#18 Episode - Simplifying the Safe

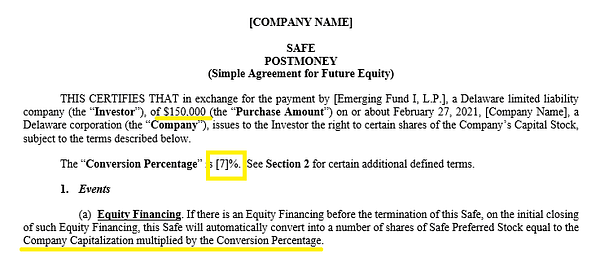

Remove the Valuation Cap and Discount. Replace it with a Conversion Percentage (%).

Key Takeaways: Remove the valuation cap and discount from the Post-Money Safe and replace it with a “Conversion Percentage.”

Principal Amount / Valuation Cap = Conversion Percentage (X%).

Just negotiate how much ownership you want to sell in a company — X% for $Y.

(Note: If you deal with Safes often, you can skip this part and scroll down to The Heart).

Since Y Combinator first introduced the “Safe” in 2013, early-stage deals have exploded. That’s not to imply a direct, causal link, but Safes have become the de facto securities instrument for early-stage deals in Silicon Valley and elsewhere.

A Word by Any Other Name

A “Safe” is a backronym for “Simple Agreement for Future Equity.”

Some see the Safe as a euphemism for Risk in early-stage venture capital investments. The greatest risk any investor takes—perhaps greater than gambling—is investing in early-stage startups. Paradoxically, that’s where the Safe is most often used.

But as risky as early-stage bets are, VCs and angels don’t typically do well if they only take one shot. The nature of venture capital investing is said to follow a power law distribution, which means if investors seek to maximize their returns they would be wise to invest in as many quality deals as the fund can get access to and invest in. Safes are the investing instrument that allows that to happen at scale.

Key Features of Safes

Along with a snazzy name to help lubricate the wheels of commerce, Safes have three key features that founders and investors find attractive: Speed, Simplicity and Cost.

At five-pages long, the Safe was a security instrument built for fast negotiations (“high-resolution financing”)

1x liquidation preferences with built-in shadow series of preferred stock is fair

Ability to close multiple, spaced rounds instead of squeezing groups of investors into one or two rounds—founder favorable

Defer more heavily negotiated terms like board seats, M&A veto rights, information rights, and other control/economic terms to the next priced round

Founders don’t need a lawyer to draft up their Safe - sure, lawyers can help them with the process and analyze important issues, but it doesn’t take a long time to learn how to properly fill out a Safe (unlike priced equity financing docs, even with the newest addition of Cooley’s NVCA form generator).1

Different Species of Safes

I had an Anthropology college professor who was fond of saying, there are “deer-like creatures” roaming this Earth, but there’s no such thing as a monolithic “Deer.”2

Likewise, there are Safe-like documents in the wild, but there is no monolithic Safe. When the Safe was first unveiled by YC there were four downloadable versions:

Valuation Cap Only

Valuation Cap + Discount (removed from YC website as of 8/16/2021)

Discount Only

Most Favored Nation

The original (pre-money) Safe had a conversion mechanism that was difficult to understand how much of a company was being sold, as the Safe depended on issues of valuation & dilution outside of the four corners of the contract.

As Sam Altman said:

“One of the immutable laws of venture capital is that there are only 100 points on the cap table."

After five years of complaints around their structure, in late 2018, YC updated its Safe. There were several changes, two of which were significant:

Default pro rata rights were removed in the Safe by default

The Valuation Cap changed from “Pre-Money” to “Post-Money”

Here’s a comparison of the Pre-Money vs. Post-Money Valuation Caps:

The big change was that the “Original Safe” (pre-money) did not count other “Safes, convertible notes and other similar convertibles” (including the Safe itself), whereas the new “Post-Money Safe” includes all such calculations, but not the option pool increase.

Here’s an example of how that works:

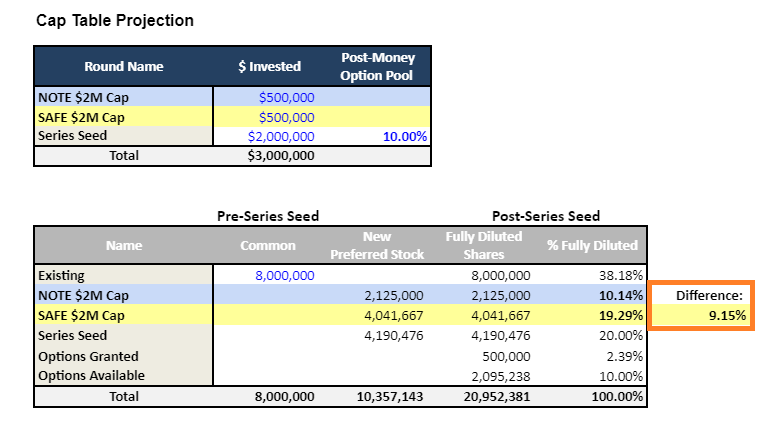

We’ll use an example of a cap table from Law of VC Episode #9 (link to cap tables):

The blue box 🟦 above shows a 0.78% difference.

That percentage represents the difference in shares between $100,000 invested on a $2 million (pre-money) note and $2 million on a (post-money) Safe, with a 20% option plan increase. Not a big difference. The Post-Money Safeholder ends up with 123,684 additional shares, but only 0.78% more of the company.

However, the problems compound when the convertible round size gets bigger and the option pool scales down (that’s because if you look at the comparison table two charts above, Post-Money Safes dilute LESS with smaller option pools, but have anti-dilution qualities when the startup raises more convertible securities, including notes & safes):

Look at that orange box! 🍊

How did the difference jump +8.4% between the Pre-Money Note and Post-Money Safe? In other words, even though the Safeholder and Noteholder invested the SAME amount of money with the SAME valuation cap, the Safeholder ends up with ~2x the shares.

Big law firms advocate for founder workarounds like “increasing the valuation cap,” but I’m not sure that solves the underlying problem.

The Heart of the Matter

I’ve seen hundreds, if not thousands of Safes in the past several years. It took me a while to master the math and conversion mechanics of how Safes work, but once I did, it became obvious that Safes can “wreak havoc” on cap tables. Some companies would like to do away with Post-Money Safes. Fred Wilson has called them a “shit show.”3

Charlie O’Donnell, a VC in New York, recently asked this question on Twitter:4

I don't understand asking for a discount for a SAFE. Isn't the whole point of the SAFE is that, under all future financings, you know exactly what % of the company you're buying? Why complicate it?

Rather than asking why complicate a Safe, shouldn’t we be asking how to simplify it?

In response to Charlie’s question, my response was to put forth a simple solution:

In other words, we can get to the heart of what’s wrong with the Post-Money Safe (which is an overwhelming lack of understanding of how Safes work) by simplifying its calculations. Instead of negotiating various Valuation Caps, why not just take the result of those equations and use THAT number as the fulcrum point for negotiations?

For example, if you’re an accelerator or venture studio, why not offer two packages to potential startups, as opposed to “one size-fits all” arrangement:

Although 3.5% and 7% have a 2x difference in dilution, the valuation caps are the same:

So it’s not just the valuation cap that matters, it’s also the dilutive effect that the Post-Money Safes can have when stacking these instruments on top of each other.

To help founders understand these effects, why not hard code the Safe so that everyone can understand these words written by Charles Hudson?5

At the end of the day, we only have 100 points of equity to split up and that’s not changing.

Conclusion

I’m not suggesting that this is an ironclad solution or that it doesn’t have holes in it. But when the terms are confusing to founders and VCs question why we have basic terms like a discount, it seems to be a good time to explore alternative options.

I welcome comments from you.

Sometimes a Safe is called a “SAFE,” or a “safe”. If you come across an “AngelSafe” or “Crowd Safe” in the wild, it’s not a Safe. It may be Safe-like, but it’s not a Safe.

Tweet from Charlie O’Donnell (@ceonyc) (Feb. 27th, 2021). A discount is not as intuitive as the name suggests: Instead of a discount off of the valuation cap or a discount off any future valuation, a discount is a percentage discount off of the price per share paid by future investors. When the principal and accrued interest under a convertible promissory note are divided by the discounted price per share, the note converts into a greater number of shares than it would otherwise receive. For example, if a company issues a note for $100,000 with a discount of 20%, and then sells preferred stock to VCs at $1.00 per share, the noteholder will receive 125,000 shares ($100,000 / [$1.00 * (100%-20%)]) of preferred stock. However, with a discount alone, the note holder will not receive any premium if the company substantially increases in value. For example, if the company sells at $100.00 per share, the discount is $80.00 per share, so an investor would receive only 1,250 shares ($100,000 / [$100.00 * (100% - 20%)]) of preferred stock. The discount is linear and applies whether the company is selling preferred stock at $1.00 per share or $100.00 per share. That is to say, if the company’s valuation skyrockets between the time it raises seed funding and when it raises a Series A, a discount alone can leave the noteholder with less of the company than he or she might expect. Therefore, many investors insist on a valuation cap in their convertible notes—uncapped notes are less common at Series Seed, but more common as the stages go further. (Adapted from Seed Funding Basics, by Jason S. Miller, Jan. 2020).

We Only Have 100 Points of Equity to Split Up (Dec 14th, 2020).

Subscribing to the Law of VC newsletter is free and simple. 🙌

If you've already subscribed, thank you so much—I appreciate it! 🙏

As always, if you'd like to drop me a note, you can email me at chris@harveyesq.com, reach me at my law firm’s website or find me on Twitter at @chrisharveyesq.

Thanks,

Chris Harvey