#33 Episode - QSBS 2.0 is Here

Qualified Small Business Stock Got a Major Upgrade Last Week: What's New?

After Congress passed the One Big Beautiful Bill Act (OBBBA) last week, President Trump signed it into law on July 4th, 2025. With one stroke of the pen, qualified small business stock (QSBS) is getting a major upgrade. VCs and founders can now cash out with 50% federal tax-free gains in just 3 years, not the full 5 years. The lifetime QSBS exemption bumps up from $10 million to $15 million per taxpayer, per company.

Here’s everything you need to know about the biggest QSBS overhaul in 15 years:

*Only C-corp stock originally issued on or after July 5, 2025 qualifies for QSBS 2.0:

1️⃣ Graduated Exit Timelines (Instead of a 5-Year Cliff)

Original QSBS Rule: More than 5 year holding period ➡ 100%1

New QSBS 2.0 Rule: 3-year minimum holding period

✅ 3 years ➡ 50% tax-free gains

✅ 4 years ➡ 75% tax-free

✅ 5 years ➡ 100% tax-free

2️⃣ $15M+ Per Taxpayer Cap

50% increase in the lifetime QSBS limits from $10 million to $15 million2

Inflation indexed from 2027 onwards

3️⃣ $75M+ Asset Limit

Limits expanded from $50 million to $75 million in aggregate gross assets3

Also inflation indexed from 2027 onwards4

💡 Why This Matters for Emerging Fund Managers

1️⃣ Early-exits: Giving LPs tax-free DPI at Years 3 and 4 is icing on the cake.

2️⃣ Higher caps: $15M per taxpayer means larger individual exits qualify.

3️⃣ Broader deal flow: Series A/B stage median fundraising (up to $75M assets)

Also, both GPs & LPs of early-stage VC funds qualify for this!

For example, since the median Series B total cash raised is <$75M, this opens an opportunity for stakeholders of Series B companies who fall in the $50M-$75M asset range to participate (even if they blew their $50M QSBS limits in prior years).

And despite an initial scare about AMT preferences, the final law confirms that gain on post-2010, and now post-2025, QSBS remains a non-preference item under AMT.5

🗓️ Action Checklist

✅ Time your new closings for ≥ July 5, 2025 (post-signing stock only).6

✅ Update reps to every term sheet/QSBS checklist (see here to download)

✅ Model exits at 3 / 4 / 5 years and what evidence you need.7

✅ Brief LPs—late LP money can’t catch the new $15M cap.

⚠️ Caveats

❌ Late-admitting LPs cannot claim QSBS on earlier fund investments8

❌ SAFEs are still in a gray area (issuance vs. conversion)9

❌ A few states like California will still tax you

The Hidden Gem: QSBS Revival

John Stout (business transition advisor) flagged what might be the biggest opportunity in the new law: Companies that previously lost QSBS eligibility can issue new qualifying stock.*

Here’s how it works:

Let’s say your startup company blew past the $50M asset limit in 2021.

If you’re under $75M today (and have never crossed that threshold before), new stock issued after July 5, 2025 can qualify

By 2030, inflation adjustments could push this to $82M+, which may open the floodgates to Series B and even later-stage companies

This creates a rare second (and third) chance at QSBS for companies and employees that thought they’d missed the QSBS window.

*Not tax advice—speak with qualified tax counsel!

Digging Deeper

Who benefits the most from this tax incentive program?

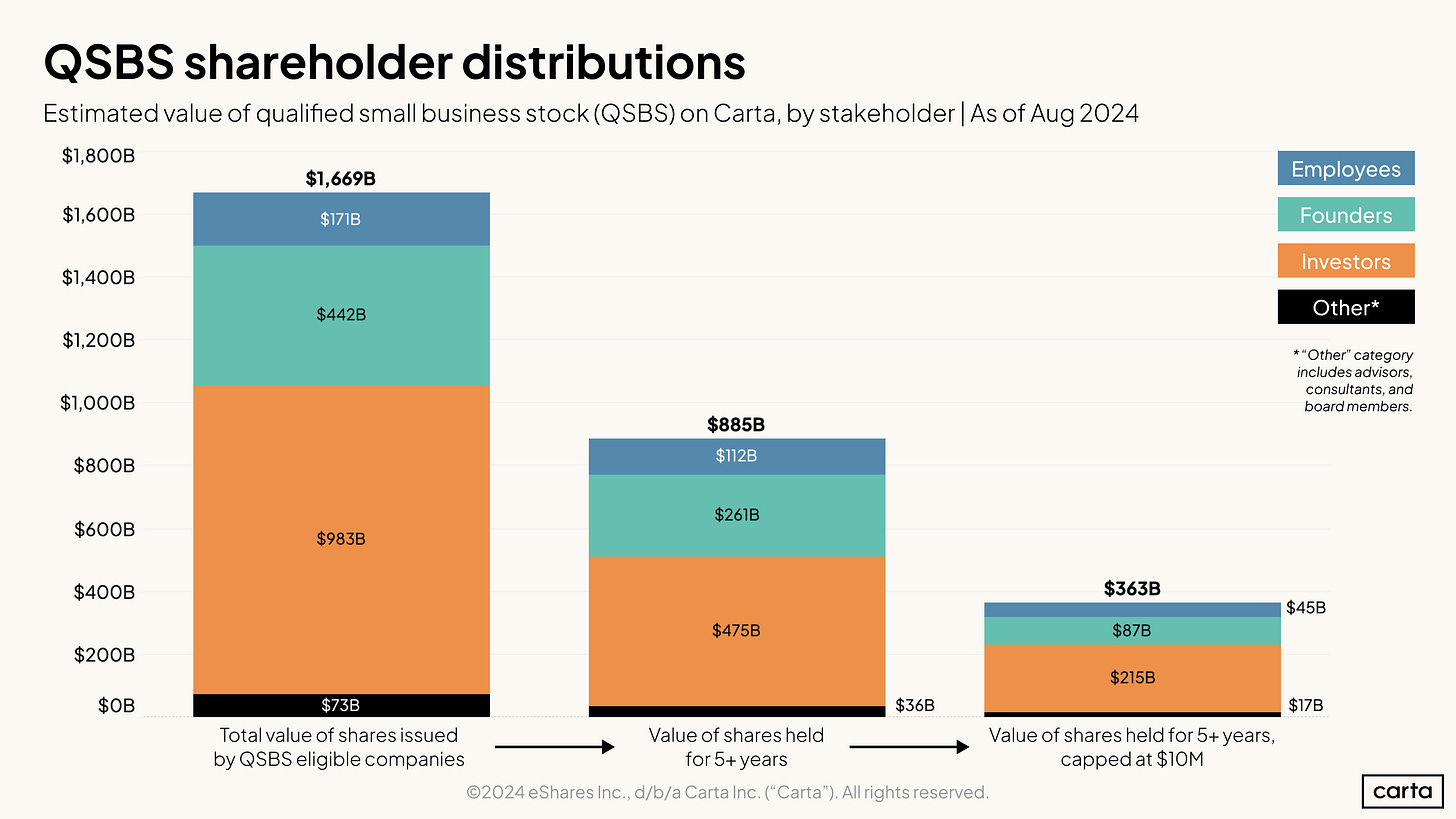

It’s clear that investors (LPs and direct investors) are the biggest winners of QSBS:

According to Carta data (August 2024), QSBS holdings are distributed across:

Investors: $983B (59% of total)

Founders: $442B (26% of total)

Employees: $171B (10% of total)

Others: $73B (5% of total)

Consequently, it’s not a surprise that most of the benefits accrue to the very wealthy:

“The new study published by the U.S. Department of the Treasury examined 11 years of tax returns claiming QSBS exclusions.17 The authors find that the wealthiest tax filers—those with total positive incomes of more than $1 million—accounted for roughly three-quarters of QSBS gains exclud5ed on individual tax returns during the period examined, but only about one-quarter of the claims filed. Meanwhile, 1 out of 5 individual tax returns claiming the exclusion reported incomes up to $100,000, with these returns accounting for just 1.4 percent of actual excluded gains. (See Figure 1.)”

U.S. Treasury research shows that 74% of QSBS benefits currently flow to taxpayers earning $1M+:10

Any expansion of QSBS will likely follow similar patterns:

This disparity reflects a dramatic difference in the amount of excluded gains claimed, with a median claim of $20,850 for filers with incomes of more than $1 million, or 1,226 times the median claim of filers with incomes less than $100,000. The very largest claims—those at the 90th percentile filed by claimants with incomes of more than $1 million—averaged $1.84 million. This would translate into a tax reduction of $438,536 for a claimant taxed at a rate of 23.8 percent (the 20 percent long-term capital gains tax rate plus the 3.8 percent net investment income tax rate).18 (See Figure 2.)

The Bigger Picture

The new QSBS rules expose a longstanding inequity: Employees can’t access these tax benefits until they exercise their options—and 2/3rds never do, while founders automatically qualify through restricted stock issued at company inception.11

The 3-year holding period changes this calculus, at least somewhat. Employees and advisors now face a compelling case to exercise early and sell into a round, if the company offers early liquidity or tender offers.

This shorter timeline—combined with the ability to roll gains after just 6 months—fundamentally improves the risk/reward of early exercise.

For VCs, the benefits flow through naturally. Both GPs and LPs qualify for QSBS on carried interest distributions (which already require a 3+ year hold for long term capital gain treatment anyway). Since most funds don't distribute carry before year three, QSBS essentially comes “free” with standard fund economics.

Bottom Line

OBBBA’s QSBS overhall tightens the feedback loop between startups and investors: faster exits, larger caps, and inflation buffers. It’s a bipartisan recognition that startup investment drives American innovation. While critics note that 74% of QSBS benefits flow to millionaire taxpayers, supporters argue these incentives channel capital into job-creating enterprises. With $1.70 trillion in QSBS value tracked by Carta alone, these expanded benefits will significantly impact startup funding and exit strategies for years to come. For now, focus on maximizing benefits under current QSBS rules while staying informed about potential changes.

Not legal or tax advice. Consult experienced counsel on transaction-specific QSBS eligibility.

Footnotes

Qualified Small Business Stock (QSBS) is a function of five elements:

Time

5+ years holding period

6+ months to rollover (§1045)

Size

≤$50M gross assets for stock issued before July 5, 2025

≤$75M+ gross assets (plus any inflation adjustments starting in 2027) for stock issued on or after July 5, 2025

Nature of Transaction

Direct Issuances (qualifying)

Redemptions/Corporate Buybacks/Rollovers (potentially disqualifying)

Secondary Sales & Transactions (disqualified)

Type of Business

Domestic (US) C-corp

Active business (most startups qualify!)

Qualified Trade or Business

A qualified trade or business is any business, except for five broad categories of companies:

(A) Services in the fields of health, law, engineering, architecture, accounting, actuarial science, performing arts, consulting, athletics, financial services, brokerage services, or any trade or business where the principal asset of such trade or business is the reputation or skill of one or more of its employees.

(B) Financial Services such as banking, insurance, financing, leasing, investing, or similar business

(C) Farming: any farming business (including the business of raising or harvesting trees);

(D) Oil & Gas + Mineral Extraction: “Business involving the production or

extraction of products that would provide depletion deductions under sections 613 and 613A”

(E) Hospitality: “Business operating a hotel, motel, restaurant, or other similar businesses.”

Important clarification: Each taxpayer gets their own cap. A fund with 20 LPs doesn’t mean $300M in sheltered gains—each LP’s tax benefit depends on that LP’s proportional ownership at the time the fund initially made the investment.

The total amount of gain from a single issuer that a taxpayer can exclude under §1202 is limited to the greater of: (A) 10 times the taxpayer’s aggregate adjusted basis in the QSBS of that issuer that is sold in the tax year; or (B) the applicable lifetime dollar cap per issuer, determined as follows:

For stock acquired before July 5, 2025: The cap is $10 million, reduced by any QSBS gain from the same issuer claimed in prior years.

For stock acquired on or after July 5, 2025: The cap is $15 million (subject to inflation adjustment for taxable years beginning after 2026). This is a single, lifetime cap per issuer. It is reduced by the total QSBS gain claimed by the taxpayer from that same issuer in all prior years, plus any gain claimed on older stock (acquired before July 5, 2025) in the current tax year.

Remember, as we explained in Law of VC #19, it’s not valuation that matters, but aggregate gross assets of the company (amount of cash + aggregate adjusted tax basis of property held by the company). In other words, it’s the balance sheet assets immediately after a round closes, not the cap table valuation, that matters.

#19 Episode - Venturing in Taxes

Taxes have been on a lot of people’s minds since President Joe Biden unveiled the American Families Plan and his proposed tax policy last week (2021):

Inflation adjustments, by the numbers:

Base: $75,000,000

Inflation: Pegged to CPI, but we’re just using ~2.30% as a placeholder (starting 2027)

Annual increases are calculated in the chart above

Gross Assets Cap values are properly rounded to nearest $10,000

The “One Big Beautiful Bill Act” (H.R.1 passed on July 3, 2025) explicitly protects all new QSBS exclusion tiers from Alternative Minimum Tax (AMT) treatment, meaning that the 50%, 75%, and 100% gain exclusions for qualified small business stock will not trigger AMT liability for stock acquired after September 27, 2010. The law amends Section 57(a)(7) to ensure these enhanced exclusions remain exempt from AMT preference item treatment. This preservation of AMT protection represents a significant victory for startup founders and investors who had worried that the new structure might inadvertently trigger AMT complications.

Naturally this leads to questions like “should I change the date of my stock issuance?” and “Any thoughts on what existing startups can do / if there's a path to conversion i.e. set up new C-Corp and roll over existing shares”? You should never redate a contract merely because the law becomes more favorable now than it was when you issued into the stock. In particular, setting up a new C-corp & rolling over shares won’t help you re-qualify for QSBS - the law specifically adds a provision (§1223) to disqualify such exchanges:

Also practitioners should be aware of the corporate redemption provisions that disqualify QSBS, but I’ll quote them here for ease of reference (available in the QSBS Checklist):

5. Redemption Analysis

The Company has not redeemed stock from the Stockholder or, to the Company’s knowledge, any related party (within the meaning of Sections 267(b) or 707(b) of the Code) at any time during the four-year period beginning on the date two years before the Issue Date of the stock in question, other than de minimis redemptions and certain disregarded redemptions?

The Company has not redeemed stock during the two-year period beginning on the date one year before the Issue Date with an aggregate value (as of the time of the redemption) exceeding 5% of the aggregate value of all the Company’s stock as of the beginning of such two-year period, other than de minimis redemptions and certain disregarded redemptions?

Section 1202(c)(3)(A). Redemptions exceed the de minimis exception only if the aggregate amount paid for the stock exceeds $10,000 and more than 2% of the stock held by the Stockholder and related parties, by value. Treas. Reg. § 1.1202-2(a)(2). Redemptions are disregarded if they are incident to the termination of services (where such redeemed stock was acquired by an employee or director in connection with the performance of services), death, disability or mental incapacity, or divorce. Treas. Reg. § 1.1202-2(d).

Section 1202(c)(3)(B). Redemptions exceed the de minimis exception only if the aggregate amount paid for the stock exceeds $10,000 and more than 2% of all outstanding stock of the Company, by value. Treas. Reg. § 1.1202-2(b)(2). Redemptions are disregarded if they are incident to the termination of services (where such redeemed stock was acquired by an employee or director in connection with the performance of services), death, disability or mental incapacity, or divorce. Treas. Reg. § 1.1202-2(d).

Most VCs know about QSBS, but rarely know about how to properly capture and report it.

Here’s a streamlined process to get it right:

1️⃣ 𝗙𝗿𝗼𝗻𝘁𝗹𝗼𝗮𝗱 𝘁𝗵𝗲 𝗲𝗳𝗳𝗼𝗿𝘁: 95% of QSBS tracking occurs upfront

✅ All NVCA equity deal documents should include QSBS language:

• Add QSBS Reps & Warranties in Stock Purchase Agreement (SPA)

• Add QSBS Covenant from Investors' Rights Agreement (IRA)

• Add QSBS Checklist as optional add-on from IRA schedule

✅Save all financials from the Data Room:

• Download balance sheets and financials showing the company meets the <$50M aggregate gross asset test

• Financial statements 𝘪𝘮𝘮𝘦𝘥𝘪𝘢𝘵𝘦𝘭𝘺 𝘢𝘧𝘵𝘦𝘳 the round closes (it is standard practice to receive the next quarterly financials after a round closes)

2️⃣ 𝗠𝗮𝗶𝗻𝘁𝗮𝗶𝗻 𝗮 𝗖𝗲𝗻𝘁𝗿𝗮𝗹𝗶𝘇𝗲𝗱 "𝗤𝗦𝗕𝗦 𝗙𝗶𝗹𝗲"

Create & maintain a dedicated QSBS file for each investment:

• Final closing documents

• QSBS checklists/questionnaires

• Financial statements (before & after the time of investment)

• QSBS memos or status summaries

• Centralized tracking spreadsheet or QSBS software

3️⃣ 𝗥𝗲𝗽𝗼𝗿𝘁 𝗬𝗼𝘂𝗿 𝗤𝗦𝗕𝗦 𝘁𝗼 𝗜𝗻𝘃𝗲𝘀𝘁𝗼𝗿𝘀

Ultimately QSBS accrues to a fund's partners—transparency is key:

• Automate tracking with software (Carta, CapGains) for ongoing checks (also consider usefulness of QSBS attestation services)

• Alert tax advisors of qualifying investments early on

• Clearly communicate QSBS eligibility status to LPs

• K-1 Reporting: New IRS proposals (late 2023) will require dedicated codes and disclosure of QSBS gains and eligibility on Schedule K-1

✅ 𝗢𝘁𝗵𝗲𝗿 𝗖𝗼𝗻𝘀𝗶𝗱𝗲𝗿𝗮𝘁𝗶𝗼𝗻𝘀

• Long-Term Capital Gains: As a limited partner, LPs may see tax-free distributions two years sooner, enhancing DPI and effective IRR for early exits. But even after three years, with 50% in QSBS benefits, it means the effective long-term capital gains rates for the top income earners goes from 23.8% to 11.9% after a 3 year holding period, and from 11.9% to 5.95% after 4 years, and finally from 5.95% to 0% tapping out at 5 years.

• Early M&A Planning: You have less than 60 days to preserve QSBS rollover gains. Section 1045 rollovers are therefore uncommon for VC funds as timing is tight and it requires proactive management, but they can be a powerful tool if a big exit happens

• Annual QSBS Portfolio Review: Don't bog down your portfolio companies with lengthy questionnaires or repeat checklists - just briefly check for potential QSBS disqualifying changes annually—company asset levels, redemptions, business shifts, etc

• Use Information Rights: If you're a Major Investor, proactively use your rights to request annual QSBS updates from the company to avoid any surprises (409A report, financial statements, etc.). The company can provide information sufficient to determine QSBS status—use these early on!

• Proportional Ownership at Initial Entry: As a limited partner, QSBS is limited to your proportional interest in the fund at the time the fund acquires the investment. Increasing your capital commitment later won’t retroactively qualify you for higher QSBS benefits on existing investments.

🔹 Example: If you owned 5% of the fund when it made an investment, your QSBS benefits are based on that 5%, even if you increase your stakes later.

LPs only qualify for QSBS treatment if they were part of the fund when it directly invested in the startup & held that interest “at all times” thereafter:

But that starts over after each new investment.

In other words: (1) LPs are eligible for QSBS tax advantages only if they were part of the venture fund at the moment the fund made a direct investment in a startup and maintained their equity stake “at all times” (continuously) thereafter, and (2) the QSBS eligibility criteria resets with each new investment the fund makes.

Example: So, for example, if an LP joins the fund after the fund already invested $100K in Startup A, that LP would not be eligible for QSBS benefits on the gains from Startup A. However, if the same LP is still part of the fund when the fund invests in Startup B, that LP would be eligible for QSBS benefits on gains from Startup B, provided they maintain their interest in the fund continuously from the point of investment in Startup B onwards and the investment in Startup B otherwise qualifies as QSBS (5 years, QSBS eligible at the time of investment, etc.).

So:

QSBS encourages potential LPs to commit early to capitalize on tax benefits across fund investments.

Warehoused investments become less desirable from a tax perspective (open question whether SAFEs will qualify with a second bite at the apple at conversion)

Prioritizing early acquisitions & strategic QSBS rollovers can significantly enhance tax efficiencies of LP portfolios

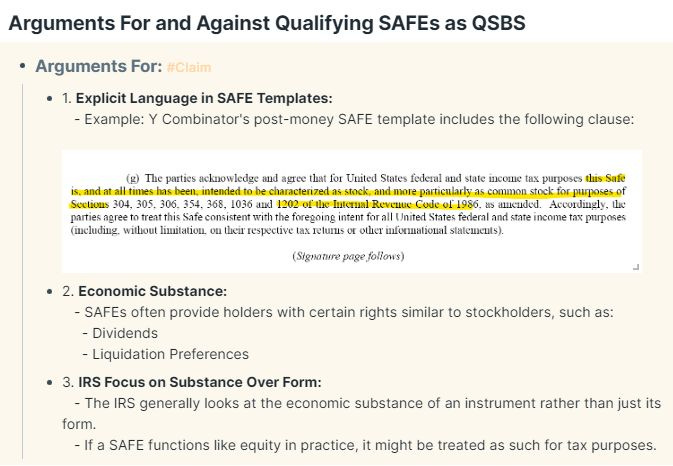

Question: Is there clarification on whether the 3-5 year QSBS clock starts on a SAFE investment or only when new stock is issued/SAFEs are converted?

The answer is no, but this is one of the biggest ambiguities the new rules on QSBS now. The treatment of SAFEs for the holding period remains a gray area. Do they start when SAFE is converted/new stock is issued? Or do we believe the IRS will treat SAFEs as “stock”?

Tax experts generally act conservatively and will treat the holding period for a SAFE at conversion when stock is issued, not before. The new rules don’t change that.

The short answer is—the law is uncertain. But why, exactly?

Lack of IRS Guidance

There’s currently 𝗻𝗼 𝗰𝗹𝗲𝗮𝗿 𝗜𝗥𝗦 𝗴𝘂𝗶𝗱𝗮𝗻𝗰𝗲 on whether SAFEs qualify as “stock” under Section 1202 of the Tax Code (the qualified small business tax statute).

🔹 𝗪𝗵𝘆 𝗜𝘁 𝗠𝗮𝘁𝘁𝗲𝗿𝘀: If a SAFE qualifies as "stock" at issuance, the 3-to-5 year holding period for QSBS starts immediately. If not, the clock starts only when the SAFE converts to equity, potentially years later. Timing is everything with QSBS.Arguments For & Against SAFEs Qualifying as QSBS

🔹 𝗙𝗼𝗿 𝗦𝗔𝗙𝗘 𝗤𝘂𝗮𝗹𝗶𝗳𝗶𝗰𝗮𝘁𝗶𝗼𝗻:

• 𝗘𝘅𝗽𝗹𝗶𝗰𝗶𝘁 𝗟𝗮𝗻𝗴𝘂𝗮𝗴𝗲: Unlike the Pre-Money SAFE, Y Combinator's Post-Money SAFE includes a clear reference to the QSBS tax statute—see §5(g):"[𝑇]ℎ𝑖𝑠 𝑆𝑎𝑓𝑒 𝑖𝑠, 𝑎𝑛𝑑 𝑎𝑡 𝑎𝑙𝑙 𝑡𝑖𝑚𝑒𝑠 ℎ𝑎𝑠 𝑏𝑒𝑒𝑛, 𝑖𝑛𝑡𝑒𝑛𝑑𝑒𝑑 𝑡𝑜 𝑏𝑒 𝑐ℎ𝑎𝑟𝑎𝑐𝑡𝑒𝑟𝑖𝑧𝑒𝑑 𝑎𝑠 𝑠𝑡𝑜𝑐𝑘, 𝑎𝑛𝑑 𝑚𝑜𝑟𝑒 𝑝𝑎𝑟𝑡𝑖𝑐𝑢𝑙𝑎𝑟𝑙𝑦 𝑎𝑠 𝑐𝑜𝑚𝑚𝑜𝑛 𝑠𝑡𝑜𝑐𝑘, 𝑓𝑜𝑟 𝑝𝑢𝑟𝑝𝑜𝑠𝑒𝑠 𝑜𝑓 𝑆𝑒𝑐𝑡𝑖𝑜𝑛[...] 1202..."

• 𝗘𝗰𝗼𝗻𝗼𝗺𝗶𝗰 𝗥𝗶𝗴𝗵𝘁𝘀: Post-Money SAFEs provide holders with substantive economic rights similar to stockholders:

- Liquidation preferences

- Dividends

• 𝗦𝘂𝗯𝘀𝘁𝗮𝗻𝗰𝗲 𝗢𝘃𝗲𝗿 𝗙𝗼𝗿𝗺: The IRS generally examines the economic substance of an instrument rather than its form. If a SAFE functions like equity in practice, it should be treated as such for tax purposes.

🔹 𝗔𝗴𝗮𝗶𝗻𝘀𝘁 𝗦𝗔𝗙𝗘 𝗤𝘂𝗮𝗹𝗶𝗳𝗶𝗰𝗮𝘁𝗶𝗼𝗻:

• SAFEs lack basic stock characteristics—for example:

- No substantive voting rights

- Not on the cap table

- No stock issuance formalities

- Lack of corporate rights (no shareholder lawsuits, no fiduciary duties)

• SAFEs convert to equity only upon certain triggering events (e.g., a priced round). Until then, Safeholders lack traditional ownership rights.Classification Considerations

• Post-money SAFEs have more equity-like features than pre-money SAFEs, but both may be closer to 𝗽𝗿𝗲-𝗽𝗮𝗶𝗱 𝗳𝗼𝗿𝘄𝗮𝗿𝗱 𝗰𝗼𝗻𝘁𝗿𝗮𝗰𝘁𝘀 than equity.

• A SAFE can be viewed as an open transaction with no fixed or determinable share amount or price until conversion.

• The IRS views open transactions as incomplete stock for tax purposes, deferring income or gain recognition until the transaction closes.

• Thus, SAFEs may not qualify for QSBS until conversion—when the share amount and price are determined.Conservative Approach

The safest strategy for investors prioritizing QSBS eligibility may be to:

• Wait until the SAFE converts; or

• Invest directly on the cap table with preferred stock instead of SAFEs

Chart sourced from a recent research report entitled, “The qualified small business stock exclusion overwhelmingly benefits the wealthy and should be reformed in 2025”.