#31 Episode - VC Funds Regulatory Playbook

The Carta Policy Team Just Dropped the 'VC Regulatory Playbook' for Emerging Fund Managers. Let’s Review It.

Key Takeaways: We have written a lot about VC fund regulations here on Law of VC—probably more than any other Substack. Today, our attention turns to the Carta VC Regulatory Playbook. My initial thoughts are that this is the best practical guide on VC fund regulations. It distills the complex nature of SEC rules down to simple checklists and a good framework for emerging fund managers. Let’s review it in more detail. (Link).

Ed. 3/6/2024: The Corporate Transparency Act has been ruled unconstitutional by a federal district court in Alabama, but only for a select group of 65,000 business members. More here.

Ed. 3/12/2024: The U.S. House of Representatives passed a transformative bill for VCs & emerging fund managers [H.R. 2799], but it will face an uphill battle to keep it alive through the halls of the Senate and the White House. More here.

Ed. 6/21/2024: The Fifth Circuit Vacated the SEC’s Private Fund Adviser Rule on June 5, 2024. from has good key takeaways here.1

Ed. 12/3/2024: California SB 54, requiring DEI reporting by venture capital firms, has been amended by SB 164, now in effect. The first compliance deadline is extended to March 1, 2026 (registration) and April 1, 2026 (data reporting). The admin agency is now the Department of Financial Protection and Innovation (DFPI).

Ed. 2/7/2025: As of February 7, 2025, the situation with FinCEN’s Beneficial Ownership (BOI) Reports remains in a state of judicial cluster f—limbo. Although the U.S. Supreme Court on January 23, 2025, granted the federal government’s motion to lift the nationwide injunction issued in the Texas Top Cop Shop case—a separate nationwide order stemming from a district court case Smith v. U.S. Department of the Treasury still remains in force. In practical terms, this means:

Mandatory Filing Status: Reporting companies are not currently obligated to file beneficial ownership information with FinCEN. They remain shielded from liability if they choose not to file while the Smith order is active.

Voluntary Submissions: Companies may to submit their reports voluntarily.

“Back in Effect”: The Supreme Court’s decision did remove one judicial barrier to enforcement; however, because another injunction is still blocking the filing requirement, the CTA’s reporting obligations are not fully “back in effect” for reporting entities yet.

On February 7th, 2024, the Carta Policy Team posted the VC regulatory playbook:

What is It?

The VC Regulatory Playbook is a 23-page guidebook that covers these topics:

Regulation of the ‘fundraising process’

Regulation of ‘private funds’

Regulation of the ‘fund manager’

ERA Compliance Checklist

Additional Regulatory Considerations

Back in Law of VC #20 - a Simple Framework, we learned that there are three principal laws that govern 80%+ of venture fund law:2

This is the same regulatory framework that underlies Carta’s VC Regulatory Playbook:

LPs: Regulation of the Fundraising Process

Funds: Regulation of Private Funds

GPs: Regulation of the Fund Manager

FAQs: Framing it in this way can help us understand some of the nuances and the common legal issues that emerging fund managers face today. For example—

Q: Can I advertise my fund’s offering?

Yes—see Rules 506(b) and (c):

Rule 506(b): no general solicitation or advertising is allowed;

Rule 506(c): you can advertise but only if you take “reasonable steps to verify” your LPs are accredited investors.3

Q: How many investors can legally invest in my venture fund?

Q: Do I need to file a Form ADV?

<$25M: ⚠️ If your total assets under management (AUM) are less than $25M million, you may not be eligible or even permitted to file a Form ADV with the SEC—see Regulation of the Fund Manager section, below.

Let’s dive into the most important parts of the guide:

I. Regulation of the Fundraising Process

Regulation D: The Key Takeaways

In the Last Money In Substack,

and laid out a very good high-level summary of the primary exemptions under Regulation D:You can think about the differences [between Rule 506(b) and Rule 506(c)] in the ability to leverage the public or not. Under 506(c), you can advertise your fund on a large billboard or even a Super Bowl TV ad, while 506(b) is more restrictive, like a private club with a member’s only invite.

Rule 506(b)—Member’s Only

Rule 506(b) is the traditional way to raise a fund. Most funds use this exemption because it offers two key advantages: (i) private placements provide a cleaner regulatory pathway, including the option to rely on Section 4(a)(2), and (ii) the rules are more lenient if you’re willing to forgo public advertising.

Pro Tip: While it may be possible to add 35 non-accredited LPs in 506(b) fund offerings, GPs almost always avoid it due to the uncertainty, disclosure obligations & costs.

Rule 506(c)—Influencer’s Wanted

Consider Rule 506(c) as the modern/influencer way to raise a fund. For example, most AngelList rolling funds are 506(c) funds. These funds tend to be more social media focused—Balaji (@balajis) and Jason Calacanis (@jason) are each publicly raising $50-100+ million venture capital funds under Rule 506(c).

Turner Novak launched Banana Fund 2 (a $20M VC fund) using Rule 506(c):

Form D

Funds relying on Rule 506 are required to file a Form D6 with the SEC within 15 days after “first closing”—that is, the date upon which any LP is “irrevocably contractually committed” to invest in the fund; which is generally the date both the GP and LP sign their counterparts to the limited partnership agreement (LPA) and fund documents.7

But just to be 100% clear, there’s no 'registration' of any securities offering offering under Reg. D—you’re exempt from registration so you either just check a box under Form D for Rule 506(b)—for private offerings, or Rule 506(c)—for public solicitations:

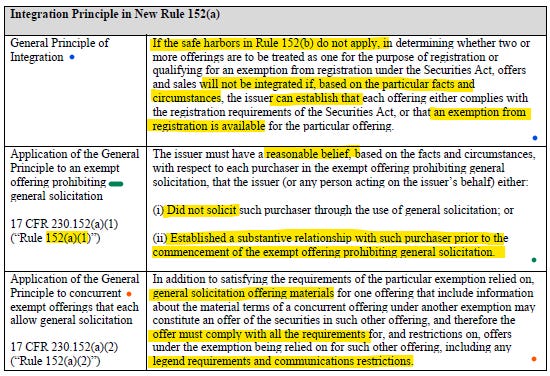

Integration Doctrine

Can you have a dual offering—that is, can you use Rule 506(b) and (c) at the same time?

Generally no, it’s not possible to have a 506(b) and (c) offering launched at the same time because these separate offerings would be “integrated” and therefore out of regulatory compliance; however, the SEC recently amended Rule 152 and it provides a clear framework for determining whether two or more offerings occurring close in time may be considered integrated—and if you file a Form D for a completed Rule 506(b) offering followed by Rule 506(c), the two offerings can be in regulatory compliance and therefore avoid integration.8

II. Regulation of Private Funds

The key sections that govern the investor limitations of private funds are found in sections 3(c)(1) and 3(c)(7) of Investment Company Act:

Section 3(c)(1)

Section 3(c)(1) exempts private funds that have 100 or fewer “beneficial owners”.9

Section 3(c)(1)(C)—Qualifying Venture Capital Funds

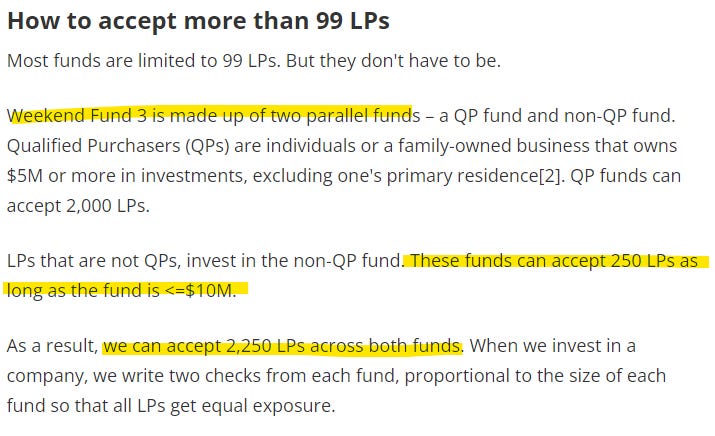

Section 3(c)(1)(C) also exempts venture capital funds that have 250 or fewer beneficial owners if their fund size is limited to no more than $10 million—the SEC just proposed increasing this limit to $12 million to account for inflation.10

Section 3(c)(7)

A Section 3(c)(7) fund provides an exception for funds whose securities are owned exclusively by 'qualified purchasers,' who are either (a) individuals or family entities with at least $5 million in net ‘investments', or (b) an entity or institutional LP with at least $25 million in net ‘investments’.

Wall Street hedge funds and large VCs often have only qualified purchasers in their funds, which makes their regulatory burden easy and simple. It also allows the fund to raise from practically an unlimited number of LPs.

For example, how can a venture capital fund adviser have over 600-750 LPs in a single fund? It’s because every LP in that fund is a qualified purchaser.11

III. Regulation of the Fund Manager

Who are Investment Advisers?

“Investment advisers” are essentially just fund managers and VCs:12

If you are (i) in the regular business of (ii) giving investment advice about securities (iii) for compensation, you are an “investment adviser”.

In other words, if you accept third party money and make startup investments on behalf of LPs, you are most likely an adviser. For example, if your activities include identifying portfolio investments for funds, accepting management fees and carry, or managing the startup positions within a portfolio, you fall squarely within the legal definition of an investment adviser. This can even arise from your activities as lead investor on a fund investment platform.13

Exempt Reporting Advisers (ERA)

An ERA is a fund manager that follows an exemption and files a Form ADV with FINRA. More on Form ADVs under “ERA Compliance Checklist”, below.14

There are two primary exemptions for ERAs:

Private Fund Adviser:

“Solely” advises private funds of which the fund manager has less than $150 million in total AUM across all funds managed by the adviser

VC Fund Adviser:

“Solely”15 acts as a fund manager to venture capital funds*

*Definition of Venture Capital Fund

What’s considered a “venture capital fund” under federal law?

Legally, a VC fund is a private fund that:

✅️ holds itself out as pursuing a venture capital strategy

✅️ holds no more than 20% of its assets in ‘non-qualifying investments’ (the “20% Non-Qualifying Basket” rule)16

✅️ is not substantially leveraged

✅️ doesn’t provide redemption rights except in extraordinary circumstances

✅️ is not registered under the Investment Company Act

Here’s a simple explanation of how the “20% Non-Qualifying Basket” rule works:

Every time a GP invests in any non-venture capital asset, the GP must check to see if its non-VC investments are below the 20% non-qualifying investment (NQI) limit.

For example, if a $50 million fund has $10 million in crypto tokens (NQI), and the GP wants to invest an additional $5 million in secondary resales (NQI), the GP would not qualify as a federal VC adviser since the non-venture capital assets, totaling $15 million, will exceed 20% of the fund ($15M / $50M = 30%). Therefore, the GP must find another exemption—such as the Private Fund Advisers Exemption—or publicly register with the SEC.

Q: Can “warehoused investments” be considered 'qualifying investments' (i.e., VC assets) even though they were not originally acquired by the venture fund?

“Warehoused investments” are pre-fund formation investments that the fund manager would like to transfer into the fund upon first closing. Can warehoused assets qualify as “direct” or “qualifying investments”?

Yes, but only if specific conditions are met:17

Direct Acquisition: You or your affiliated entity (such as an SPV) must have acquired the investment “directly” from the portfolio company.

Full Disclosure: The terms of the warehoused investment must be clearly outlined so all investors (LPs) know before their commitment to the fund.

Transfer at Cost: It's best practice to transfer warehoused investments into the fund at the original cost basis, avoiding the perception of any conflicts of interest.

SEC Updates Its FAQ on Form ADV

There are two types of ERAs in the U.S. federal system:18

SEC ERAs: An ERA reporting to the SEC under federal law is an “SEC ERA”;

State ERAs: An ERA reporting to state regulators is a “State ERA.”

You can file as a State ERA and SEC ERA, but only if your AUM is $25+ million. For fund managers who manage <$25 million AUM, state law provides the relevant rule. But in some states, you go through the same filing process—except a checkbox to file the Form ADV with state regulators (“Submit a report to one or more state securities authorities”) instead of submitting it to the SEC (“Submit an initial report to the SEC”).19

This dual regulatory system can lead to differences in reporting requirements, exemptions, and compliance obligations:

Pro Tip: ⚠️ Importantly, if a fund manager is ineligible to register with the SEC because their AUM is under $25 million, the fund manager may be ineligible to file as an SEC ERA.

As to that last point, one of my emerging fund clients received an email from the SEC earlier this year, with words to the effect of:

Based on your latest Form ADV filing, it does not appear your firm is eligible to report as an SEC exempt reporting adviser (ERA) because you are not eligible to register with the SEC, primarily because in your Form ADV Section 7.B.(1), you report that you are managing less than $25 million in private fund gross assets/regulatory assets under management. You further do not qualify for registration under specific exemptions that would allow you to operate without SEC registration, such as being a multi-state adviser or a related adviser under certain SEC rules. Please submit a final report with the SEC to terminate your reporting as an SEC ERA.20

On October 26, 2023, the SEC updated its FAQs on ERAs:

Q: Must I be otherwise required to register with the SEC to be eligible to file as an SEC Exempt Reporting Adviser?

A: Yes. Because filing as an Exempt Reporting Adviser is an exemption from registration with the SEC, an adviser must be otherwise required to register with the SEC to rely on such exemption. See Form ADV’s Glossary of Terms for more information. (Posted October 26, 2023)

This creates an interesting regulatory paradox. If you’re a State ERA, but ineligible to file a Form ADV as an SEC ERA, what happens to your legal status if you complete the same steps and disclose the same information in your Form ADV? For instance:

Accredited Investor Status: Rule 501(a)(1) automatically qualifies “any investment adviser relying on the exemption from registration with the SEC under section 203(l) or (m) of the Investment Advisers Act of 1940,” but not State ERAs.

Corporate Transparency Act (CTA): The CTA mandates annual reports for all “reporting entities” unless you fall under one of the 23 exemptions. SEC ERAs that rely on Section 203(l) of the Advisers Act are exempt as are their funds. But not private advisers nor State ERAs—that means VC fund managers under $25M AUM may need to file disclosures for all of the funds they manage since there is no exemption for Section 3(c)(1) or 3(c)(7) funds, only for VC advisers & funds that file as SEC ERAs. Your regulatory burden is greater for smaller funds. An odd result!

Private Fund Adviser (PFA) Rules: What if a fund manager cannot be designated as an ERA under federal law, would the PFA rules still apply to State ERAs? What’s their status with the SEC if the advisers are not subject to SEC reporting and are not subject to SEC examinations? Generally speaking, those State ERAs would still need to comply with the PFA rules as enacted, but those rules may change depending on the outcome of a recent lawsuit filed in federal court.

State Rules for Fund Managers

State adviser regulations across the U.S. have been keyed into this USA map:

How does California treat their State ERAs?

California treats ERAs identically as SEC ERAs but with two key differences:

50%+ VC Funds. California ERAs need only 50% of each fund invested in venture capital investments at least once a year to meet the thresholds of a venture capital fund.21

Retail Buyer Funds. On the other hand, a private fund that is not a venture capital fund but has at least one accredited investor is called a ‘Retail Buyer Fund,’ which requires substantially more steps for compliance:

PPM: Advisers must provide “material disclosures” regarding the fund and “the nature of advisory relationship” between the GP and the fund’s LPs.

Audit: Advisers must provide their LPs with audited financials annually.

Qualified Clients: Advisers may only charge “performance fees” (i.e., carried interest) to “qualified clients” ($2.2 net worth).

In California, you’re considered a "State ERA" not a "Dual ERA" or “SEC ERA”, if you have under $25 million in AUM.

IV. ERA Compliance Checklist

In addition to the ERA Compliance Checklist by Carta, there is another checklist available by the Investment Adviser Association (IAA)—entitled Form ADV Part 1A Checklist:

Here is a summary of Carta’s ERA Compliance Checklist:

Reporting Requirements

Form ADV—Part 1A includes:

Basic identifying information

Fund size

Other business interests

Disciplinary history

Control persons and ownership percentages

Filing Process:

Electronically file Form ADV with FINRA’s IARD system; publicly available here.

Initial filing is due within 60 days of the fund’s first closing.

Annual updates within 90 days of fiscal year end (e.g., March 31st, 2024).

More frequent updates for any material changes throughout the year.

SEC estimates it will take the average filer 23.77 hours to file their Form ADV.

Some law firms charge $10K+ to file a Form ADV but this depends on complexity of filing and number of funds; generally this should cost no more than $3.5-5K.

State Registration and Blue Sky Filings:

ERAs under $25M AUM should check if their state requires a Form ADV filing.

Notice filings and state fees ($100-250+) are often required in states.

Many states have exemptions mirroring the federal VC exemption.

Fiduciary Duties and the Advisers Act

Fiduciary Duties:

Good Faith: Always place the interests of your clients, including your private funds (and LPs), above personal gain or other firm interests.

Full Disclosure: Disclose all material facts pertinent to the investment advisory relationship, including any conflicts of interest.

Non-Waivability: Understand that fiduciary obligations cannot be waived, even with LP disclosure or investor consent.22

Anti-Fraud Requirements:

ERAs must still comply with the anti-fraud prohibitions under Section 206 and Rule 206(4)-8 of the Advisers Act, which broadly cover fraudulent, deceptive, or manipulative conduct.

Prohibition of Misleading Conduct

Avoid making false or misleading statements to current or prospective LPs—the most important places this is made are in emails and your LP deck.

Do not omit material facts necessary to prevent statements from being misleading.

Refrain from engaging in practices that could be deceptive or fraudulent.

Specific Prohibited Activities

Providing investors with misleading performance data

For example, showing 10x returns on portfolio but the data is cherry picked or misleading personal investments.

Promising or implying guaranteed returns

Making inaccurate disclosures regarding management fees & expenses.23

Conflicts of interest

Where a conflict exists and can be waived (eg, a principal transaction for a warehoused asset that is to be transferred into the fund), informed written consent by LPs must be provided prior to the effective date of transfer.

SEC Pay-to-Play Summary

ERAs (Exempt Reporting Advisers) are subject to the Advisers Act requirements that prohibit investment advisers from engaging in pay-to-play practices.24

In simple terms, an adviser cannot receive compensation for services provided to a government entity or official after making political contributions to the same.

Key Points:

ERAs and their associates face a two-year cooling-off period after contributing to an official or government entity before receiving compensation for advisory services provided to that entity.

ERAs are prohibited from soliciting or coordinating campaign contributions for government officials or entities they serve or seek to serve.

Pay-to-Play violations under the Advisers Act are strict liability, meaning intent is irrelevant—any violation can lead to liability.

The SEC pursues Pay-to-Play violations and has recently brought several cases but most have turned out to settle for a few thousand dollars or less.

Material Non-Public Information (MNPI):

Section 204A of the Advisers Act requires that all investment advisers, including ERAs, to establish, maintain, and enforce written policies and procedures reasonably designed to prevent the misuse of Material Nonpublic Information (MNPI) by the fund manager or anyone associated with the fund manager.

For example, if a VC fund manager, or anyone associated with the fund manager, engages in trading based on portfolio company information before it becomes public, or if they inform others who then trade on this information, such actions may constitute insider trading and possibly the release of MNPI.

Checklist for Emerging Fund Managers:

Written Policies and Procedures:

Establish written policies to prevent MNPI misuse.

Adopt a code of ethics.

Specify expected business conduct.

Reporting Requirements:

Identify “access persons” subject to reporting obligations (like managing directors, managing partners, and general partners).

Ensure timely reporting of securities transactions and holdings to the CCO.

V. Other Fund Regulations

Carta’s VC Regulatory Playbook also covers the following rules and regulations:

Private Fund Advisers Rules

Corporate Transparency Act

California’s VC Diversity Disclosure law

H.R. 2799: Expanding Access to Capital Act (VC Wish List)

Here’s a brief description of each:

Private Fund Advisers Rules*

Ed. 6/21/2024: The Fifth Circuit Vacated the SEC’s Private Fund Adviser Rule on June 5, 2024. Chris Hayes has good key takeaways here.

(Note: Caution, PFA is no longer good law!)

Ed. 6/21/2024: The Fifth Circuit Vacated the SEC’s Private Fund Adviser Rule on June 5, 2024. Chris Hayes has good key takeaways here. (Note: Caution, no longer good law!)

Corporate Transparency Act

Beneficial Ownership Reporting Requirements under the CTA25

The Corporate Transparency Act (CTA) mandates U.S. companies to disclose beneficial ownership information to the Financial Crimes Enforcement Network (FinCEN) to enhance corporate transparency and combat money laundering activities.

Here’s a summarized checklist:

Who Must Report: All corporations, LLCs, partnerships, certain trusts, etc. operating or registered in the U.S. (“Reporting Companies”)

A. Exempt Entities (No Reporting Required): The CTA exempts 23 categories of entities from the definition of “Reporting Company,” including:

VC fund advisers—SEC ERAs.26 VC fund advisers relying on Section 203(l) (that is, according to the SEC, larger VC firms with >$25M in AUM/capital commitments) are exempt.

Venture capital funds. “Pooled investment vehicles”—that is, private funds relying on Section 3(c)(1) or 3(c)(7) of the Investment Company Act AND advised by a larger VC fund adviser/RIA.

Management Companies (Investment Advisers). Exempt if the management company is a VC fund adviser exempt under Section 203(l). If a separate entity from the exempt adviser: (a) it’s not automatically exempt, and (b) its exemption status depends on its specific structure and other potential exemptions, such as the “Control/Subsidiary” status.

GP LLC for a Venture Capital Fund—Control/Subsidiary. Not explicitly exempt on its own but may be exempt if: (a) Ownership interests are controlled by an exempt entity (such as an exempt Management Company), or (b) qualifies for the subsidiary exemption (such as the GP owned by the Management Company).

SEC Registered Investment Advisers—RIAs. “Registered” advisers, meaning you have registered with the SEC (annual audits, qualified clients, custodians, etc.) and are reporting all your information to the SEC.

Large Operating Companies. More than 20 Full-Time Employees + $5M in annual sales, all within the United States:

Companies (startups and funds) that do not otherwise qualify for a reporting exemption may qualify for the exemption if they:

Maintain an operating presence at a physical office in the US;

Have more than 20 full-time employees in the US; and

Have filed a US tax return in the previous year reporting over $5 million in US-source gross receipts or sales.

Non-US Funds. Non-US funds fall outside the scope of the CTA if: (a) formed outside of the United States, and (b) are not registered to do or doing business in any U.S. state or tribal jurisdiction. Many investment managers take the position that their funds don’t need to register in any state, so non-US funds typically have no CTA obligations.

B. Entities That May be Required to Report to FinCEN:

Smaller VC fund advisers with <$25M AUM—State ERAs. As mentioned above, while SEC ERAs relying on Section 203(l) are exempt (that is, larger VC firms with >$25M in AUM/capital commitments), smaller VC fund managers (under $25M AUM) do not have a specific exemption available. That is, there’s no CTA exemption available for Section 3(c)(1) or 3(c)(7) funds themselves, nor apparently VC advisers that file as State ERAs (under $25M in AUM). In other words, this may create a heavier regulatory burden for smaller funds, which would be an unexpected outcome.

Fund-of-Funds/Private Funds. No exemption for “private fund advisers” exempt from SEC registration under Rule 203m-1 (i.e., fund-of-funds and other non-VC funds do not qualify without an RIA advising them or as a Large Operating Company).

Portfolio Companies That Are Not “Large Operating Companies”. Pre-seed/seed portfolio companies often won’t qualify as exempt Reporting Companies unless they are “Large Operating Companies” (see above—$5M in annual gross sales, over 20 FTE).

Key Considerations:

The exemptions primarily revolve around SEC registration status and the VC $25M AUM threshold

Smaller VC firms (< $25M AUM) & funds may face more reporting obligations

The structure of the VC firm (relationship between investment adviser, GP, and management company) is important in determining exemption status

Each entity in the fund structure needs to be evaluated separately for exemption eligibility

Required Information:

Entity Details: Legal name, DBAs, principal business address, jurisdiction of incorporation, Taxpayer ID (EIN); and;

For Each Beneficial Owner/Company Applicant: Name, date of birth, residential address, and a unique identifying number from an ID document, along with an image of that government sponsored ID.

Definitions:

“Beneficial Owner” Individuals owning at least 25% of the company or exercising substantial control, including executive officers, managers, GPs board members, or even investors with significant control rights.

“Company Applicant” The individual who files the entity’s creation or registration documents, or the one primarily controlling the filing.

Deadlines:

For Existing Entities: January 1, 2025, if formed before January 1, 2024.

For New Entities: Within 90 days for entities formed between January 1, 2024, and January 1, 2025; within 30 days for entities formed after January 1, 2025.

Updates: Must be filed within 30 days of any change in beneficial ownership.

Penalties for non-compliance include civil penalties up to $500 per day and criminal penalties up to $10,000 and/or imprisonment for up to two years

For a lot more useful information on Beneficial Ownership Rules and the CTA, checkout this Substack by

and :California’s VC Diversity Disclosure law

HR 2799: Expanding Access to Capital Act (VC Wish List)

On Friday, March 8, 2024, the U.S. House of Representatives passed a transformative bill that would revolutionize how VC-backed startups, crypto, emerging fund managers and the venture capital industry, as a whole, operates. However, this 1/2 Congressional law looks like a “VC wish list” that will probably never see the light of day, as it attempts to pass insurmountable odds in the Senate and the White House.

Here’s a summary of the laws that would apply:

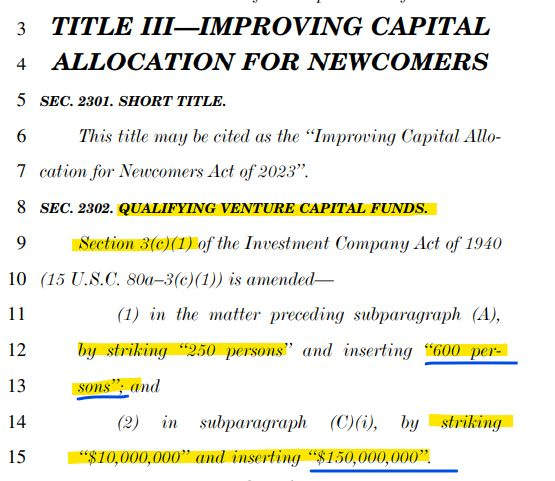

Expanding Access to Venture Capital Funds: At the heart of the bill (from a VC funds perspective) is an adjustment to the “Qualifying Venture Capital Funds” criteria under Section 3(c)(1)(C) of the Investment Company Act. By elevating investor limits from 250 to 600 LPs and expanding assets under management (AUM) thresholds from $10 million to $150 million, the bill paves the way for VC funds to embrace a broader investor base to manage substantial sums of money.27

Inflation Adjustments: The bill acknowledges the impact inflation has had, particularly on benchmarks, and it has a long overdue update to the AUM limits for private fund adviser exemptions. This would adjust the $150 million cap to ~$203 million to match the 35.87% CPI inflation since 2010, with provisions for annual adjustments; this change ensures that regulatory frameworks keep pace with economic realities, maintaining relevance and efficacy.

Open Investment Access Through Accredited Investor Thresholds: Perhaps the most groundbreaking provision is the redefinition of “accredited investor” status. By allowing any investor to qualify, provided their investment does not exceed 10% of their annual income or net worth, the bill aims to democratize access to venture capital and private funds. This approach could revolutionize startup and VC financing, inviting a wider array of LPs into the venture capital ecosystem.

Simplifying Risk Disclosures and Empowering Investors: The introduction of a short investor self-certification form, limited to two pages, is a significant step towards streamlining the accredited investor process. This form enables investors to acknowledge their understanding of the risks involved, streamlining the path to becoming an "accredited investor" and fostering a more accessible and informed investment landscape.

Improving Capital Allocation for Newcomers (2024): By including individuals receiving personalized investment advice from licensed professionals (Series 7, 65, or 82) in the accredited investor definition, the bill opens up professional gates the venture capital has faced than ever before.

These regulatory expansions will allow VC funds to expand to a pool of investors & manage larger funds without strict regulatory constraints on fund size and limits.

Now, the big question here will be whether this law passes the Senate (and whether it clears the Presidential veto) which, in an election year with the Senate a lot more interested in investor protections. The odds of the bill being enacted into law are somewhere between ~0.01% to 33%.28 But realistically, it’s probably on the low end, which makes this law a true VC wish list that will likely never come to reality—not without serious concessions, at least.

The White House released their arguments as to why the Biden administration is strongly opposing H.R. 2799:29

Investor Protections at Risk: The Biden Administration opposes H.R. 2799 due to concerns that it would significantly dilute longstanding investor protections by exempting VCs from existing regulations and undermining state and federal safeguards. This could lead to a less transparent and accountable capital market environment, increasing the potential for investor abuse and financial losses.

Erosion of Worker Rights: The law is criticized for potentially facilitating the misclassification of employees as independent contractors, stripping workers of critical protections like minimum wage, overtime pay, and unemployment insurance. This misclassification undermines the economic stability of America's workforce and threatens the well-being of the middle class by depriving them of essential labor protections.

Undermining Regulatory Expertise and State Efforts: The Biden Administration is concerned that H.R. 2799 oversteps by rewriting SEC regulations and preempting state laws aimed at protecting investors and employees. Such actions disregard the specialized knowledge and procedures of regulatory bodies and state governments, compromising the effectiveness of regulatory oversight and state efforts to enforce fair labor practices and protect investors. “These technical matters are best left to established administrative procedures and agency expertise.” Again, their words, not mine.

The Last Word: Carta’s VC Regulatory Playbook has a lot to offer and I just included the parts that were interesting, but I encourage you to download it if you are an emerging VC looking for a comprehensive framework and checklists for regulatory compliance.

Footnotes

Impact on Private Fund Advisers (General Partners) (URL)

Complete Invalidation: The PFA Rule was invalidated entirely. Future similar regulatory rules would require new legislative action by Congress.

Limitation of SEC Authority: The decision limits the SEC’s authority in the private funds space and possibly beyond. The SEC cannot use Dodd-Frank Section 211(h) to justify rules for private fund advisers.

Fiduciary Duty Clarification: The fiduciary duty of an investment adviser is to the fund, not individual investors. This limits the SEC’s ability to extend retail investor protection rules to private funds.

Anti-Fraud Rule Constraints: The SEC’s ability to use Section 206(4) of the Investment Advisers Act as a broad regulatory tool is curtailed. The SEC must clearly define fraudulent acts before issuing preventive regulations.

URL: https://static1.squarespace.com/static/63fe5761f287fb47d76a075a/t/66757ba6f4e60d7ce01cc81c/1718975398283/Capitol+Asset+Strategies+Memo+-5th+Circuit+Vacates+Private+Fund+Adviser+Rule+6-24.pdf

See Law of VC episode #20 - A Simple Framework for more regulatory frameworks:

#20 Episode - A Simple Framework

If you just joined us, this is the 20th episode of Law of VC, a free newsletter covering Venture Fund Law, Emerging Funds & Legal Tech. The Structure and Principles of Venture Fund Law A simple overview of venture fund law is what’s missing from my library of articles.

See Law of VC episode #28 - Everyone in VC is an Accredited Investor”:

#28 Episode - Everyone in VC is an Accredited Investor

Key Takeaways: A new proposed law would create an exam for non-accredited investors to become accredited. But due to venture fund limits and other regulations, the impact may be closer to zero. Three recommendations to fix that: Increase the number of LPs allowed per fund, open up equity crowdfunding to funds, and ease restrictions on qualifying investm…

⚠️ New $12 Million Qualifying VC Fund Threshold

On February 14, 2024, the SEC proposed to adjust the definition of “qualifying venture capital funds” that allow up to 250 beneficial owners (LPs) with no more than $10 million in aggregate capital contributions and uncalled committed capital to qualify. The proposed SEC rule would raise this threshold to $12 million to account for inflation. This threshold must be adjusted every 5 years to account for inflation.

Parallel Funds

100 LP limits can be avoided if you operate a 3(c)(1) fund with a 3(c)(7) fund in parallel; the two funds can coexist and increase the number of LP slots to raise. However, you cannot add two or more Section 3(c)(1) funds together—otherwise they become “integrated.”

The parallel funds structure is a strategy that many GPs have used recently, including Ryan Hoover at Weekend Fund 3:

The SEC has said in 2024 it will propose amendments to Reg. D and Form D that will likely change the regulatory reach and timing of the current rules. As of 2022, 18.5% of U.S. households qualified as accredited investors, a significant increase from 1.8% in 1983, the first reporting year of Reg D. Without adjustments to inflation, the U.S. accredited investor population is projected to rise to 31% by 2032. Funds have historically made up a little more than 1/3rd of all Form D filings, but more than 3x the number of Form D amendments:

The proposed changes to Form D and Reg D are projected to happen in April of 2024.

The SEC allows fund managers to file before a first closing so most funds today just file their Form D before their closing, so the initial Form D has relatively little information. Amendments should be filed within a year after first closing but not everyone does this.

“A Rule 506(b) offering, followed by a Rule 506(c) offering: Where a Rule 506(b) offering is completed and then followed by a Rule 506(c) offering, we believe integration should not be a concern because it is clear the investors in the Rule 506(b) offering were not attracted to the offering by the general solicitation in the subsequent Rule 506(c) offering. However, application of the five-factor test [before Rule 152 was amended] may not produce this result.” —The SEC.

More on the Integration Doctrine and Rule 152 is available here:

By default, one LP equals one beneficial owner (1:1). There are four “Look-Through Rules” or exceptions that apply notwithstanding the default rule:

Multiple LPs investing into an entity ‘formed for the purpose of’ specifically investing into the fund (SPVs with fund-of-fund investments);

Any LP investing 10% or more of a fund’s ‘voting securities’ (LP interests are almost always considered voting securities if the fund has any governance);

Any LP investing 40% or more of the LP’s assets into the fund; and,

Doing something indirectly that would be illegal if done directly—that is, structuring around these rules as a sham to evade the Act’s rules. Examines the substance over form of a fund’s legal structure.

See Footnote #2, above.

See Motley Fool has a venture capital arm that has raised a Section 3(c)(7) Fund with 629 LPs, closing $145 million in 2019.

While “investment adviser” is a broader term than a “fund manager” or a “VC”, within our context, the terms can be used interchangeably since every fund manager qualifies either as an “investment adviser” or “investment adviser representative”.

In the U.S., investment advisers can avoid costly registration requirements by qualifying as “exempt reporting advisers” (ERAs). ERAs must meet certain minimum requirements and file ongoing regulatory reports. To become an ERA, advisers must submit a truncated Form ADV through FINRA and amend it annually to report on their activities and funds. ERAs must also comply with various state and federal regulations. Upon submitting the Form ADV, ERAs receive a Central Registration Depository (CRD) number, which can be used to lookup previous filings on the Investment Adviser Public Disclosure website.

The “Form ADV” is a standard document used by fund managers to register with the SEC or state securities regulators (RIA) or to report as an exempt reporting adviser (ERA).

Form ADV: RIAs are required to register with the SEC or state securities authorities. As part of this process, they submit Form ADV, which provides comprehensive information about their advisory business. ERAs, on the other hand, often file a subset of Form ADV with the States and/or with the SEC (Part 1A).

State Notice Filings: ERAs may need to provide state securities authorities with a copy of their Form ADV and any amendments filed with the SEC. These filings are known as “notice filings.”

Data Collection: The data published in the Investment Adviser Public Disclosure (IAPD) come from electronic submissions of Form ADV by investment adviser firms to the Investment Adviser Registration Depository (IARD) system. This system, which is operated by FINRA Regulation, Inc. (FINRA), allows fund managers to fulfill their filing obligations under both state and federal law through a single electronic submission over the Internet.

Annul Updates: Advisers update their Form ADVs every year by March 31st.

Sections of Form ADV: The Investment Adviser Information Reports focus on specific sections of Form ADV, including:

Item 1 – Identifying Information

Item 2 – SEC Registration

Item 3 – Form of Organization

Item 4 – Successions

Item 5 – Information About Your Advisory Business

Item 6 – Other Business Activities

Item 7 – Financial Industry Affiliations and Private Fund Reporting

Item 8 – Participation or Interest in Client Transactions

Item 9 – Custody

Item 10 – Control Persons

Item 11 – Disclosure Information

ERAs: ERAs only file Items 1, 2, 3, 6, 7, 10, and 11 on Form ADV. They are exempt from certain reporting requirements.

“Solely” advises one or more venture capital funds:

The term “solely” is an important qualifier: When fund managers “solely” advise venture capital funds, it means they exclusively manage VC funds. VC fund managers generally cannot manage other private funds or investment vehicles beyond direct VC investments.

For example, if a fund manager serves other funds like crypto funds, private equity funds, or fund-of-funds (which fall outside the 20% basket rule), the VC adviser exemption won’t apply. Instead, the fund manager would need to rely on the private fund adviser exemption or register as an RIA. Note that funds under $25 million follow state law, which can differ significantly from federal law.

Importantly, the Advisers Act restrictions apply to each fund individually, not the entire portfolio. If you manage a position in a non-qualifying fund (e.g., secondary resale or fund-of-funds), you risk losing the federal VC adviser exemption.

The second element of the VC fund definition is the most important—Rule 203(l)-1(a)(2):

(2) Immediately after the acquisition of any asset, other than qualifying investments or short-term holdings, holds no more than 20 percent of the amount of the fund’s aggregate capital contributions and uncalled committed capital in assets that are not qualifying investments, valued at cost or fair value, consistently applied by the fund. § 275.203(l)-1(a)(2).

“Qualifying Investments” generally means direct equity-like investments in startups, including Convertible Notes, Safes, Preferred Stock, Warrants, etc.

“Non-Qualifying Investments” includes promissory notes and debt only instruments, secondary transactions, public stock, digital assets and fund-of-funds investments.

Source: The SEC:

The [SEC] would not object to [a VC fund manager] treating a “Warehoused Investment” as if it were acquired directly from the qualifying portfolio company for purposes of the definition of “venture capital fund” under Rule 203(l)-1 of the Advisers Act provided that: (i) the Warehoused Investment is initially acquired by the adviser (or a person wholly owned and controlled by the adviser) directly from a qualifying portfolio company solely for the purpose of acquiring the investment for a prospective venture capital fund that is actively fundraising; and (ii) the terms of the Warehoused Investment are fully disclosed to each investor in the venture capital fund prior to each investor committing to invest in the fund.

SEC ERAs vs. State ERAs:

Under $25M: If a fund adviser has <$25 million in AUM, it’s not required to register with the SEC and is in fact prohibited from doing so. That’s because at this level, an adviser is not eligible to register with the SEC unless required by state law. Most emerging venture capital fund advisers will not meet that threshold, which means they will ignore federal law and look up what state law requires.

$25M+: If the fund adviser has $25+ million AUM but is otherwise exempt under the private fund adviser exemption or the venture capital fund adviser exemption, it may be required to file a truncated Form ADV with the SEC as an exempt reporting adviser. If the state requires the fund adviser to register, then it must register with the state’s securities commissioner and may also be required to file a truncated Form ADV with the SEC as an exempt reporting adviser if the private fund adviser has AUM of $110 million or more.

To be honest, I was a bit confused by the SEC’s interpretation because it means a fund manager under $25 million AUM is prohibited from filing as an ERA with the SEC.

CA Rule 260.204.9(a)(4)(A) defines a “venture capital company” as a firm that meets one of three types of VC firms:

(A) the fund must have at least 50% of its assets (other than short-term investments or distributions to LPs) in venture capital investments valued at cost.

(B) The entity qualifies as a "venture capital fund" according to the definition in SEC rule 203(l)-1 (17 CFR § 275.203(l)-1).

(C) The entity is recognized as a “venture capital operating company” (VCOC) under ERISA, in which a 50% of its assets are in venture capital investments and the firm obtains “management rights” in each portfolio company. (29 CFR § 2510.3-101(d)).

In Law of VC #30, we discussed that the SEC ended up not adopting the more draconian indemnification prohibition initially proposed, as fiduciary duties and antifraud provisions at the federal level already cover much of the prohibited activity, including negligence. Ed. 6/21/2024: The Fifth Circuit Vacated the SEC’s Private Fund Adviser Rule on June 5, 2024. Chris Hayes has good key takeaways here. (Note: Caution, PFA is no longer good law!)

#30 Episode - Survival Guide to VC Regulations

Key Takeaways: On August 23, 2023, the SEC enacted comprehensive new rules for private fund advisers, including venture capital (VC) firms. There are seven new rules. VCs need to comply with two of them and they’ll have 18 months to do it. Most sub-rules can be

Demanding management fees upfront or applying fund expenses without proper disclosures & policies can result in multi-million dollar fines. See SEC Charges Venture Capital Fund Adviser with Misleading Investors (2022); see also NH Bureau of Securities Reaches Settlement with Manchester-Based Alumni Ventures Group (2022).

⬛ On March 1, 2024, the Corporate Transparency Act (CTA) was ruled unconstitutional by a federal court judge in Alabama, but what does it mean for emerging VCs and SPV allocators?

• WHO MUST REPORT: Under the CTA, all corporations, LLCs, partnerships, certain trusts, and funds operating or registered in the U.S. (“Reporting Companies”) must report to FinCEN, a US federal agency. The federal law applies to 33+ million entities formed in the US that are not exempted.

• WHO IS EXEMPT: Common exceptions include (i) large companies, (ii) RIAs, or (iii) venture capitalists (VCs) who file as SEC exempt reporting advisers—that is, VCs with $25M+ in assets under management (AUM).

—Notably, State ERAs do not seem to be exempt from the CTA, which means many emerging VCs would have to comply with the law unless they file a Form ADV that relies on §203(l)-1, the federal VC adviser exemption.

• WHEN IS REPORTING DUE: The CTA went effect on January 1st, 2024, and entities formed before 2024 would must complete their filings by January 1st, 2025.

• WHAT'S THE BIG DEAL: Penalties are $500/day + up to $10,000 in fines and 2 years in federal prison.

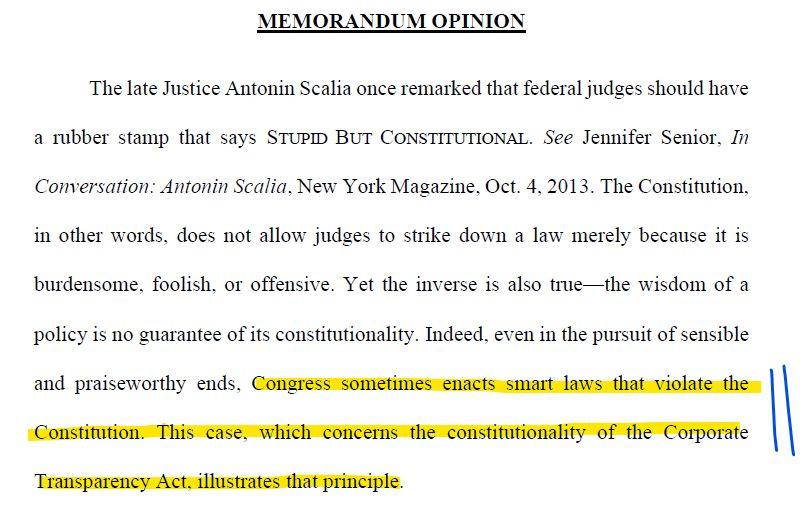

• WHAT HAPPENED IN ALABAMA: The CTA sparked a huge debate behind the scenes as lawyers argued for legitimate regulatory oversight vs. constitutional freedoms.

—On the one hand, Congress was concerned about significant activity in money-laundering and the CTA was intended to enhance KYC/AML to combat money laundering/terrorism financing, promote corporate transparency & ensure national security by requiring self-reported disclosures from most companies.

—On the other hand, the National Small Business Association (NSBA), which represents some 65,000 small business interests, argued that it was unconstitutional to put federal regulatory oversight on businesses which the CTA extends beyond the constitutional powers granted to Congress.

—The NSBA also argued (i) the mandate placed an UNDUE BURDEN on small businesses (including emerging fund managers), both in terms of privacy and financial costs, with compliance expenses estimated at $8K in year 1; (ii) what if HACKERS can breach the US federal databases with security and privacy issues very much a concern; and (iii) what is the CTA's effectiveness in preventing money laundering, terrorism financing, and other illicit activities if the BAD GUYS can simply bypass the filing requirements, rendering the CTA ineffective in its primary goals?

✍️⚖️ The judge, in his 53-page opinion, wrote:

“Congress sometimes enacts smart laws that violate the Constitution... This case, which concerns the constitutionality of the Corporate Transparency Act, illustrates that principle.”

The decision permanently prevents the government from enforcing the CTA against the NSBA and its members. The NSBA had argued that the CTA placed an unfair burden on small businesses by mandating the disclosure of "highly personal" details to the Financial Crimes Enforcement Network (FinCEN) and imposed significant compliance costs.

• WHO DOES THE CASE EXEMPT? Right now the ruling seems to apply just to the 65K NSBA members, but this case will work its way up the chain, possibly even to the US Supreme Court.

The March 1 judgment applies to 0.1%-0.2% of the small business owners FinCEN estimates are impacted by the Corporate Transparency Acts' Beneficial Ownership Information filing requirement.

Here is the applicable VC exemption for the Corporate Transparency Act:

“Venture capital fund adviser. Any investment adviser that:

(A) Is described in section 203(l) of the Investment Advisers Act of 1940 (15 U.S.C. 80b–3(l)); and

(B) Has filed Item 10, Schedule A, and Schedule B of Part 1A of Form ADV, or any successor thereto, with the Securities and Exchange Commission.”

This is Item 10:

But the important part is that it is “filed … with the SEC”. In other words, it is an SEC ERA, not just a State ERA.

H.R. 2799, Report No. 118–143, Part I (Mar. 8, 2024), Title III—Improving Capital Allocation for Newcomers.

X.com and GovTrack.us:

You're the best in the business, Chris. Plain and simple. This is excellent.