#20 Episode - A Simple Framework

The Regulatory Structure and Principles of U.S. Venture Capital Funds

If you just joined us, this is the 20th episode of Law of VC, a free newsletter covering Venture Fund Law, Emerging Funds & Legal Tech.

The Structure and Principles of Venture Fund Law

A simple overview of venture fund law is what’s missing from my library of articles.

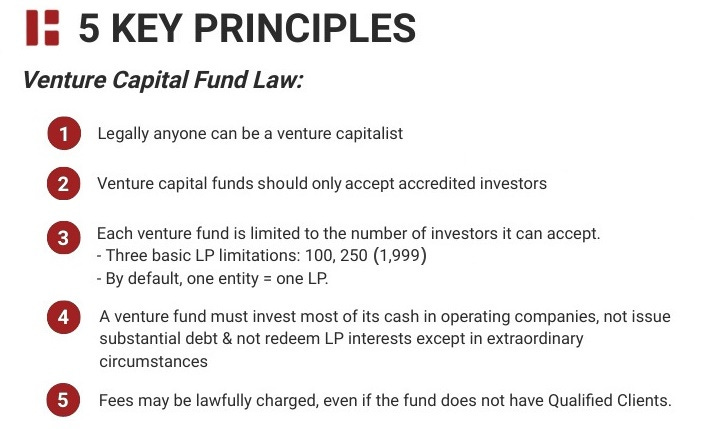

We came close to that in Episode #11 - a Framework for Venture Capital Fund Law. In that article, we learned about the 5 Key Principles of Venture Capital Fund Law:

But that framework had a bottom-up, first principles approach. Today’s framework is a top-down, structural approach.

Here are the three main laws that govern 80%+ of venture capital fund law:

But before we dive into these laws, let’s first test your knowledge.

Pop Quiz—True or False:

Non-accredited investors can become accredited investors simply by raising a venture fund.

Non-accredited investors can legally invest in venture funds.

Venture funds cannot legally accept more than 99 LPs.

A venture fund can legally invest >20% of its assets in crypto, NFTs & buyouts.

California law permits non-VC private funds—crypto funds, fund-of-funds, etc.—to charge carried interest to investors who do not qualify as “qualified clients”.

Answer Key:

Let’s go over the answers and then we’ll explain the rules for each law.

1. True1, but only for purposes of their own fund, see Principle #1, above.

2. True2, but only under certain circumstances, per Rule 506(b).

3. False3, the limitations are 100/250 + 1,999 beneficial owners, see Principle #3.

4. False4, see Principle #4.

5. False5, only venture funds get to use this exception. See Principle #5.

1. Securities Act of 1933

The Securities Act is the backbone of venture law. The 88-year old statute (1) requires companies to disclose certain financial and other information, and (2) prohibits deceit, misrepresentations, and fraud in the offer and sale of securities.

Rule 506(b) and Rule 506(c) are the laws that govern most exempt securities offerings. In 2019, the amount of capital raised through Rule 506 offerings was $1.5 trillion. In total, private exempt offerings for securities accounted for $2.7 trillion in new capital, compared to only $1.2 trillion for public offerings. (See SEC Commissioner Herren Lee’s Statement on Exempt Offering, 2020).

Key Concepts

What are “Securities”?

A “security” is a broad term that includes all stocks, options, warrants, convertible notes, Safes, LP interests, LLC interests, and any other type of investment contract. Pretty much every form of equity can be a security, although not all forms of equity are necessarily securities. Essentially, securities are any passive investment where investor does not have a role in decision making process regarding the investments.6

This can be confusing. The smart play here is to treat all equity issuances as securities unless your lawyer says otherwise.7

What is an “Accredited Investor”?

An accredited investor is an investor suitability standard that qualifies those who meet it to invest in private companies through the purchase of securities.

There are three common accredited investor tests:

1. Net Worth: An individual with net assets over $1 millionAssets aren’t defined by law but generally include investments such as Safes and convertible notes. What’s not included? The investor’s primary home.

2. Annual Income: Individuals with annual income over $200k or $300k (with spousal equivalent) in each of the last 2 years and a reasonable expectation of reaching the same in the current year.

3. Company Insiders/Knowledgeable Employees: Are you a director, officer, or general partner of a fund that’s raising money? If so, you should meet the criteria of an accredited investor for that entity or fund.

Recently, the SEC expanded the definition of accredited investor to include knowledgeable employees of a private fund (but only to invest in their own fund) and license holders of Series 7, 65 or 82 exams (but only if in good standing).

Here are all the accredited investor rules in order:

Pro Tip: The secret to verifying an accredited investor is to use a third party verification letter signed by a lawyer or accountant:

Can you legally advertise or solicit your fund’s offering?

Yes, but generally only under Rule 506(c):

all purchasers in the offering must be accredited investors;

the fund manager must take reasonable steps to verify the accredited investor status of each investor;

What are the rules on advertising or soliciting prospective investors of a private fund or a startup that doesn’t want to use Rule 506(c)?

“Information not involving an offer of securities may be widely disseminated without violating the rules against general solicitation”

Pro Tip: To avoid the prohibition of solicitation and advertising, only offer interests in your fund to those who you have a substantive, pre-existing relationship with.

2. Investment Company Act of 1940

The Investment Company Act regulates investment companies.

An investment company is a “pooled investment vehicle” that issues its own securities and is primarily engaged in the business of investing and trading the securities of others. All venture funds and private funds match this description, but are deemed “exempt” investment companies because they qualify under an exemption—almost always, either Section 3(c)(1) or Section 3(c)(7) of the Investment Company Act.

As stated above, Section 3(c)(1) funds may not legally raise from more than 100 beneficial owners (or 250 if a venture fund is under $12 million). Section 3(c)(7) funds must be owned by “qualified purchasers.” Section 3(c)(7) funds may have many more than 100 investors, but the public limit of investors is 1,999, so as to avoid registration under the Securities Exchange Act of 1934.

Key Concepts:

What is a “Qualified Purchaser”?

“Qualified purchasers” are investors that meet certain requirements for purposes of the Investment Company Act. The term includes any person that falls within the meaning of Section 2(a)(51) of the Investment Company Act—generally, individuals or family offices with $5 million in investments or institutional investors with $25 million in investments.

Determining “qualified purchaser” status and calculating the amount of “investments” held by a prospective investor is, like the accredited investor standard, based on a “reasonableness” threshold.

What are “Investments”?

“Investments” are securities and other assets held for investment purposes such as Safes, notes, preferred stock, common stock, real estate holdings, commodities, financial contracts, private fund subscriptions, and other investment contracts, but exclude securities in one’s startup or any other entity controlled by such person seeking qualification, unless the securities in question are (i) interests in another private fund, (ii) a public company, or (iii) a startup valued at $50 million+.

“Control” means the power to exercise a controlling influence over the management or policies of a company, unless such power is solely the result of an official position with such company. (See 15 U.S.C. § 80a-2(a)(9)).

— Do Safes and common stock qualify as “investments” for purposes of the Qualified Purchaser standard?

Yes, provided such securities are not issued in a company controlled by the qualified purchaser, unless they are in (i) another private fund, (ii) a public company, or a (iii) $50m+ startup.

Pro Tip: Open a parallel fund structure to increase your cap of 100/250 beneficial owners. For example, Ryan Hoover and Vedika Jain of Weekend Fund raised from over 350 LPs, but the true limits are even higher.

3. Investment Advisers Act of 1940

Finally, the Advisers Act regulates investment advisers.

This Act regulates those who receive compensation for advising others on investing in, purchasing, or selling securities. The law either requires registration with the SEC or an applicable exemption (VCs are exempt reporting advisers, or “ERAs”). The two most important adviser exemptions are for venture capital funds and private funds:

What is a “Private Fund”?

“Private Funds” are just those funds that qualify for an exemption under either Section 3(c)(1) or Section 3(c)(7) of the Investment Company Act.

What is an Exempt Reporting Adviser?

The Advisers Act goes hand-in-hand with the Investment Company Act.

The first ERA is a VC fund adviser (the General Partner or Managing Director) and this is where “venture capital fund” is defined by law. (See footnote #4).

The second type of ERA is a private fund adviser—essentially any fund that’s not a venture fund. This bucket includes:

—“Small advisers” (sub*$25 million in assets) who may register only with state securities authorities.

—“Large advisers” and certain “mid-sized advisers” who must register with the SEC unless they fall under the “Private Fund Adviser Exemption” or “Venture Capital Adviser Exemption” to registration.

The Private Fund Adviser Exemption is available to advisers that solely manage private funds and have less than $150 million in assets under management.

Many states follow federal law, including California, with the exception of private funds. To charge carried interest, a private fund adviser may only have qualified clients in their fund—a federal standard recently amended to mean $2.2 million net worth or $1.1 million invested in the fund.

Pro Tip: The easiest way to do business in the investing world with minimal regulatory oversight is to become a venture capitalist.

Subscribing to the Law of VC newsletter is free and simple. 🙌

If you've already subscribed, thank you so much—I appreciate it! 🙏

As always, if you'd like to drop me a note, you can email me at chris@harveyesq.com, reach me at my law firm’s website or find me on Twitter at @chrisharveyesq.

Thanks,

Chris Harvey

Raising venture capital funds gives GPs the ability to claim accredited investor status. See Rule 501(a)(4) (the D&O of Issuer Test), or Rule 501(a)(11) (Knowledgeable Employees). And the fund itself can become accredited if it either has more than $5 million in capital or accepts only accredited investors. See Rule 501(a)(8).

See Principle #2 and Law of VC #11 (VC funds should only accept accredited investors); 35 Non-Accredited Investors are permitted per offering, Rules 502, 506(b), but a few caveats:

Less than 1% of funds accept non-accredited investors (it may be closer to 0%).

It is a widely held belief and industry norm that non-accredited investors cannot legally invest in funds. The relevant laws have recently been relaxed. See Rule 502(b).

At least 100 “beneficial owners” is permitted, and for “qualifying venture capital funds” under $12M, at least 250 beneficial owners. Plus, you can do something a few funds have caught onto—including Weekend Fund—and combine Section 3(c)(7) to add up to 2,250 LPs, with the major roadblock that 2,000 of those LPs need to be “qualified purchasers.” [Ed. 5/4/25]

A “venture capital fund” is defined by Rule 203(l)-1 under the Advisers Act as a private fund that relies on Sections 3(c)(1) or 3(c)(7) of the Investment Company Act of 1940 and (i) holds itself out as pursuing a venture capital strategy, (ii) holds at least 80% of its assets in “qualifying investments” or cash, (iii) is not substantially leveraged, (iv) does not provide redemption rights other than in extraordinary circumstances, and (v) is not registered under the Investment Company Act.

See California § 260.204.9 Private Fund Adviser Exemption, “Retail Buyer Fund”. California law does not allow private fund advisors to charge carried interest unless a “qualified client”. Venture capital is the exception. This means if you're an accredited investor but not a qualified client, your private fund manager can't force you to pay carry, at least under applicable California law.

Hat tip to Arvind Mehta for this definition.

Nick Grossman, a partner at USV, wrote a great introductory article on the most common test to determine whether something is a security, see Visual Guide to the Howey Test (2018).