s decisions regarding the addition of specific GPs or the provision of enhanced information access or oversight rights to LPs.

Review: Generally, all non-exempt covered transactions are subject to CFIUS review.

Securities Exchange Act of 1934

§12(g)(1) registration requirements (public registration > 2K investors)

Broker/Dealer exemption under Rule 3a4-1:

No bad boy disqualifications (fraud, crime, NASD/CRD, etc.)

GPs do not receive transaction-based compensation, directly/indirectly

In other words, fees and carry cannot be issued based on the LP capital raised or deployed into portfolio companies

Recipient must not be an “associated person” of broker-dealer

Performs “substantial” and “primary” duties on behalf of the fund

Does not participate in any offering more than once every 12 mos.

Regulation S

Regulation S provides a safe harbor to VC funds and third party placement agents. An offer must be an “offshore transaction” which does not involve any “direct selling efforts” in the US.

California (or jurisdiction of fund managers’ residency)

Foreign State LLC Registration

Certificate of Good Standing (Status)

Statements of Information

Certificate of Registration for Out-of-State Limited Partnership

CA, NY or state of domicile of Fund Managers

Note: In California, an unregistered foreign LP is subject to a penalty of $20 for each day it transacts intrastate business in California without registration, up to a maximum of $10,000. (Cal. Corp. Code § 15909.07)

Auxiliary Documents

Management Agreement

To allocate management fees from GP if not in the Fund LPA

Clarify the Management Company is the Investment Adviser

Compliance Manual for ERA

Managing Directors and employees commit to conflicts of interest policies such as no insider trading policy, pay-for-play rules, etc.

ERAs still subject to and must comply with certain provisions of the Advisers Act, the Exchange Act, and general anti-fraud regulations.

Amendments/Adjustments to Subscription Agreement

Assignment and Assumption Agreement

Cancellation and Release Agreement

Employee and Venture Partner Agreements

Advisor Agreements

Non-Disclosure Agreements

Carried Interest Award Agreements

Bonus: The Overall Checklist

23-point fund launch checklist (

—TheFundCFO).Legal is only one part of the overall fund formation process.

More here:

Notes, Thoughts & FAQ (Substack Only)

A Note on Nomenclature. “VC” is a generic term—it can refer to either the firm or people running it. The people who run a VC firm are often called the “GPs”—but again, this is not universal. GP can also refer to the VC firm itself.

Accredited Investor Status. All venture capitalists (VCs) should qualify as “accredited investors”9 and “knowledgeable employees”10 of their own fund, per Rule 501(a)(1), (a)(11) under Regulation D. A “knowledgeable employee” of a VC fund includes: (1) the General Partners; and (2) employees participating in investment activities with 12+ months of experience performing similar duties. An ERA is automatically an accredited investor under Rule 501(a)(1).

Alternative Fund Structures. All venture funds share a similar structure but material differences can exist in organizational makeup (series LP funds), economics (carry and management fees), fundraising methods (Regulation D—Rule 506(b) or 506(c), Regulation S), fund size and maximum number of LPs (Section 3(c)(1); 3(c)(7); qualifying venture capital funds; offshore funds), timing for investment activities, fund term, governance, methods for managing conflicts, regulatory and tax structures and compliance issues including with respect to federal securities laws and state laws affecting fund formation and operations.

Tax and Accounting

Why use a partnership model for funds? (See answer below)

Waterfall Allocations and Distributions Review

Unrelated Business Taxable Income (UBTI) for non-profits

Effectively connected income (ECI) issues for foreign investors

GP Commit and Management Fees Setoffs

Form of Salary or Compensation for Fund Managers

Warehoused Investment Portfolio Review

Section 83(b) Tax Filing for Carried Interest Grants

Forming Parallel Funds or Offshore Funds

Section 3(c)(7) Qualified Purchaser Fund

Naming Conventions

Fund Name + Fund Number[-A] [, L.P.]

—Example 1: Adventure Capital Fund I L.P. (QPs only)

—Example 2: Adventure Capital Fund I-A L.P.

Dual Investing Vehicles Based on Pro Rata Ownership

Nominee Agreement

Master-Feeder Structures for Non-US Persons in Offshore Feeder

Non-US persons Tax and Regulatory Issues

Foreign US Taxes: PFIC, CFC, Form 8832 Check-the-Box Regs, etc.

Regulatory Issues: FATCA, CRS, MLRO, etc.

Non-US Person Fund Advisers

If your firm’s principal place of business is not in the United States: A foreign adviser can rely on an SEC exemption to avoid having to file Form ADV if fund manager is operating on foreign soil and meets specific rules:

Miscellaneous, Taxes and State Registration Matters

Tax Forms and Franchise Taxes

FAQs

What are the advantages of using a partnership model for a venture fund?

The advantages of using a partnership model for venture funds include the ability to avoid double-taxation associated with corporations, to pass-through long term capital gains + QSBS to the GP/LPs, and zero-tax consequences for carried interest grants as profits interests. A series or LLC does not typically change the underlying tax structure and should be similar to a limited partnership model.

Disadvantages of using a partnership model for a venture fund include the legal responsibility of managing the fund, the need to negotiate the LPA, the holding period of long term capital gains, franchise taxes, and comply with federal securities laws and state laws.

What are the benefits of utilizing the Regulation D safe harbor?

The benefits of utilizing the Regulation D safe harbor include the ability to raise an unlimited amount of capital, the ability to publicly advertise (under Rule 506(c) with the requirement to take reasonable steps to verify investor accreditation), very light disclosures filed with the SEC, and the ability to avoid drafting a PPM.

What are the requirements for a fund to qualify for the 3(c)(1) & 3(c)(7) exemptions?

For a fund to qualify for the 3(c)(1) exemption, it must be limited to 100 beneficial owners, unless (i) it is a venture fund $10 million or less (in which case the number increases to 250 person) or (ii) a Section 3(c)(7) fund is formed, in which case two parallel funds can exist with up to 1,999 Qualified Purchasers only in one fund.

Importantly, two funds can co-invest at the same time. However, any single fund using the Section 3(c)(7) exemption may only have Qualified Purchasers it, even one accredited investor ruins the exemption. Under Section 3(c)(1) you cannot form two Section 3(c)(1) funds to get around your investor caps unless (i) one of the funds is offshore in a Regulation S offering, or (ii) the investors consist of the GPs or knowledgeable employees of the GP. See also, this Twitter exchange here:

Disclaimer: This article is intended to provide VCs with an overview of the key aspects of forming a venture capital fund. However, it is not intended to be an exhaustive resource, and other factors may apply to your specific situation. You are strongly encouraged to seek guidance from experienced fund counsel to ensure compliance with the issues discussed above.

Subscribing to the Law of VC newsletter is free and simple. 🙌

If you've already subscribed, thank you so much—I appreciate it! 🙏

As always, if you'd like to drop me a note, you can email me at chris@harveyesq.com, reach me at my law firm’s website or find me on Twitter at @chrisharveyesq.

Thanks,

Chris Harvey

A good companion piece to this checklist is a three-part series on forming a venture capital fund written by Sydecar and Junto Law: Starting (and Running) a Venture Capital Fund - Part I: Legal Structures and Players.

On Management Companies:

“Having a management company is not a legal requirement for managing a venture capital fund. A solo fund manager may choose to take on the advisory and management responsibilities of the fund individually. However, many fund managers prefer the legal protections and separations of using an LLC. It may also be easier to use a separate LLC to manage the many operating expenses of a fund and keep records cleaner for tax and accounting purposes. Finally, if you are not a solo fund manager, setting up a management company allows for more than one member to have rights and benefits of the fund.”

It may also be helpful to form other various entities depending on the tax, regulatory and legal structure proposed. One common method is forming two parallel funds (continue reading until you see “Adding a Parallel Fund or Offshore Fund”).

IRS Tax Code Section 1061 requires VCs to wait three years before they can receive long-term capital gain treatment for vested carried interests. See Law of VC #24 Episode, fn. 17.

See Law of VC #24 Episode, The Ultimate Guide to Fund Terms, the key terms include Advisory Committee • Capital Commitments • Carried Interest • Clawback • Conflicts of Interest • Fund Size • Fund Expenses • Key Person • Management Fees • Side Letters • Suspension & Removal • Time and Attention • Warehousing • Waterfall. See here:

Regulation D. A Form D must be filed with the SEC within 15 days of initial closing of a fund.

Beneficial Ownership: Under the 3(c)(1) exemption, the fund manager must keep track of the number of investors. By default, each LP counts as one investor or “beneficial owner”. The SEC has affirmed the GP interest in a limited partnership is not usually a security and most recent amendments to securities laws confirm the default limits are 100 persons, not 99. However, look-through rules may require the fund manager to go beyond the default 1 LP = 1 beneficial owner formula, and count all those who stand to gain as the ultimate beneficial owners. For example, we must count all ultimate beneficial owners (1) in an SPV that has been formed for the specific purpose of investing in a fund, and (2) if the LP’s capital commitment is 10% or more of the fund’s aggregate commitments. In either case, the beneficial owners of that investor are counted toward the 100 LP seat limit. See more here:

Qualified Purchasers: Under the 3(c)(7) exemption, there is no legal restriction on the number of available LPs, but the Exchange Act of 1934 places a practical limitation of 2,000 investors before the fund must register to go public. All investors in a 3(c)(7) fund must meet the definition of “qualified purchaser” under the Investment Company Act of 1940. Typically, a “qualified purchaser” is either an individual or family investment vehicle with $5 million or more in investments, or an entity with $25 million or more in investments. Any fund with one or more accredited investors cannot get around these restrictions. In other words, integration rules apply making separate 3(c)(1) funds offered in close proximity to be deemed a single fund by the SEC for the purposes of the 100 investor limit. See here:

Venture Capital Fund: Rule 203(l)-1 defines a “venture capital fund” as a private fund that:

Accredited Investor Rules. Rule 501(a) - 13 accredited investor rules:

Rule 3c-5(b) excludes not only “Knowledgeable Employees” (which must be ‘natural persons’) from any count of LP limits in 3(c)(1) funds, but also any company owned exclusively by Knowledgeable Employees—see the highlighted text below:

Here’s the legal definition of Knowledgeable Employees, who qualify as Accredited Investors.