#9 Episode - The Mutable Laws of VC

Key Takeaways: Not all Notes are created equally—know the difference between Fully Diluted Basis vs. Issued and Outstanding. Not all shares are created equally—know the liquidation preference stack. There are 3 main ways to convert notes. Post-Money Safes can be highly dilutive to the founders.

This is the third article in a four-part series on cap tables:

#7 Episode—Universal Cap Tables (9/16/20)

#9 Episode—Mutable Laws of VC (10/4/20)

#10 Episode—The Stories Behind Cap Tables (10/13/20)

Cap Table Challenge!

Last week, I issued a cap table challenge:

Several people tried their hand at it, including Fred Destin who responded within a few minutes of my original post. But since we had already worked on a similar problem together, I asked him to kindly take it down until someone could confirm the math.

By and large, the math from everyone seemed good. However, the problem required more than just a math solution. Ryan Juliano, an attorney on the East Coast, caught on and asked me on Twitter for the missing information:

Ryan had the *correct* approach, which is never assume you have all the answers. Once you realize you’re missing key information, just ask the source to clarify it. Without that information, it would have been impossible to pick the “correct” result. You may even have a perfect cap table with zero math errors, but if your key assumptions were “wrong,” your pro forma cap table is going to be “wrong.”

Key Takeaway: A fully standard and automated approach to early stage equity cap tables does not exist, and it will not likely exist for so long as founders and investors continue to use different forms and tailored language (notwithstanding NVCA’s Model Legal Documents and the Series Seed dot com equity package).

I’ll go over a step-by-step answer to the challenge below, but first, let’s go over some key elements and background on the cap table.

Background on Cap Tables

A cap table is just a ledger of who owns what in a company. It’s important for two primary reasons:

Economic Terms

Voting and Control Rights

Fund managers should know their target ownership percentages, dilution, price per share, and liquidation preferences for each round (Economic Terms), but also understand the portfolio company’s “Major Investor” rights, pro rata rights, protective provisions, and any dual-class share structures (Voting and Control Rights).

Not a Legal Document

While a cap table is not a legal document, it's probably the most important corporate record or system-of-record. Cap tables are tools for granting equity and modeling exits. A pro forma cap table should always be sent in advance of each financing round.

A pro forma cap table tracks the equity dilution before and after a financing, including ownership dilution and economic terms.

Cap Tables are Zero-Sum Games

Last week, I received some push back on my statement here:

Every cap table only has 100 points. It's a zero-sum game.

One investor chimed in—”What if, it wasn’t a zero-sum game? Founders can always issue more shares. We are not cutting cakes. Each person brings a candle and together they have a bigger flame” 🕯️

Why can't founders just continue to split up their stock, authorize more shares and set higher valuations in order to make up for any dilutive hits from earlier rounds?

Sure, founders can try that, but as Fred Wilson noted in a 2009 article about dilution:

“It is a subject near and dear to entrepreneurs, maybe the dearest subject of them all.”

There are four reasons why founders should not expect to reduce their dilution by continuing to increase the company’s valuation:

Subject to #3 below, the average dilution by stage is highly predictable

Founders often own far less at exit than they might think (~11%-17% at Series D)

Star performers and average performers have wildly different experiences

Later rounds don’t always translate to increased returns for founders

After Series D, the average ownership at exit is as follows:

Founders: 11-17%

Employees: 17-21%

Investors: 66-68%

Sam Altman (@sama) wrote about dilution in early stages:

Terms like ‘seed round’ and ‘Series A’ are less clear than they used to be, but in general, I recommend companies think about selling 10-15% in a seed round and 15-25% in their A round (and about 7% if they go through an accelerator). When these combine into one large initial round, I suggest trying to sell no more than 30% of the company in total [through Series A].

Let’s put that advice against the average dilution based on 10 years of transaction history from NVCA/Aumni (35,000 transactions with 17,000 unique investors)

Median VC Fully Diluted Ownership is Predictable Across Stages

Seed—21%; Series A—24%; Series B—19%; Series C—14.5%; Series D—11%

The chart above represents the median percentage of fully diluted ownership that the new money purchases in an equity financing across the stages listed above.

—Source: Aumni NVCA Enhanced Term Sheet, July 2020

As Jose Ancer wrote, the typical VC fundraising cycles create misaligned incentives:

“No amount of 'friendliness' changes the fact that every cap table adds up to 100%. Treat the fundraising advice of investors – even the really super nice, helpful, “founder friendly,” “give first,” “mission driven,” “we’re not really here for the money” ones – accordingly. The most clever way to win a zero-sum game is to convince the most naive players that it’s not a zero-sum game.”

Three Key Elements of a Cap Table

Three of the most important elements of a cap table are as follows:

Key Terms

Key Assumptions

Conversion Mechanics

Key Terms

Convertible Notes—(i) “discount”; (ii) “pre-money capitalization” (w\ valuation cap); and (iii) any liquidation overhang.

“Discount”

According to Fenwick & West (2019-2020), (i) the median discount of Pre-Seed deals is 20% and (ii) 85% of those deals had a valuation cap. A discount is based off of the price per share in the next qualifying equity round, not a current discount of the valuation cap.

Most early-stage convertible instrument financings have both a valuation cap and a discount, so you should be familiar with both terms.

“Conversion Price” means the lower of: (a) the lowest per share purchase price paid for the Qualified Financing Securities by the investors of new money in the Qualified Financing, multiplied by 0.80, or (b) [the Valuation Cap / Fully-Diluted Capitalization].

“Pre-Money Capitalization” or “Pre-Money Shares”

There are two basic ways to calculate the pre-money capitalization for purposes of converting a convertible note. The first calculation is simple: Calculate the total outstanding shares prior to the investment, including the options granted but not the currently available options or expanded option pool. The second calculation is more complex: Calculate all securities on a “fully-diluted basis” (e.g., including the reserved plan and ungranted options) so that the existing common stockholders will assume the dilutive effects when those options are issued and exercised.

Between 2019-2020, 84% of first money deals (Pre-Seed/Seed) had a valuation cap, which dropped to 48% of Series A investments had a valuation cap. Only 21% of deals by Series B have a valuation cap (the majority just use a discount).

Here’s a typical definition of “issued and outstanding”:

the quotient resulting from dividing the Valuation Cap by the number of outstanding shares of Common Stock of the Company immediately prior to the Qualified Financing (assuming conversion of all securities convertible into Common Stock and exercise of all outstanding options and warrants, but excluding the shares of equity securities of the Company issuable upon the conversion of Notes or other convertible securities issued for capital raising purposes (e.g., Simple Agreements for Future Equity)).

Here’s a typical definition of “fully diluted capitalization”:

…the quotient obtained by dividing (1) the Valuation Cap (as defined below) by (2) the Company’s fully-diluted capitalization immediately prior to the initial closing of the Qualified Financing (assuming, without duplication, full conversion or exercise of all outstanding convertible or exercisable securities, options and warrants, and the issuance of all shares reserved for grant pursuant to the Company’s equity incentive plan, but excluding any outstanding convertible notes or other convertible securities issued for capital raising purposes) (the “Fully-Diluted Capitalization”)

Liquidation Preference Overhang

In 2015, Mark Suster wrote about the “One Simple Paragraph Every Entrepreneur Should Add to Their Convertible Notes.” Liquidation Overhang happens when there is a convertible note that converts into preferred stock without a mechanism to address the discounted shares.

For example, if an investor invested $1M on a Note with a 20% discount and the note converted to preferred stock, the investor will receive shares with a liquidation preference of $1.25M. The liquidation overhang gives the investor $250,000 more in liquidation preferences than they actually paid fair market value for.

“There are two ways to give early investors more shares—in accordance with the risk they took—without creating an unnecessary liquidation preference overhang:

Award the discount via common stock: Investors get preferred stock up to the aggregate amount of their liquidation preference and then all their discount shares are issued via common stock. Ideal for founders.

Shadow series: Offer to create a new series of preferred stock with the same rights as other investor’s preferred stock, but with a liquidation preference, conversion price (preferred-to-common) and dividend that matches the lower price at which the Safe instrument converts into.”—@Holloway, Downstream Consequences: Exits. [Note: It’s a little surprising to see the chart below with more than 50% of these clients having liquidation preference overhang]

(Source: Fenwick & West, 2019/2020 Survey of Convertible Debt).

“Shadow class preferred stock” a clause (one paragraph) added to convertible notes:

Notwithstanding the foregoing, if the Conversion Price is less than the price per share at which Equity Securities are issued in the Qualified Financing, the Company shall convert this Note into shares of a series of the Company’s preferred stock that is identical in all respects to the shares of preferred stock issued in the Qualified Financing (e.g., if the Company sells Series Seed Preferred Stock in the Qualified Financing, the shadow series would be Series Seed-1 Preferred Stock), except that (A) the per share liquidation preference of the shadow series shall equal the conversion price of the securities, and (B) the basis for any dividend rights, will also be based on the conversion price of the new preferred stock, along with adjustments to any price-based antidilution and dividend rights provisions.

This paragraph converts the Noteholder’s shares into a new series of preferred stock (e.g., “Series Seed-1 Preferred Stock”) that is “identical in all respects” to the main series sold to other investors (e.g., Series Seed Preferred Stock), except the new series addresses the “liquidation overhang” problem and it ensures Noteholders aren’t given more liquidation preference, relative to the dollars they invested, than the liquidation multiple promised to the Series Seed holders. (See The Problem in Convertible Notes.)

Key Takeaway: Not all shares are created equally. Know your liquidation pref stack.

Safe—Cap: "Company Capitalization"

Safes refer to the fully diluted capitalization as the “Company Capitalization”:

“Company Capitalization” is calculated as of immediately prior to the Equity Financing and (without double-counting, in each case calculated on an as-converted to Common Stock basis):

Includes all shares of Capital Stock issued and outstanding;

Includes the Capital Stock issued upon conversion of the Investor Safe and any other SAFE or convertible securities converting into the applicable financing;

Includes all (i) issued and outstanding options, restricted stock awards or purchases, RSUs, SARs, warrants or similar securities, vested or unvested (together, “Options”) and (ii) promised but ungranted Options; and

Includes the Unissued Option Pool (all shares of Capital Stock that are reserved, available for future grant and not subject to any outstanding Options or Promised Options (but in the case of a Liquidity Event, only to the extent Proceeds are payable on such Promised Options) under any equity incentive or similar Company plan); and

Excludes, notwithstanding the foregoing, any increases to the Unissued Option Pool (except to the extent necessary to cover Promised Options that exceed the Unissued Option Pool) in connection with the Equity Financing.

The Post-Money Safe converts slightly differently than the Original Safe or Note:

The big differences between an Original (Pre-Money) Safe versus the Post-Money Safe, are that (1) in the Pre-Money Safe, the Option Pool Expansion is included, but not in the Post-Money Safe, and (2) the Post-Money Safe converts all Safes, notes and other convertible instruments in the pre-money. In other words, the company’s valuation for calculating the conversion of the Post-Money Safe is now measured after all convertibles are converted into preferred stock (the Original form of Safe explicitly excluded Safes and convertible notes in the conversion calculation).

Key Takeaway: Post-Money Safes count all Safes, notes and other convertible instruments, including the dilution from the Safe itself, as part of the pre-money. They can be highly dilutive to the founders.

Key Assumptions:

Know your key variables: Pre-Money Valuation, Pre-Money Shares

Pre-Money Valuation. The pre-money valuation is the agreed upon value of the company immediately prior to the new investment. The price per share is the single most important factor, which is in large part determined by the Key Assumptions and Mechanics of the conversion.

Pre-Money Shares. This will depend on our mechanics and whether the pre-money price is fixed or variable.

Option Pool Expansion

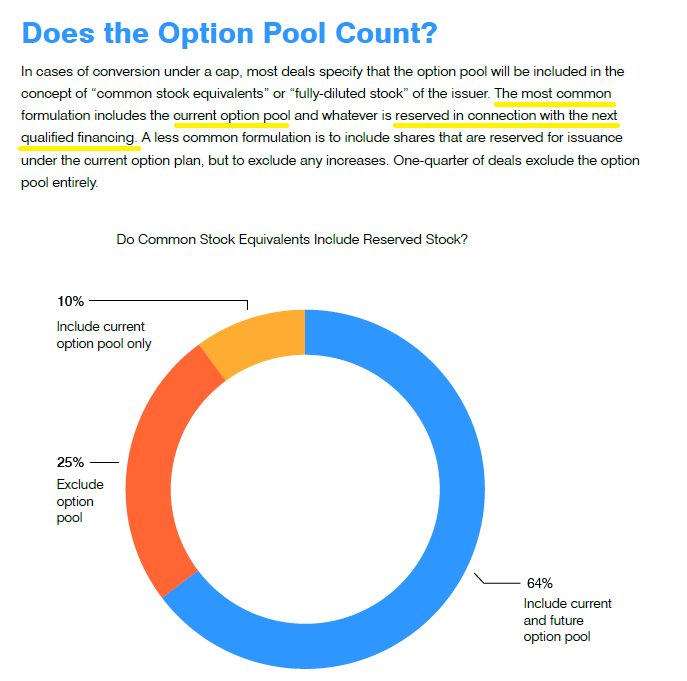

Option Plan. The number one question for convertible notes with a valuation cap is what does the definition of Fully-Diluted Capitalization include? Does it count the Option Pool in the pre-money? Think of Unallocated Options as “unseen dilution” or “yet to happen” dilution, although Founders will feel it at closing.

(Source: Fenwick & West, 2019/2020 Survey of Convertible Debt)

Conversion Mechanics:

There are three different ways to calculate the conversion of convertible securities:

Pre-Money Method

Fixed Ownership Percentage Method

Dollars Invested Method

There are three excellent resources to explain this math:

—Alexander Jarvis: Key convertible note terms no one understands & cost you big

—Cooley: Calculating Share Price with Outstanding Convertible Notes

—Venture Deals (Brad Feld): Chapter 9, which is largely a copy of the Cooley article

Pre-Money Method

The pre-money method causes both the founders and Series Seed investors to be diluted by the shares issued upon conversion of the notes in proportion to their ownership percentage. The post-money valuation becomes variable but the pre-money valuation stays fixed. This method is very founder friendly.

Percentage-Ownership Method

In the percentage-ownership method, the percentage ownership of a company that the investor is purchasing is fixed and the other variables are computed based on that. For example, it’s a fixed post-money valuation, where you work backwards. It is investor friendly.

Dollars-Invested Method

The dollars-invested method is a compromise between the pre-money and the percentage-ownership method. Under this method, the post-money valuation of the company is fixed equal to the agreed-upon pre-money valuation plsu the dollars invested by the new investors plus the principal and accrued interest on the outstanding notes that are converting. The dollars-invested method gives the founders credit for principal and accrued interest that are being converted into equity as if these were funds being newly invested into the company, but only the founders are diluted by the extra shares the noteholders are receiving due to the discount.

Let’s work out the hypothetical I gave last week and then happy to link to the file, and exchange comments over this website or otherwise on social media.

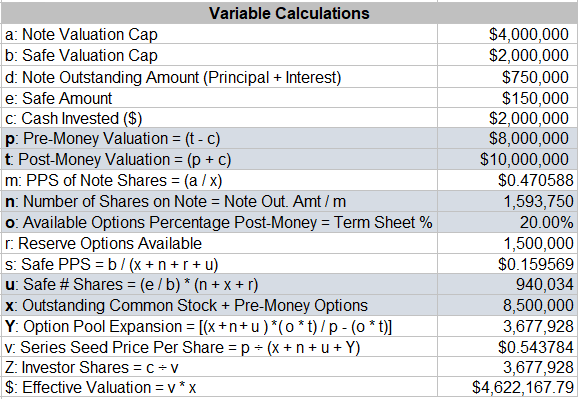

Solving Challenge Step by Step:

Pre-$ Valuation: $8M

New: $2M

Post-$ Valuation: $10M

8M Common (Pre-$)

500K Options issued

1.5M Currently Available

20% Available Pool Post $

$750K Note (P+I) $4M cap*

$150K Postmoney Safe $2M cap

First, we need to check our key assumptions. What’s included in the Pre-Money Shares?

*The Key, Missing Assumptions:

The convertible notes will be converting on the Cooley Series Seed convertible terms which were initially setup for converting on an issued and outstanding basis, excluding convertible notes, Safes, reserve pool and the option pool expansion:

…quotient resulting from dividing $4,000,000 by the number of outstanding shares of Common Stock as of the date of the Note (assuming conversion of all securities convertible into Common Stock and exercise of all outstanding options and warrants, but excluding the shares of equity securities of the Company issuable upon the conversion of Notes or other convertible securities issued for capital raising purposes (e.g., Simple Agreements for Future Equity)).

I missed the part of the Note that read “as of the date of the Note” (italicized and bolded above). Technically, we should calculate the actual number of options and shares issued and outstanding as of the date of the Note, and plug those numbers from there. But we can’t go back in time. So, to solve this, let’s assume we have the same number of shares immediately prior to closing as of the date of the convertible note. NOW, we should have all the information we need to calculate the converting tranches:

Solving for the Cap Table

(Note: Rounding was not done with best practices here)

PPS for Notes = $4,000,000 / 8,500,000 = $0.470588… (Note PPS)

Number of Shares for Notes = $750,000 / $0.4706 = 1,593,750 (Note Shares)

PPS For Post-Money Safe = $2,000,000 / (10,000,000 + 1,593,750 + S)

S = Post-Money Safe dilution, solving for a circular equation in Google Sheets, that number will be 940,034

Edit 10/6/20: To calculate this number by hand, you just need to know the trick about Post-Money Safes: With a valuation cap, the Safe will always equal the percentage of the Purchase Amount / the Valuation Cap. e.g., $150,000 / $2,000,000 = 7.5%. Once we know the fully diluted basis of all pre-money shares plus the conversion all convertible notes, we can solve for the share number by this equation:

Total Pre-Money Shares / (1 - Post-Money Safe %)

We start with 10,000,000 (8.5M outstanding +1.5M available) + 1,593,750 = 11,593,750 (“Pre-Money Shares”)

11,593,750 / (1 - 7.5%) = 12,533,784

7.5% * 12,533,784 = 940,034 shares

= $2,000,000 / (12,533,784) = $0.159569… (Safe PPS)

Number of Shares for Safe = $150,000 / $0.159569 = 940,034 shares (Safe Shares)

Option Plan Expansion

Edit 10/6/20: Two ways to calculate this number.

Option 1: Use Excel to create a circular reference

Option 2: Math. *Y = [((x + n + u) * (o * t) / p - (o * t)]

[*Edit, typo fixed: 10/15/20 — prior formula multiplied instead of added]

Number of Preferred Stock Shares = $8,000,000 / (8,000,000 + 2,000,000 + 1,593,750 + 940,034 + 2,177,928) = $8,000,000 / 14,711,712 = 0.543784…

$2,000,000 / 0.543784 = 3,677,928

Total Number of Shares in Entire Round = 18,389,640

Subscribing to the Law of VC newsletter is free and simple. 🙌

If you've already subscribed, thank you so much—I appreciate it! 🙏

As always, if you'd like to drop me a note, you can email me at chris@harveyesq.com, reach me at my law firm’s website or find me on Twitter at @chrisharveyesq.

Thanks,

Chris Harvey