#10 Episode - The Stories Behind Cap Tables

Key Takeaways: Startups don’t need capital—they need signal. Founders choose individual VCs based on their chemistry, high-conviction and fast commitment. VC brand reputation is just table stakes. Founders ultimately want true believers on their cap tables, not rent-seeking status monkeys.

This is the fourth and final series on cap tables:

#7 Episode—Universal Cap Tables (9/16/20)

#9 Episode—Mutable Laws of VC (10/4/20)

#10 Episode—The Stories Behind Cap Tables (10/13/20)

We have discussed the math and the law behind cap tables. Today we discuss the most important element of them all: The Stories Behind Cap Tables.

A cap table is not just a ledger of who owns what in a company. It also tells a powerful story about a company, such as:

Who backs you?

What’s your narrative? and

Who holds the power?

1. Who Backs You?

Venture capital is a relationship-first package with three key elements:

Capital

Advice

Signal

A). Capital

Without money, venture capital wouldn’t work. However, over the last decade in VC, money has essentially become commoditized. Near zero-interest rates, aggressive monetary policy, loosening of private market regulations, software eating the world, increased corporate venture participation and cultural shifts have all contributed to a massive amount of capital into this relatively small alternative asset class.

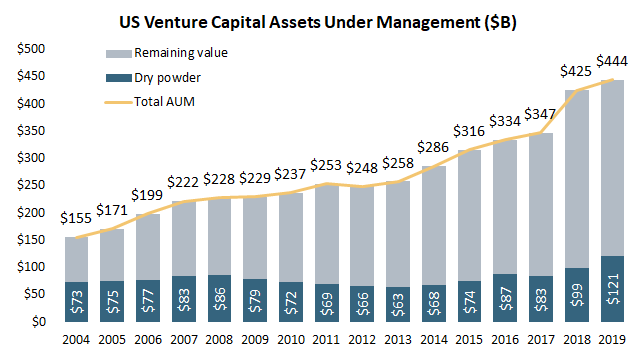

For example, at the end of 2019, there were over 1,300 venture capital firms with 2,200+ active venture capital funds managing $444 billion in assets under management. Venture keeps getting bigger year after year. VC is projected to grow even bigger in 2020.

(Source: NVCA Yearbook 2020)

B). Advice

Since capital has been superabundant, advice (or more accurately, the marketing of it) has been a key differentiator for VCs, at least, historically.

Starting in the early 2000s, VCs like Fred Wilson, Brad Feld and Naval Ravikant blogged about their experiences online. It worked. Founders found them helpful.

Venture capital firms turned that idea (Helpful VC) into a business model. It signaled to founders that a VC’s value-add was a competitive advantage.

In 2005, First Round Capital and Founders Fund led the way for “founder-friendly” terms and service offerings. Other funds soon followed.

In 2009, a16z launched and upended the VC industry by hiring an entourage of in-house professionals to assist their portfolio companies.

Ten years later, the ethos of founder-friendly and trusted advisor inspired the meme culture of @VCStarterKit’s “Let Me Know How I Can Be Helpful”. Startup advisory services seem to have reached peak meme.

As Mario Gabriele wrote in Power in the Valley:

For a long time, VC had such a compelling product (money), service was an afterthought. Now, it is everything.

The problem is that once the service offering becomes everything it’s no longer useful as a competitive advantage. Being helpful and founder-friendly is expected.

Accelerators, venture studios, launchpads & incubators also changed the game, unlocking cap tables with 5-10% ownership.

Y Combinator, 500 Startups & Techstars structured their programs for distributing advice and investment at scale. The problem with advice, however, is that it doesn’t scale. But networks do. And so, accelerators continue to attract a large pool of talented founders to join their ranks and keep the flywheel going.

C). Signal

The biggest question VCs need to know is why back this team and this particular idea? Less than 1% of startups receive VC funding. VCs receive 1000s of requests before settling. VCs have opportunity costs. And those costs can turn into signal.

“Startups don’t need capital—they need signal.” —@Naval

Q: Founders flock to signal, but what is it?

If a top-tier venture firm leverages its reputation to lead a round, that sends a signal to the market. Founders want the “best investors” on their cap table because they believe it will increase their odds of success (note: not all signals are created equally).

High signal-to-noise ratio in the venture world usually means an easier time fundraising, receiving media attention, recruiting quality investors, employees, partners & customers, and making things overall easier for the startup.

Q: What creates signal?

i) Big Reputation

In the early days of venture capital, reputation was about who you knew. Today, who you know still matters, but it’s less important in a post-Internet world. It’s about credibility.

Credibility is tied to a VC’s reputation in a way that financial capital is not.

If Sequoia invests $1 million in a startup, it’s a very small amount relative to the reputational risk Sequoia faces if something goes wrong. On average, 7 out of 10 portfolio companies don’t return their initial capital, so folding is not bad—it’s the expected result. But miscalculating founder integrity, bad media attention, etc.—these can burn a VC’s reputation. That is far worse than losing $1 million.

For example, in 2020, Sequoia made a $21 million mistake by investing too quickly in a company called Finix, a payments infrastructure startup. Sequoia gave away the money because Finix directly competed with its #1 startup, Stripe.

Why give away $21 million for a mere conflict of interest? On the surface, that seems like a dumb move. LPs could not have been happy. On the other hand, that number clearly shows how much Sequoia values its reputation.

Reputation is like organic traffic to a website whereas capital is like paid advertising. Reputation is earned, whereas capital is not. SEO can boost your organic traffic, but it can also be gamed. Reputation is no different. Which is why VCs shamelessly plug, self-promote, and congratulate their network. That kind of signaling works. 👏👏👏

Reputation takes a long time to build, but it can be burned down in an instant.

“It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you'll do things differently.” —Warren Buffett

Elizabeth Holmes leveraged her Stanford connections to create the cap table for Theranos. To add credibility, the company courted several prominent politicians, including Henry Kissinger, George Shultz, Bill Frist and lawyer David Boies. Theranos raised $1.4 billion. However, the most striking feature about Theranos’ cap table was not the presence of so many big-wig politicians but the lack of any top-tier Silicon Valley investor. There was one Silicon Valley investor who backed the company, but this investor was last seen on the Forbes Midas List in 2006, which he still widely promotes today, 14 years later. How much reputational loss do you think this caused? It’s not something we can really measure.

ii) Character

Who’s behind the reputation seems to matter more than the reputation itself. Leonardo DiCaprio, LeBron James and Shaquille O’Neal all have social capital built over the years and invest in startups, but what signal do they send when they’re on a cap table?

Shaq invested in Google’s Series A round in 1999. So too did Arnold Schwarzenegger, Henry Kissinger and Tiger Woods. Google was valued at $75M. To Shaq and other celebrities, venture capital is a way to diversify their holdings, but just like VCs, the real risks for them are more reputational than financial ones. Which is probably why Shaq tends to keep quiet about his investments.

iii) Accountability

Founders don’t just choose to work with venture capital firms. Rather, they work with a VC partner. Traditionally, that meant a GP at a venture capital firm, but now founders can choose from solo capitalists, super angels and rolling fund managers.

Accountability is something individuals can own in ways that entities cannot. Clear accountability is about risk and reward. Without accountability, there is no credibility. And there is no better way to show credibility than by leveraging one’s own name. That’s why founders tend to trust individuals over institutional players. Accountability acts as filter for skin-in-the-game:

“Accountability, skin in the game, these concepts go very closely hand in hand. I think of accountability as reputational skin in the game. It’s putting your personal reputation on the line as skin in the game.” —@Naval

iv) Transparency

Transparency and feedback promote accountability but they also come with reputational risk. Lawsuits and rating systems are still considered taboo in VC.

For example, in 2004, Naval Ravikant sued Bill Gurley, Benchmark, and August Capital. He was labeled a “pariah” in the press.

Naval alleged that his former cofounder and VCs conspired against him by hiding material information. After the Dot Com crash, Naval was told the shares he owned in eOpinions were worthless. What they failed to mention was that the company had secured a $12+ million contract from Google. Naval consented to the sale. 18 months later, the successor company went public at $750M. Benchmark and August Capital’s shares were valued at $30M each at the time. His former cofounder’s shares were valued at $20M. Naval received nothing.

While Naval’s lawsuit “raised some eyebrows” in the industry, the parties settled out of court for an undisclosed sum. Naval said the settlement helped him start AngelList. And while he went on to have a successful career as an angel investor, one has to wonder if that had any impact on the cap tables he may have missed.

v) Feedback

Providing feedback about VCs also brings reputational risk, at least for founders. It’s why there are so many founder alt-accounts on social media, but only one noteworthy alt-VC account (@prayingforexits). It’s also why VC Guide, an anonymous VC feedback scoring system, is frowned upon by the establishment. VC Guide allows investor reviews by anonymous founders. Essentially, it’s NPS scores for VCs.

Logan Bartlett, a GP at Redpoint Ventures, tweeted this about the website:

VC Guide serves as an important reminder about the role of reputation. Character is not reputation, reputation can be gamed and people can lose their reputations quickly.

But, as we will see below, soft power is better than a big reputation.

2. What’s Your Narrative?

As Bill Gurley noted to founders, the art of storytelling plays an important role in the venture space:

“In today’s unique Internet business environment, the art of storytelling has taken on increasing importance. Because of “network effect” and “increasing return” phenomena, many people believe that first movers will most likely take the lion’s share of an Internet market. So far, in portals, auctions, and book and toy e-tailers, this has proven to be the case. The company that is most likely to move first is most likely the one with the most money, and the company with the most money is the one that has had the proper ability to sell its story to the investment community.”

The same is true for venture capitalists. The first mover advantage in venture capital is capital allocation—the first VC who joins a cap table will get the best prices, but they also have the most to risk, both in terms of capital and reputational risk.

Founders want true believers on their cap tables, not rent-seeking, status monkeys. Smart founders want to work with VCs who have deep conviction in them. Startups are in survival mode. Having investors on their cap table with strong conviction makes things easier. No one wants to go through difficult times with a group of non-believers.

Alex Danco wrote an excellent piece on the special relationship shared between founders and VCs. Referencing it, Julian Lehr explains why storytelling matters:

“A founder’s job is essentially to create the most compelling narrative of what their company will look like in 10 to 20 years time. It’s not lying, it’s telling pre-truths. Being contrarian just means that you came up with a novel fantasy plot no one else had thought of yet.

Sometimes founders are able to re-create the fantasy narratives of their pitch decks. Sometimes you end up with Theranos.”

The company’s mission, values and vision of the founders should align with those who are on its cap table.

VCs have an incentive to tell good stories—20%+ carried interest is at stake.

Labor is often an overlooked element but workers typically make up a significant part of a cap table. Most employee option pools are 15-20% of the company. Their voice matters too.

In today’s world, with a global pandemic, social unrest, wildfires, storms and a politically-charged environment, sometimes things are going to go against the company’s narrative, which can result in a misalignment of interests on the cap table.

For example, a couple of weeks ago, Brian Armstrong, the CEO at Coinbase, put employees on notice that political activism and political debates would not be tolerated on the job (“Coinbase is a mission focused company”). Brian believes that politics detract from the focus of the company’s mission and it won’t help the company achieve its long term goals. If an employee disagrees, they can leave. A severance package was offered.

People either loved or hated it. The two most prominent responses were from Paul Graham, the cofounder of YC, and Dick Costolo, the cofounder of Twitter.

Paul Graham’s original tweet:

Dick Costolo’s response:

Q: How does this tie into a cap table?

Future employees of Coinbase are put on notice that their politics are not welcome at work. That kind of narrative will self-select for a certain individual.

Employees are critical to a company’s story. Negative or positive Glassdoor ratings can impact that story. And employee feedback is indicative of its culture. Make sure there is alignment on fundamental beliefs and narratives between who’s on the cap table and the stories they are telling other people about you.

3. Who Holds the Power?

A cap table provides the best indicator for who holds the power in a startup. Reviewing a cap table along with the company’s certificate of incorporation can reveal some key insights, such as:

Loss of founder control from dilution.

Super founder control with a majority interest or dual-class of stock.

Investors with protective provisions by holding certain preferred stock

Abnormal option pools (e.g., greater than 25%, or less than 10%).

Ex-founders or ex-advisers dragging down the cap table with dead equity.

Questionable holding structures (unknown entities and SPVs with large %)

Liquidation preferences, dividend rights and voting structures

Power comes in two forms on a cap table: (1) voting control, and (2) soft power.

A). Voting Control

In a corporation, there are three zones of power: Officers, directors and stockholders. The stockholders vote in the directors who appoint the officers. It’s not a horizontal structure like the U.S. government, but a vertical, top-down structure where stockholders sit on top.

There are many ways to retain control in a corporation outside of a cap table, but the most common way is through the power of shares. Shares of common stock in a corporation represent a bundle of rights, including the right to receive future profits (dividends) and the right to control company decisions (voting). For most corporations, common stock is a one-share, one-vote structure. But that can be changed.

While the right to vote and the right to dividends are fundamental rights to all common stock, they are not absolute. Delaware law, for example, permits corporations to issue stock with unequal voting rights (“dual-class” or “multi-class” structure):

Every corporation may issue 1 or more classes of stock or 1 or more series of stock within any class thereof, … which classes or series may have such voting powers, full or limited, or no voting powers, … as shall be stated and expressed in the certificate of incorporation....” (emphasis added) —DGCL, § 151(a).

When a corporation sets a dual-class voting structure, it creates two classes of stock. In Class A, stockholders receive one vote (or note votes) per share, but founders and executives in Class B can have more votes (e.g., 10-20 votes per share). Dual-class stock allows founders to retain voting control, even while their dilution slips well below 50%. Some companies even implement more than two classes, like Palantir, which has a three class voting structure.

Dual-class stock is a popular trend for Silicon Valley tech companies going public. Between 2005 and 2015, the number of U.S. companies with dual-class share structures increased by 44%. In 2019, 38% of tech companies going public incorporated a dual-class structure. While early tech companies such as Google and Facebook pioneered the dual-class model in the tech industry, this model has been around for years.

For example, with Ford’s long-standing dual-class structure, the Ford family retains 40% of the voting rights through ownership of the company’s Class B shares, even though those shares represent only a tiny fraction of the company’s overall equity. Berkshire Hathaway is also well known for its two classes of shares— Class A and Class B. Class B shares have 1/1500th of the voting power of Class A shares. Also, Snap actually has no voting rights for its shares and Palantir has voting rights so convoluted that they might as well be non-voting.

Most preferred stock has special rights attached to it—whether through protective provisions such as a veto rights on M&A, financing, or unilaterally taking the company public through registration rights. Most of those control rights will be referenced in the Certificate of Formation, the Investors’ Rights Agreement or as a minimum number of shares (which can be found on the cap table).

B). Soft Power

At its core, venture capital is a relationship-driven, people-first business. That makes human psychology and human behavior important parts of the craft.

More relevantly, “personal relationship and chemistry” is the #1 most important factor for both selecting a VC by founders (bottom-left side of the chart, below) and for VCs partnering with other VCs (bottom-right side):

(Source: Creandum, the VC/Founder Split)

Perhaps the most revealing thing about the above chart is that operational support and VC brand recognition are near the bottom of the list of important factors—although reputation is what gets your foot in the door.

Key Takeaways: Founders choose individual VC investors who click with them, have high conviction and commit fast; VC brand reputation is just table stakes.

One of the key insights from some very smart people is that real power lies in the hands of VCs who have mastered the ability to charm and impress founders. What those in social psychology would call “referent power.” Referent power is a form of reverence gained by a leader who has strong interpersonal relationship skills. It’s about collaboration and influence, rather than command and control.

As Mario Gabriele, once again, wrote in Power in the Valley:

Venture capital is half-way through a transformation. Power dynamics are changing in [Silicon] Valley. As capital is commoditized, institutions lose appeal, expertise is more common, and informational edges are copied, real power will lie with masters of referent power. Those able to persuade by the sheer force of their personality — to compel as Rasputin once did — may prove the difference in winning competitive deals. The future belongs not only to those that understand markets, but those that understand people.

Of course, there are many ways to join a cap table. But there is one tried and true way to gain and maintain power on a cap table—be an empathic all-star to your founders.

Subscribing to the Law of VC newsletter is free and simple. 🙌

If you've already subscribed, thank you so much—I appreciate it! 🙏

As always, if you'd like to drop me a note, you can email me at chris@harveyesq.com, reach me at my law firm’s website or find me on Twitter at @chrisharveyesq.

Thanks,

Chris Harvey