What 'Institutional Ready' Means for Emerging VC Funds (X-Post)

A legal perspective for Emerging Managers

Benedikt Langer recently invited me to share my thoughts on institutional readiness for emerging managers in his newsletter, Embracing Emergence.

Benedikt is on a mission to bring transparency and authentic connection to relationships between emerging managers and emerging LPs. He has been instrumental in helping fund managers articulate their own voice and perspective—an approach far more compelling than flashing logos or being sales-y in a pitch deck.

I recommend checking out Embracing Emergence. Start with "Monks and Managers", "The Case for Convergence between LPs and Emerging Managers," or "What I Look For In Emerging Managers". They capture Benedikt’s unique perspective. And if you’re an emerging manager looking for your own unique perspective in your deck, you now know who to contact.

Here’s my article, originally published in Embracing Emergence, with footnotes added below.

Introduction

In 1972, Don Valentine launched Sequoia Capital with a $3 million fund. Today, Sequoia has shed its venture capital origins and registered with the SEC as an investment adviser.1 It now manages $60 billion across dozens of funds, including its flagship $20 billion evergreen fund that has “patient capital” attracted to it.2

Sequoia's transformation from an emerging fund to an institutional powerhouse mirrors what's happening in venture capital today. “Blackstone in a hoodie” is how some people are describing it.3 But it all started with the public markets.

Public Markets <> Private Markets

When Amazon went public in 1997, it had just $30 million in annual revenue.4 Today, startups need to reach $300-$400+ million in ARR to launch an IPO. U.S. public companies have been halved over that same period—from 8,000 listed companies in 1999 to ~4,000 in 2024.5 Nearly 90% of companies generating $100+ million ARR are staying private.6

Meanwhile, over the past quarter century, the venture industry has been transformed from a $100 billion cottage industry into a $1.25+ trillion asset class. At the same time, the number of VC firms has exploded from less than 1,000 to 4,000+ globally.7 Today, venture represents ~25% of all private equity capital.

Matt Levine said it best:

“Private markets are the new public markets.”

The VC Industry Splits in Two

As public markets became increasingly less accessible for new companies, capital flooded into private markets and split the VC industry into two:8

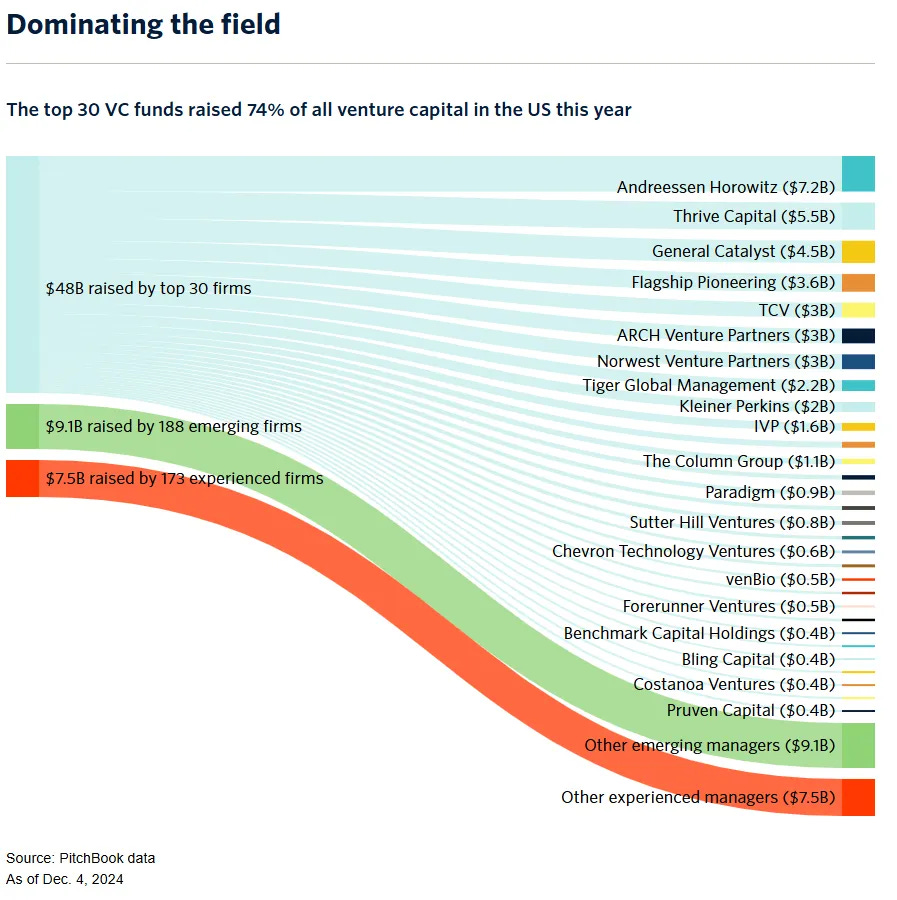

The Mega-Platforms: Large, multi-stage funds started to grow and eventually began to operate more like Blackstone than a traditional VC firm. In 2024, just 30 of these firms captured 74% of LP commitments in venture capital. One firm in particular—a16z—pulled in $7.2 billion (11%) alone:

Experienced and Emerging Firms: The remaining 26% of capital is being fought over by experienced VC firms (14%) and emerging VC firms (12%), including solo GPs, seed-stage firms and other venture firms through Fund III.

A massive consolidation of the VC industry is underway:

This is opening up the doors to a new class of fund manager.

The New Kingmakers

Bill Gurley saw it coming:

“When I first started, everything was bespoke…. Today, branded firms have moved from $500 million commitment every three or four years to $5 billion, so 10x. And they're participating actively in what we would call late-stage—although I've always thought late-stage was a euphemism for a big check. There are people willing to put $300 million in an AI company that's 12 months old. So that's not late-stage, it's just a big check.”9

But there are three key insights that many people seem to miss to the story:

Not only are the mega-platforms writing bigger checks, they’re also operating with far more flexibility than traditional venture firms. Dozens of firms like a16z, Sequoia, and General Catalyst have all become RIAs with the SEC, which allows them to invest and manage a broad range of assets beyond equity stakes in startups—including crypto, secondaries, and fund-of-funds.

They’re also pioneering new fund structures, offering periodic liquidity to LPs, running tender offers, participating in secondaries, creating wealth management divisions and launching evergreen structures that can hold capital indefinitely. These capabilities let them play a fundamentally different game than the traditional 10-year venture fund.

With their expanded resources and capital base, these firms need deal flow at every stage. Rather than sourcing every new opportunity, they’re underwriting the next generation of emerging managers:

General Catalyst invests in up-and-coming GPs;

Sequoia Capital runs a highly selective fund-of-funds program; and,

Marc Andreessen’s family office backs top emerging fund managers.

Meanwhile, specialist fund of funds (“FoF”) are backing emerging VC fund managers:

Allocator One (a EU-based FoF investing in the top 3% of emerging GPs)

Cendana Capital (a premier FoF, invests in early stage VC funds globally)

Main Character Capital (invests in bold, high-conviction fund managers, with a special emphasis on the top 5% returns among fund managers)

Pattern Ventures (invests in top performing GPs in the $5M-$50M AUM range)

Screendoor (backs GPs with their first institutional check)

Why would FoF firms focus on a segment seemingly in decline? It’s no secret that FoFs have historically offered investors good risk-adjusted returns (2005-2019):10

The catch is that to access this institutional capital, emerging managers must meet an increasingly high operational bar. The days of raising a fund on a pitch deck and a hyperlink are over. Emerging managers are expected to be institutional ready.

What does ‘Institutional Readiness’ Mean?

From my experience, FoFs want emerging fund managers to raise the bar and act more like institutional-quality capital:

Now, let's briefly dive into what this practically means for the average emerging fund manager. From audits and compliance to LPACs and sophisticated tax structuring, the expectations placed on emerging fund managers are rising. Here’s a quick checklist:

1. Audits

Start with quarterly reports/reviews for Fund I, transition to audits by Fund II+ ($30M is around the fund size when LPs start to become very curious about audits)

Budget $30-50K+ annually for a nationally recognized audit firm (generally required if your LPs are backed by state agencies and pensions)

Consider the costs of illiquid VC funds, parallel funds, stub years

Maintain clean books from day one using institutional-grade fund admin

2. Due Diligence

Build a clean data room with the basics (firm documents, fund materials, etc.)

Include: Track record analysis, investment memos, portfolio company updates, team bios, and reference lists

Create a comprehensive DDQ (Due Diligence Questionnaire) proactively

Document your investment process, decision-making framework, and portfolio construction methodology

3. LPAC (Limited Partner Advisory Committee) Structure

Create an LPAC before you need it

3-5 seats with LP representation

Consider also adding an optional investment committee/advisory board

Establish meeting cadence: Ad hoc or periodically

4. Regulatory Compliance

Company Act look-through rules, 9.99% voting limits and parallel funds

Implement institutional-grade compliance policies

Conduct annual compliance reviews

5. Side Letter Management

Develop a standard side letter template with the key terms you’re willing to offer (MFN, Co-Investment Rights, LPAC Seat, Investment Committee/Advisory Board Participation, Capacity Rights for Successor Funds, Enhanced Reporting)

Establish clear boundaries on what terms you'll negotiate

Track all side letter provisions in a central location or database

Ensure pre-closing MFN compliance across all LPs

The Path Forward

The consolidation of venture capital is fundamentally raising the bar for what it means to be an emerging fund manager. Emerging managers who recognize this shift and proactively build institutional infrastructure will be best positioned to capture their share of the $75+ billion in annual LP commitments.

The good news is you don't need to build everything at once. Start with the basics—a good fund admin, a clean data room, and an organizational checklist. As you grow, layer in more sophisticated infrastructure. The key is demonstrating to LPs that you understand the institutional requirements and have a clear plan to meet them.

In this new era of venture capital, being a great investor is table stakes. The managers who will thrive are those who combine investment acumen with operational excellence—proving they can build not just a portfolio, but enduring relationships alongside the institutions.

Lastly, I wanted to thank John Gannon of Venture5 Media for keeping this newsletter alive. It’s been over a year since I’ve published an article here, but my readership grew 20%+. John and his team have been instrumental in that and also for allowing us to be a sponsor to his newsletter, Moves in VC, as well as the main sponsor for the 2024 Venture Capital Salary Survey covering venture professionals (download it here in case you missed it). 🙏

Every VC firm’s AUM, legal structure and fund names are legally mandated to be disclosed annually through FINRA’s Form ADV form. Most of that information is public record, including Sequoia Capital’s latest Form ADV filing on the SEC’s website, https://adviserinfo.sec.gov/firm/summary/157373.

As of 2022, Sequoia had approximately US$85 billion in assets under management. At the time, its umbrella brand had three regionally focused venture entities: (1) Sequoia Capital ops in Europe and the United States, (2) Peak XV Partners in India and Southeast Asia, and (3) HongShan (HSG) in China. But after 2024, it split into three entities; US/Europe Sequoia manages less AUM today. The US firm’s total regulatory assets under management (AUM) is $60,451,155,154, with 181 employees, 31 performing investment advisory functions (including research) and 64 pooled investment vehicles (funds), most of which are domiciled in the Cayman Islands or Delaware. For example, its flagship fund is Sequoia Capital Fund LP, a Cayman Islands vehicle with a gross asset value of $19,598,652,712.

Following in the footsteps of a16z and Sequoia, Lightspeed became a registered investment adviser (RIA) this year. It can now invest in and hold large positions of public stocks, secondary shares, private equity buyouts, roll-ups, crypto and any other non-VC asset.

Under the legal definition of a “venture capital fund,” each fund must not have more than 20% of its capital invested in non-qualifying (NQI) assets—which is everything but direct equity investments in portfolio companies (i.e., VC assets or “qualifying investments”).

Here’s the second element of the VC fund definition—Rule 203(l)-1(a)(2).

A “venture capital fund” is …

(2) Immediately after the acquisition of any asset, other than qualifying investments or short-term holdings, holds no more than 20 percent of the amount of the fund’s aggregate capital contributions and uncalled committed capital in assets that are not qualifying investments, valued at cost or fair value, consistently applied by the fund. § 275.203(l)-1(a)(2).

Qualifying Investments generally means direct equity and equity-like investments in companies, including convertible notes, Safes, preferred stock, options, warrants, etc.

Non-Qualifying Investments (NQI) includes promissory notes, secondary transactions, secondary SPV investments, public stock, digital assets and fund-of-funds investments.

Apparently, its 1996 revenue was $15.7 million and the Q1 1997 revenue was $16 million (just for that quarter), but by 1997 the full-year revenue ballooned to $147.8 million. See Alex Wilhelm’s A Look Back In IPO: Amazon, The Giant In Progress, Crunchbase (2017).

Note that estimates of the total number of listed companies vary. For example, data from the World Bank showed 8,090 listed domestic companies in the US in 1996, falling to 4,266 by 2019, and 4,144 in 2020. Another recent study says the US peaked at 6,500 public companies in 1997, and pegs the number of public companies in 2024 closer to 4,500. Regardless, everyone agrees publicly traded companies are on the decline:

Source: The Decreasing Number of Public Companies, Meketa, Sept. 2024

How to Raise a VC Fund, How AI is Changing Private Markets | Samir Kaji, CEO of Allocate, The Peel with Turner Novak (June 19, 2025).

NVCA 2025 Yearbook, PitchBook. The number of US venture firms is pegged at 3,111, but that number doesn’t factor in a number of emerging fund managers who fly under the radar. The AUM for the VC industry in 2024 was counted as $1.25 trillion.

Insiders know this greatly oversimplifies things, but this statement is directionally accurate in terms of impact. It’s also very interesting to see the five “Emerging Venture Archetypes” that are starting to cluster around the modern venture firm model:

1) Inception Stage Platforms

Antler, YC, FJ Labs, SV Angel

2) Niche Power Law Hunters

Precursor (Charles Hudson), Wischoff, boldstart (Ed Sim)

3) Multi-Stage Mega Funds

a16z, General Catalyst, Lightspeed, Sequoia

4) Idea to IPO aka Studio Funds

Atomic, Alloy (High Alpha)

5) Cash Flowing Tiny-Tech PE

Constellation (Mark Leonard), Tiny

The Gift and The Curse of Staying Private with Bill Gurley, Invest Like The Best with Patrick O’Shaughnessy (June 10, 2025).

See John Felix, Pattern Ventures: The Fund of Funds Fallacy: Why LPs Need to Rethink Their VC Strategy, reviewing PitchBook performance benchmarking data from 2005-2019, comparing net TVPI for the entire VC universe—“Direct VC” on the left side vs. VC FoFs on the right side.

𝗧𝗵𝗲 𝗔𝘂𝗱𝗶𝘁 𝗖𝗼𝘀𝘁 𝗥𝗲𝗮𝗹𝗶𝘁𝘆 💰

Average audits cost: 𝟮𝟱𝗞−𝟲𝟬𝗞+ per fund per year

For a typical fund 10-year lifecycle: $𝟱𝟬𝟬𝗞+ total audit costs

With parallel fund structures: 1.5x to 2x the costs

𝗪𝗵𝘆 𝗶𝗻𝘀𝘁𝗶𝘁𝘂𝘁𝗶𝗼𝗻𝗮𝗹 𝗟𝗣𝘀 𝘀𝘁𝗶𝗹𝗹 𝘄𝗮𝗻𝘁 𝗮𝘂𝗱𝗶𝘁𝘀:

Large LPs may have public backers or fiduciaries that require audits

Risk management practices that were preparing for the PFA Rules—internal policies take time to change after regulatory shifts

Fiduciary responsibilities to their own investors

𝗪𝗵𝗲𝗻 𝘆𝗼𝘂 𝗠𝗜𝗚𝗛𝗧 𝘀𝗸𝗶𝗽 𝗮𝗻 𝗮𝘂𝗱𝗶𝘁:

Fund <$30M with mostly non-institutional LPs (family offices, HNW)

Using AngelList/Sydecar/Carta for custody + LP reporting

Clear anchor LP buy-in

𝗪𝗵𝗲𝗻 𝘆𝗼𝘂 𝗦𝗛𝗢𝗨𝗟𝗗 𝗴𝗲𝘁 𝗮𝗻 𝗮𝘂𝗱𝗶𝘁:

Institutional LPs core to the fund demand it (e.g., your anchor investor)

VC fund >$30M and if verified financials are absolutely necessary

Future plans to raise institutional capital

Occasionally I’ll do due diligence projects for funds and other clients. For example, I have a FoF client that regularly asks me to do their emerging fund due diligence work. Here’s a checklist of what a FoF might review with their GPs:

Emerging Fund Due Diligence: A Practical Guide for Fund of Funds

1️⃣ 𝗚𝗼𝘃𝗲𝗿𝗻𝗮𝗻𝗰𝗲 & 𝗢𝘃𝗲𝗿𝘀𝗶𝗴𝗵𝘁

2️⃣ 𝗘𝗰𝗼𝗻𝗼𝗺𝗶𝗰 & 𝗧𝗮𝘅 𝗧𝗲𝗿𝗺𝘀

3️⃣ 𝗥𝗲𝗴𝘂𝗹𝗮𝘁𝗼𝗿𝘆 𝗖𝗼𝗺𝗽𝗹𝗶𝗮𝗻𝗰𝗲

4️⃣ 𝗢𝗽𝗲𝗿𝗮𝘁𝗶𝗼𝗻𝘀 & 𝗔𝗱𝗺𝗶𝗻𝗶𝘀𝘁𝗿𝗮𝘁𝗶𝗼𝗻

---

1️⃣ 𝗚𝗼𝘃𝗲𝗿𝗻𝗮𝗻𝗰𝗲 & 𝗢𝘃𝗲𝗿𝘀𝗶𝗴𝗵𝘁

✅ GP Removal (Conditions & Process)

✅ GP Conflicts of Interest Disclosures

✅ GP Devotion of Time

✅ Fiduciary Duties Owed by GP

✅ Decision-Making Processes

✅ LPAC Role & Responsibilities

✅ LP Reporting Guidelines

✅ Deadlock Resolution Mechanisms (2 or 4 person GPs)

2️⃣ 𝗘𝗰𝗼𝗻𝗼𝗺𝗶𝗰 & 𝗧𝗮𝘅 𝗧𝗲𝗿𝗺𝘀

✅ Affiliated Limited Partners (reduced/zero fees to GPs & team members)

✅ Capital Call Schedule (Timing, Amounts & Late Fees/Interest)

✅ Distribution Waterfall (Type, Premium Carry, Hurdle)

✅ Fund Expenses/Org Expense Cap vs. Management Fees

✅ Special Tax Requirements (ERISA, ECI, FATCA, etc)

✅ Subscription Line/Credit Facilities

✅ Tax Mandatory Distributions

✅ Warehoused Assets/Prior Investments (potential loss of QSBS)

3️⃣ 𝗥𝗲𝗴𝘂𝗹𝗮𝘁𝗼𝗿𝘆 𝗖𝗼𝗺𝗽𝗹𝗶𝗮𝗻𝗰𝗲 (VC Funds)

✅ Compliance with §§203, 206 (Code of Ethics, Pay-to-Play, Written Policies)

✅ CFIUS Protections and Compliance

✅ Investment Limitations & Restrictions per §203(l) vs. §203(m)

✅ Look-Through Rules and Beneficial Ownership Tests per §3(c)(1)

✅ NQI/Qualifying Investment Limits (20% Non-VC Bucket)

✅ Warehoused Investments

✅ State ERA rules for VC firms <$25M

4️⃣ 𝗢𝗽𝗲𝗿𝗮𝘁𝗶𝗼𝗻𝘀 & 𝗔𝗱𝗺𝗶𝗻𝗶𝘀𝘁𝗿𝗮𝘁𝗶𝗼𝗻

✅ Trademark Rights and IP Ownership

✅ Fund Assets and SPV listings

✅ GP and Non-Managing Member Vesting Schedules

✅ Location of Principal Office & Key Personnel

✅ New Members and Carry Participants

✅ Policy on Compensation for Team Members

✅ Service Providers (Fund Admin, Tax, Legal Counsel)

✅ Verification of Firm's Track Record

✅ Cybersecurity and Risk Management

Setting up your LPAC early is a good idea.

The day before Silicon Valley Bank collapsed two clients called me up and said they wanted to move their LPs’ money out of SVB for fear of a bank run. After telling them that I highly doubted the bank would ever collapse, I remember saying they should just get LPAC approval. Unfortunately, they hadn’t setup their LPAC yet, so it took a few hours to find anyone interested—but at that point, the bank’s wires had stopped working.

Remember, setting up your LPAC early is a good idea.

Checklist for Launching an Institutional-Ready Venture Fund on any Platform ✅

𝗟𝗲𝗴𝗮𝗹 𝗦𝘁𝗿𝘂𝗰𝘁𝘂𝗿𝗲

✅ Form separate or combined GP & Management Company entities

✅ Count LPs & Determine Need for Customized LPA & Side Letters (Look-Through Rules)

✅ Draft Key Terms: Management Fees, Fund Size, GP Commit/Cashless Contributions, Key Person Suspension, GP Removal, Term, Extensions, Termination, Recycling, Org Expense Cap, Fund Restrictions, etc.

𝗥𝗲𝗴𝘂𝗹𝗮𝘁𝗼𝗿𝘆 𝗖𝗼𝗺𝗽𝗹𝗶𝗮𝗻𝗰𝗲

✅ Securities Act: Rule 506(b) vs 506(c)

✅ Company Act: §3(c)(1) vs 3(c)(7)

✅ Adviser Act: VC Rule 203(l)-1 vs Non-VC 203(m)

✅ Verify beneficial owner counts & look-through requirements

✅ 10% ownership: Add ratchet provision or form parallel fund

✅ Track 40% and not "formed for the specific purpose of" tests

✅ CFIUS Considerations

✅ Firm-level compliance policies (AML, FCPA, MNPI, Pay-to-Play)

𝗙𝗶𝗻𝗮𝗻𝗰𝗶𝗮𝗹 𝗮𝗻𝗱 𝗧𝗮𝘅 𝗥𝗲𝗽𝗼𝗿𝘁𝗶𝗻𝗴

✅ Establish quarterly financial reporting cadence and timelines

✅ Budget for annual GAAP-audited financials (audit support ≠ audit; $30K+ per year)

✅ Determine first-year/stub period audit approach

✅ Tax review: QSBS, Tax Distributions, Waterfalls, Clawbacks

𝗟𝗣 𝗠𝗮𝗻𝗮𝗴𝗲𝗺𝗲𝗻𝘁 𝗮𝗻𝗱 𝗚𝗼𝘃𝗲𝗿𝗻𝗮𝗻𝗰𝗲

✅ Setup your LPAC before its too late

✅ Side Letters: MFN, LPAC seat, fee structures, co-investment rights, etc.

✅ Create system for tracking LP-specific reporting requirements

✅ Implement MFN management system with appropriate carve-outs

✅ Establish capital calls, management fee payments, GP commit schedule

✅ Draft Due Diligence Questionnaires (DDQs) proactively

✅ Firm level insurance (E&O coverage), shoot for $1M+ per $100M

𝗙𝗶𝗱𝘂𝗰𝗶𝗮𝗿𝘆 𝗗𝘂𝘁𝗶𝗲𝘀

✅ Understand heightened fiduciary obligations

✅ Document conflicts of interests through LPAC ("Principal Transactions")

✅ Prepare All Warehoused Investments to Fund, Transfer to Fund ASAP

Your content is gold - keep up the great work!