#8 Episode - The Immutable Math of Cap Tables

Cap Tables are Broken, but Not Because of Your Math Skills

Key Takeaways: Always ask for a pro forma cap table in every financing round. Never rely on a third party to run your cap table. Clarify any ambiguities. Misunderstandings of terms are far more common than mistakes of math.

This is the second article in a four-part series on cap tables:

#7 Episode—Universal Cap Tables (9/16/20)

#9 Episode—Mutable Laws of VC (10/4/20)

#10 Episode—The Stories Behind Cap Tables (10/13/20)

Today, we offer three sample cap tables, two scenarios and one challenge you will likely face when dealing with cap tables as an emerging fund manager.

We’ll stick to the basics—ownership structure and option pool expansions—and then move to the more difficult problems such as converting stacks of post-money Safes and pre-money notes on the next article.

I am also issuing a challenge to the first person who correctly gets the math & pro forma cap table correct 👇

Background of the Problem

A cap table is a numerical representation of a company's current ownership structure. In other words, a cap table (or “capitalization table”) lists who owns what in a company. It usually includes the actual number of shares, percentage of ownership, and value of equity in each round of investment.

A “pro forma” cap table tracks the equity dilution before and after a financing, including ownership of the founders, employees, advisors, investors, option plan holders and other stakeholders entitled to an ownership interest in the company.

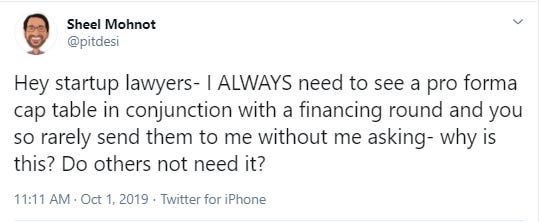

Pro tip #1: Always ask for a pro forma cap table in every financing round.

Heed the wise words of VC Sheel Mohnot (@pitdesi):

Why do you need one? Because a cap table provides incredibly useful information:

ownership % in a portfolio company

calculation of your pro rata rights

liquidation preference stack

general economic rights

voting percentages

identity of key players

Cap tables also minimize violations of corporate law (e.g., exceeding the authorized share count limit) and lower the likelihood that shenanigans are played on the cap table between rounds.

Theory of Constraints

"One of the immutable laws of venture capital is that there are only 100 points on the cap table."—Sam Altman, former YC President, on Dilution

That statement seems obvious, but the theory of constraints holds that the limiting factor of a cap table is that there is only 100 points to distribute. It's a zero-sum game. Each company has a set of majority and minority interest holders on its cap table.

On the surface, a cap table is just a set of simple math problems. Over time you learn that cap tables are driven by human emotions and soft power. With only 100 points on a cap table, venture capital fund managers need to find a way to get their ownership targets onto a cap table or they risk losing out on an opportunity.

Math Errors and Cap Table Entropy

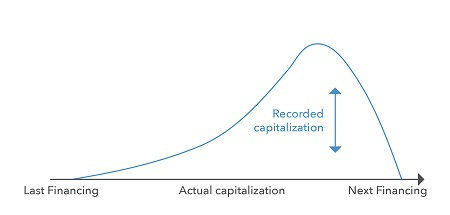

Cap tables all have varying degrees of accuracy, consistency & norms. Before online platforms, most cap tables were broken. That was often because of bad spreadsheets, human errors and cleanup issues, which online platforms did an excellent job at fixing.

However, today, the weakest link on a cap table is rarely the math. In fact, because cap table math is so precise, it often tricks VCs and lawyers into a false sense of security.

The most important thing to note is the more you neglect a cap table, the more disorder (or entropy) creeps in. The Second Law of Thermodynamics states that the entropy of a closed system will never decrease. Applied to cap tables, the more you neglect your cap table without actively managing it or consistently using an online cap table management platform, the more that entropy creeps in (source: Carta):

Notwithstanding maintenance issues, cap table problems persist today because of:

Not understanding how to calculate option pool expansions

Not understanding the various ways to set a price per share

Not understanding how to calculate post-money Safes with pre-money notes

The Dunning-Kruger Effect of startup lawyers and VCs

As Bilal Zuberi, a GP at Lux Capital (@bznotes), has written:

And it’s not just a matter of hiring expensive legal counsel:

Man, one month and the same issue with three of the largest law firms in the country! From a Series A to a billion valuation raise. —@bznotes

The Map is Not the Territory

Free online cap table calculators like AngelCalc.com, Carta’s Safe calculator, plus Microsoft Excel and Google Sheets have reduced math errors.

Again, the problems of cap tables are not usually math mistakes but more so because (1) human error can creep in any system (see, How Not to be Stupid), (2) terms are captured in legal documents rather than formulas or numbers, and (3) cap tables are often treated as a single source of truth for all equity a company has ever issued.

Even with a standard set of legal documents, there is often variability and room for interpretation—plus, it’s difficult to verify and agree on terminology without knowing what they mean and fully understanding their effects.

Cap tables are like maps of the territory. The map is not the territory.

Pro Tip #2: Never solely rely on your lawyer or an online cap table management platform to run your cap table. That’s ultimately your responsibility.

Reading Materials

First, if you haven’t already done so, please read Navi’s article on cap table dilution: “Option Pool Shuffle.”

Second, I also recommend reading Fred Destin’s Your Startup Valuation Explained. Fred is one of the best VCs when it comes to cap table math.

Finally, the YC User Guide for the Post-Money Safe is one of the best user manuals for how to calculate dilution on cap tables using Safes.

Sample Cap Tables*

Link to my sample cap table (Google Sheets):

Venture Hack’s cap table, modified to fit the example below (Google Sheets):

Fred Wilson (@avc) also has a standard cap table with liquidation waterfalls:

*Don’t sue me.

Cap Table Scenario

Let’s run through an example and then we’ll end on the key takeaways, math equations and principles, plus a challenge for any brave soul to answer correctly.

Example

The Corporate Setup:

Startup has 8M shares allocated to the Founders;

Founders reserve 2M shares (20%) for their option pool;

Founders issue 5% of the company to employees; and,

Founders want to bring on a new CTO, who will receive 10% of the company (post-money options), subject to the round closing.

Term Sheet:

$10,000,000 post-money, including (i) all currently outstanding shares, warrants, options and other convertible securities, (ii) a currently available pool of options equal to approximately 20% of the fully-diluted shares of the Company as of immediately prior to the Closing (as defined below), (iii) $1 million of Series Seed Preferred to be sold in the Closing, and (iv) issuance of a $1 million Warrant.

Summary:

$10M post-money valuation including shares, warrants, options, Safes/notes

~20% currently available option pool as of immediately prior to the Closing

+$1M warrant issued to VC

+$1M preferred stock investment by VC

Question: What is the pro forma capitalization structure of this offer?

At first blush, you might be tempted to calculate the post-money shares like this:

Founders = 8,000,000 shares

Option pool already reserved = 2,000,000 shares

$2M investment = (10,000,000 shares / 0.80) = 12,500,000

Investor receives Warrant = 1,250,000 shares; Preferred Stock = 1,250,000 shares

Easy! …right?! If you did math like that, you would be…

So, let’s back up and remember: Question your assumptions. As Fred Destin pointed out before:

Take time to negotiate a proper long form term sheet. Don’t rush into signing. Discuss each point carefully. Understand the language behind the language. Sweat the details.

First, we need to understand if we are in post-money or pre-money calculations.

$10,000,000 post-money

The phrase “post-money” gives it away. That means we’re working backwards - we know where we will end up, but we don’t know where to start. So we have to calculate everything that makes up a “$10M post-money” valuation.

Second, that means calculating the fully diluted capitalization:

(i) all currently outstanding shares, warrants, options and other convertible securities

Common stock and pre-money options = 8,500,000 (x)

8,000,000 shares issued to the Founders

500,000 shares options out of the option pool (5% of 10M)

No other warrants, Safes or convertible notes = 0

Third, we need to determine what “currently available… equal to approximately 20% … immediately prior to Closing” means in the context of “$10 million post money.”

$10 million post money, including… (ii) a currently available pool of options equal to approximately 20% of the fully-diluted shares of the Company as of immediately prior to the Closing (as defined below)

You might think that “as of immediately prior to the Closing” can't possibly mean “post money,” and while that’s a valid argument, you might be wrong. Why? Because, this exact scenario played out in one of my venture deals and the investor's lawyer (who is a partner at a preeminent law firm) said so.

“20% ‘available immediately prior to closing’ means post-money. This is a standard term. What don’t you get?” 🤔

The VC's lawyers threatened to walk if we didn’t go with their interpretation.

We even tried to clarify the term in the term sheet by listing an “effective pre-money valuation”, but that didn’t solve the problem. Their response?

“We don’t think in terms of ‘effective pre-money valuation’.” 🤷♂️

In a negotiation, you can try to play by the rules of the game, but the one who controls the money usually makes the rules (lately that power dynamic has shifted as there's more competition among VCs).

So, to arrive at the “correct” result, we would need to know that 20% available immediately prior to closing, actually means post-money.

Pro tip #3: Always be clear on the terms either by attaching a pro forma cap table or clarifying the language so precisely that there is absolutely zero room for ambiguity.

The Price Per Share

Fourth, to get the most accurate understanding of the terms, we need to lock in the most important term of a pro forma cap table: The Price Per Share.

Again, abide by the golden rule: Never assume, always build your model ahead of decision making time. The Price Per Share captures everything. It is your single source of truth. As Fred Destin said:

THE PRICE PER SHARE NEVER LIES.

Here’s the general formula:

Price Per Share = Pre-Money Valuation / Pre-Money Shares = (“PPS”)

Pre-Money Shares

Pre-money shares are the total number of shares prior to the financing round. It includes the outstanding common stock plus options granted, convertibles, and usually includes an expanded option pool, shares issued to previous investors and sometimes even the shares issued to the new investors (This is the percentage ownership method) (Edit 9/26/20: More common methods include the pre-money method and dollars-invested method, which we will discuss next week on The Law).

Here’s what we know:

Post-Money Valuation = $10M (“t”)

Common and Pre-Money Options = 8,500,000 (“x”)

Cash Invested (warrant counts as pre-money ‘investment’) = $2M (“c”)

Available options = 1,500,000 shares

How do we solve for the Price Per Share (“PPS”), the Option Pool Expansion (“Y”) and the Number of Shares to issue to the New Investor (“Z”)?

This is where things get really interesting. This is known as the ‘Option Pool Shuffle’:

(Photo: Chicago Bears, Circa 1985, The Super Bowl Shuffle).

Option Pool Shuffle

To calculate the post-money option pool we need to calculate the entire set of numbers leading up to it.

Here’s the set of equations for this type of deal:

c = Cash Invested ($)

x = Outstanding Common Stock + Pre-Money Options

t = Pre-Money Valuation (p) + c

Pre-Money Valuation (p) = t - c

Available Options Percentage Post-Money (o) = Term sheet negotiation %

Option Pool Expansion (Y) = [(x · o · t) / p - (o · t)]

Price Per Share (PPS) = p ÷ (x + Y)

Investor Shares (Z) = c ÷ s

Effective Valuation ($) = PPS · x

Two Ways to Solve This:

Download a sample cap table or render in a cap table management platform.

Also you could just run the numbers:

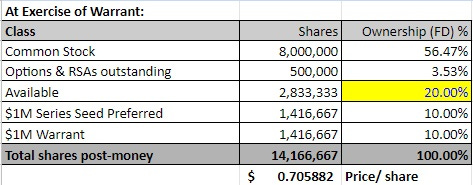

Solving for Y, PPS and Z:

c = $2M

x = 8,500,000

t = $10M

p = $10M - $2M = $8M

o = 20%

Y = (8,500,000 * 0.20 * $10M) / ($8M-(0.20 * $10M) = 2,833,333 shares.

PPS = $8M / (8,500,000 + 2,833,333) = $0.705882… (rounded up 6 places)

Z = $2M / 0.705882 = 2,833,334

So, to visualize this properly, let’s use my spreadsheet:

So, now we have it correct, right!?

…Wrong!

We forgot something. The CTO with the promised 10% post-money options.

Here’s the definition of Promised Options:

“Promised Options” are promised but un-granted options, restricted stock awards or purchases, RSUs, SARs, warrants or other like securities equal to the greater of those (a) promised pursuant to agreements made prior to the execution of the term sheet for the Equity Financing (or the initial closing of the Equity Financing, if there is no term sheet), or (b) treated as outstanding in the calculation of the Standard Preferred Stock’s price per share.

In other words, “Promised Options” just means those shares that the startup intends to issue but haven’t actually papered the file with yet. They often crop up in early stage ventures where there are FAST advisory agreements signed but no corresponding board consent or stock option agreement actually authorizing or granting the options.

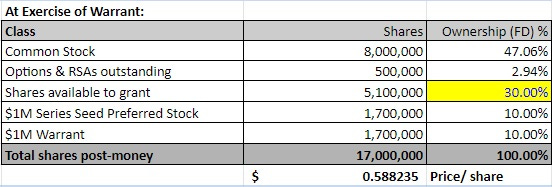

So, if you count the promised shares as 10% post-money, here’s what the “correct” pro forma cap table should represent:

Conclusions

How do you prevent this ambiguity in the pro forma cap table? This line from Navi’s How to Make a Cap Table, is instructive:

Skillful negotiators use their opponent’s standards and norms to advance their own arguments. Fancy negotiators call this normative leverage. You apply normative leverage in the option pool shuffle by using a hiring plan to justify a small option pool.

Having a hiring plan in place solves the ambiguity. This will address the investor’s concerns about having too small of an option plan but also make it fair to the founders. Planning helps resolve any guesswork and takes it out of the emotional realm. And while the plan might not actually be utilized, it is the planning process that’s far more valuable than the plan itself. “Plans are Worthless, but Planning is Everything.”

Pro tip #4: If there is any fundamental disagreement on the option pool expansion, ask the startup founders to come up with a hiring plan.

My recommendation: Have the startup use a free tool like LTSE’s Hiring Plan or ask the founders to come up with a reasonable hiring plan until the next round of financing.

The Challenge

Here’s the challenge:

You can use a cap table management program if you want. Feel free to email me, post in the comments or tag me on social media. Include a cap table with it, please. Whoever gets it right on their first attempt I’ll send a shout-out on my next newsletter and credit you on a post through Twitter and LinkedIn (if you want).

The key is understanding how to convert the notes and Safes, using the paradigm set of the problem above (without the complication of the Promised Options by the CTO).

(Edit: 10/6/2020—Challenge solved step-by-step below and in the Next Episode)

Subscribing to the Law of VC newsletter is free and simple. 🙌

If you've already subscribed, thank you so much—I appreciate it! 🙏

As always, if you'd like to drop me a note, you can email me at chris@harveyesq.com, reach me at my law firm’s website or find me on Twitter at @chrisharveyesq.

Thanks,

Chris Harvey