#29 Episode - Regulatory Leviathans

New Regs Are Coming! • Breaking Down the VC Fund Regulatory Framework • Why the Advisers Act is the SEC's Most Powerful Tool • Summary of PFA Rules for VCs

Key Takeaways: The SEC is about to pass new regulations for private fund advisers, including venture capital (VC) firms. If adopted, these rules would be the first meaningful set of VC regulations since the Dodd-Frank Act came into effect after the Great Financial Crisis of 2008. These rules cover a wide range of issues under the Advisers Act and apply to both registered and unregistered investment advisers. A final vote is expected this week. Dear readers, if these rules pass as proposed—which seems likely now—brace yourselves.

[Edited 8/31/2023: A new article has been published that goes into details on the FINAL Rules here].

[Ed. 6/21/2024: The Fifth Circuit Vacated the SEC’s Private Fund Adviser Rule on June 5, 2024. Chris Hayes has good key takeaways here. (Note: Caution, the PFA is no longer good law!]

New Regs Are [No Longer] Coming

But Three Legislative Acts Are Probably Not

In my last article, we discussed three proposed legislative acts languishing around the halls of Congress, all aimed at improving conditions for raising VC funds, including:

Increasing the number of permitted LPs per fund from 100 to 200+ LPs;1

Expanding VC “qualifying investments” to secondaries and fund-of-funds;2 and,

Granting accredited investor status to those who pass a knowledge-based test.3

Today, we look at the opposite side and focus on proposed government restrictions.

The Proposed PFA Rules

These rules proposed by the SEC for Private Fund Advisers (PFA)4 apply to VCs:5

Fiduciary Duties: GPs will be prohibited from seeking indemnification or exculpation for a breach of fiduciary duty, bad faith, negligence or recklessness.6

No Preferential Treatment Without Disclosure: GPs will be required to disclose, on a rolling basis and annually, to all current or prospective LPs any preferential treatment provided to an LP in a side letter or otherwise.7

GP Clawbacks for Taxes: GPs will be prohibited from reducing the clawback by taxes paid by the GP and otherwise required to be paid back.8

Fees and Expenses: GPs will be prohibited from passing off registration fees, examinations or investigations, even where such fees and expenses are disclosed.9

Non-Pro Rata Fee Splits: GPs will be prohibited from charging fees and expenses related to a portfolio investment on a non-pro rata basis when multiple funds invest or have invested in the same investment (e.g., with SPVs/co-investments).10

Effective Date: Will these compliance rules take effective immediately? Over time? Or will emerging managers get a break as applied to new funds only?11

Institutional Limited Partner Association's Take

Here are the key takeaways from the Institutional Limited Partner Association (ILPA)—generally, they support the new proposed rules, but with certain modifications:12

Ed. 8/26/2023: Here are the rules as they actually passed:

Before we get into the weeds of the proposed rules, it might be helpful to understand how these rules fit within the broader context of the VC regulatory framework.

Breaking Down the VC Fund Regulatory Framework⚖️

A couple of years ago, I wrote that:

“[T]here are three main laws that govern 80% of venture capital fund law”: (1) the Securities Act, (2) the Investment Company Act, and (3) the Advisers Act:13

While this is directionally accurate, it’s a bit misleading since it implies all three laws hold equal weight. But that’s not the case. In reality, only one law matters:

90%+ of the most important fund laws and regulations come from one statute—the Advisers Act. 🤯

Why is the Advisers Act the Most Important Law?✍️⚔️🫡

The Advisers Act serves as the backbone for VC fund law—but what about this law makes it so important or powerful?

It’s not because the Advisers Act is an obscure area of law that few people understand. Nor is it because the law is the newest or most specialized type of regulation for money managers—also called “investment advisers” (with an ‘e’, for some reason).14

The SEC’s Triad of Power

The reason why the Advisers Act is the most important law is because it grants the SEC the power to do three things.15

We’ve all heard that:

The pen is mightier than the sword

But what if someone holds the power to wield both the pen and the sword? And what if that someone also has the power to probe?

The Advisers Act grants the SEC all three of these powers:

By providing the SEC the power to create rules and regulations (the pen), the power to investigate (the probe) and the means to enforce those rules (the sword), the law ensures that investment advisers remain under the strict control of the SEC.

This triad of rulemaking, investigating, and enforcement authority constitutes the cornerstone of the SEC’s regulatory arsenal and why the Advisers Act is so powerful.

But true power comes not just from statutory authority, but also from court deference. Administrative agencies like the SEC receive the benefit-of-the-doubt when interpreting their own rules and laws because the Supreme Court ruled in 1982 that courts will generally defer to agencies for interpretations of statutory law (Chevron deference).16 Chevron deference ensures that government agencies like the SEC receive broad authority without much in the way of checks-and-balances because they have little judicial scrutiny to override their decisions.17

SEC Regulatory Priorities

After the boom years of 2020-2021, fund lawyers are bracing for a wave of U.S. regulatory enforcement actions that are unprecedented in scope and intensity.

Each year, the SEC unveils its list of enforcement priorities, and here are some of its stated priorities for the upcoming year 2023-2024:

Conflicts of interest*

Fees and expenses calculations*

Compliance with the Marketing and Custody Rules

Audited financial statements

Fiduciary duties*

*All of these five rules fall under the Advisers Act, although not all of them apply to VCs.

Here’s a brief overview of these rules:

Conflicts of interest: The importance of transparency and fairness in dealings cannot be overstated. Where a conflict exists and can be waived (for example, a principal transaction in which warehoused assets are proposed to be transferred into the fund), informed written consent by LPs must be provided prior to transfer.

Calculation and Allocation of Management Fees & Expenses: including the calculation of post-commitment period management fees and the impact of valuation practices at VC funds (See SEC’s action against Alumni Ventures Group).18

Compliance with the Marketing and Custody Rules: While these rules generally only apply to registered advisers, performance advertising and compensated testimonials, endorsements, solicitations will receive extra scrutiny (See SEC settlements against celebrities such as Kim Kardashian, Lindsay Lohan, Jake Paul).19

Fiduciary Duties: This varies by jurisdiction and contract, but generally, all investment advisers (including VCs / ERAs) have “fiduciary duties.”

That means that you have a duty to act in good faith with the degree of care, skill, prudence and diligence under the circumstances that a prudent person acting in a fiduciary capacity would use, in providing investment advice and managing fund assets.

How can you meet your fiduciary duties? "Consult with your lawyer" and "follow the rules" are a given, but also:

Encourage LPs to consult with THEIR lawyers and tax professionals. For example, LPs may not be aware that warehoused investments may affect their QSBS tax benefits (generally, these assets are ineligible for QSBS)

Provide full and fair disclosure and seek informed consent on all conflicts. For example, with valuation concerns, get LPAC or majority LP consent

Create and enforce internal written policies and procedures to ensure compliance with obligations. Have a code of ethics. Review annually.20

SEC Enforcement Actions

This year, Gurbir Grewal, Director of the Division of Enforcement, announced that,

“While [the SEC] set a Commission record [in 2022] for total money ordered back at $6.4 billion, including a record $4.2 billion in penalties, we don’t expect to break these records and set new ones each year because we expect behaviors to change. We expect compliance.”21

What’s causing this unprecedented level of enforcement actions? Did the highs of the bull market suddenly cause a lack of scruples and a flagrant disregard for compliance?

Not likely. What’s happening here is the SEC is noticing something peculiar in markets. Capital is no longer flowing heaviest into the public markets, where regulation is much tighter.

“Private markets are the new public markets” —Matt Levine

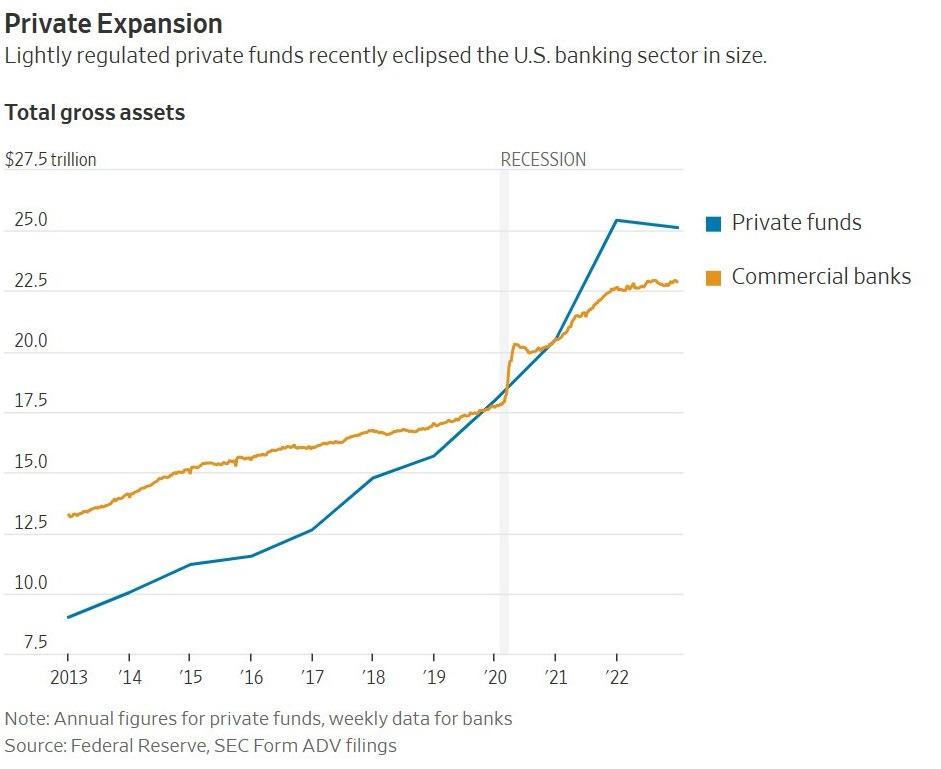

The SEC’s 2023 Enforcement Priorities manual notes that there’s been an 80% surge in the gross assets of private funds over the last 5 years, largely driven by a zero interest rate policy and market exuberance. There are now ~50,000 private funds with around $25+ trillion in assets under management. Several years ago, private markets started outpacing public markets in terms of financing volume for private deals. Even with a down market in 2023, private markets still eclipse public markets in terms of total amount raised for equity financing. In fact, just the private funds industry alone has eclipsed the U.S. banking industry since 2021:

This is why Gary Gensler said the following about this change in market dynamics:

“[T]he only enemy more dangerous than a man with unlimited resources is one with nothing to lose.” —Chuck Rhoades, Billions

The VC Community’s Response

Ben Horowitz, co-founder of a16z, has labeled the current US regulatory environment as “existential” to American innovation. Even the former SEC Chair Jay Clayton has taken aim at the “regulation by enforcement” approach under the current administration. Although not naming any single agency or individual actor, Clayton said that it is a total abuse of power if “[the government thinks that if we’re not losing cases], we aren’t suing enough businesses.”

Regardless if that rhetoric is over-the-top or not, it highlights why some business leaders think the government has taken it a step too far.

But is that true for VCs? How bad can the regulations really be?

Registered Investment Advisers (RIAs)

Patrick O'Shaughnessy isn’t so sure why more VCs aren’t fully registered as RIAs:

There are apparently only 18 registered VC firms in the US:22

a16z, General Catalyst and Sequoia Capital have all become registered investment advisers (RIAs) in recent years in order to invest more of their funds into different assets outside of startup equity (including crypto, public stocks, and secondaries). That leaves the remaining 4,000+ VC firms who are not RIAs.

So why aren’t more VC advisers moving to register with the SEC?

1️⃣ Costs: A 2017 survey revealed that exempt reporting advisers (ERAs) spend an average of $60,000 per year in compliance costs, whereas RIAs spend an average of $330,000 annually. The new PFA rules will now require VCs to eat these costs.

2️⃣ Regulatory burdens: RIAs can only charge carry to “qualified clients,” must conduct audits, comply with a list of other SEC-adviser requirements, including the need to appoint a chief compliance officer. Audits will now be required by RIAs no matter what—no more relying on private fund exception to avoid audits.

3️⃣ State regulations: For firms with less than $150 million in assets under management, it's often easier to comply with state laws. In states like California, maintaining exempt status requires 50% or more investments to be VC related, which is more lenient than the 80% federal law threshold.

Even though RIAs outnumber ERAs 10:1 across the regulatory investment landscape, in the venture capital industry, it's heavily skewed in the opposite direction (1:200+).

In early 2023, the SEC placed special emphasis on registered investment advisers (RIAs):

Currently, more than 5,500 RIAs, totaling over 35% of all RIAs, manage approximately 50,000 private funds with gross assets exceeding $21 trillion. Private fund assets continue to grow. In the past five years, there has been an 80% increase in the gross assets of private funds, with retirement plans steadily contributing to this growth. [We] will continue to focus on RIAs to private funds. [21]

If you want to avoid SEC adviser registration, each and every one of your funds has to fit into ONE of the two boxes in the graphic below below. In other words, if only one of your funds is not considered a “venture capital fund,” then you lose your VC exempt status and must rely on a different exemption, such as the private fund adviser exemption, or else you must register with the SEC as an RIA.23

Summary of Proposed PFA Rules for VCs

So where does that leave VCs? If you want to get ahead of where the regs are going, you should pay close attention to what happens with the SEC this Wednesday, August 23rd.24 Will the PFA rules proposed by the SEC come to pass? Will VCs be impacted by those rules? What about emerging fund managers, will they be exempted for now?

While we wait to see what the SEC is going to deliver, it would be a good idea to summarize the proposed PFA rules so we can compare what the final rules provide.

Here is a summary of the proposed PFA rules that apply to VCs:

Prohibited Activities for Private Fund Advisers

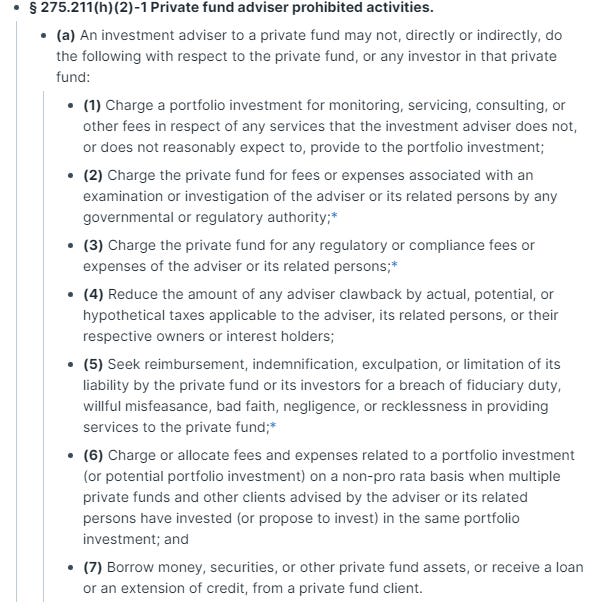

§ 275.211(h)(2)-1(a) details the prohibited activities related to fees, expenses, liability, and borrowing:25

Prohibited Fee and Expense Allocations:

(1) Charging portfolio investments for services the GP does not provide or is not reasonably expected to be provided.

(2) Charging private fund clients for examination or investigation fees of the GP or related persons.

(3) Charging private fund clients for regulatory or compliance fees of the GP or related persons.

(6) Charging or allocating fees related to portfolio investments on a non-pro rata basis for multiple private funds managed by the GP or related persons.

Restrictions on GP Clawbacks

(4) Reducing the amount of any GP clawback by applicable taxes to the GP or related persons.

Restrictions on Limitations of Liability:

(5) Seeking reimbursement, indemnification, or limitation of liability for breaches or negligence in providing services.

Borrowing Restrictions:

(7) Borrowing money, securities, or other private fund assets, or receiving a loan or extension of credit from a private fund client.

Rules on Preferential Treatment

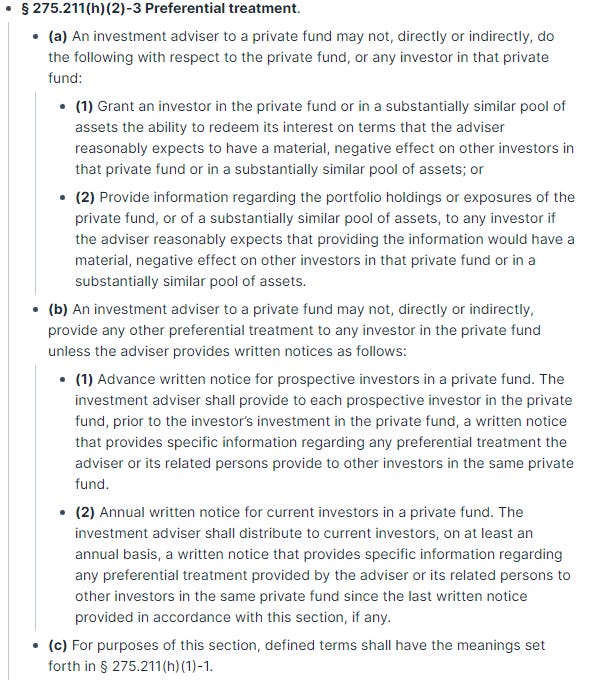

§ 275.211(h)(2)-3 outlines the rules related to preferential treatment, including redemption, information sharing, and written notices:26

Redemption and Information Sharing:

Not granting an investor the ability to redeem interests on terms that negatively affect other investors.

Not providing information on portfolio holdings or exposures if it would have a negative effect on other investors.

Disclosure of Preferential Treatment:

Providing advance written notice to prospective investors regarding specific preferential treatment provided to other investors.

Distributing annual written notice to current investors regarding any preferential treatment provided since the last notice.

Final Takeaways

There’s no doubt the PFA rules will have implications on the VC industry. It’s hard to say exactly how impactful they will be until (a) we know what the final rules provide, (b) when the rules will go into effect, and (c) how the industry and regulators use them.

But we will see some fundamental shifts on several things including:

No Indemnification for Negligence. Without provisions for indemnification in cases of ordinary negligence, fund managers will be barred from pursuing reimbursement for lapses in judgement or adhering to the standard of care expected of a reasonable person in their position. Currently you can waive ordinary negligence but not gross negligence or intentional wrongdoing.

Ordinary negligence is like getting a parking ticket because you forgot to fill the parking meter.

Gross negligence is like running over the meter and parking on the sidewalk.

Intentional wrongdoing is like hitting a person or a pet with your car because you had road rage.27

Compliance Costs and Impact. The costs associated with compliance cannot be transferred to LPs, which means that the financial burden will be directly taken by GP’s bottom line, which can have an impact on management fees and budgets. This benefits service providers, including lawyers and specialized compliance experts, as well as insurance companies capable of underwriting the newly adjusted risks. This comes at the cost of new startups or continuing new funds.

Disproportionate Impact on the Emerging Fund Managers. Large RIAs are in a much better position to accept the new PFA rules with relative ease. While these changes may increase their operational costs, the effect is manageable. On the other hand, emerging fund managers, with limited resources to meet complex compliance obligations, may face potentially existential challenges. The issue for these smaller advisers stems from a risk standpoint: they may either be unwilling to assume such a degree of risk or, if they do accept it, find themselves unable to fulfill their legal obligations should they be found in violation of the rules. This disproportionality in impact emphasizes the heightened vulnerability of emerging managers compared to their larger counterparts.

The adoption of the PFA rules by the SEC is a calculated move in line with the SEC’s more aggressive regulatory approach. While ostensibly to enhance transparency, protect investors, safeguard public interests, and address specific challenges prevalent in the private fund structure, the rules will have the effect of significantly increasing the costs of compliance, increasing insurance costs, and slowing down the formation of capital at a time when it has been one of the hardest periods to raise funds in over a decade.

There’s always a tension between investor protection and capital formation, but the question is whether the regulators will get the balance right?

We will have to wait and see until Wednesday and report back with the final rules. Stay tuned.

Disclaimer: This article is intended to provide VCs with an overview of the key aspects of the new private fund adviser rules. However, it is not intended to be an exhaustive resource, and other factors may apply to your specific situation. You are strongly encouraged to seek guidance from experienced fund counsel to ensure compliance with the issues discussed above.

Subscribing to the Law of VC newsletter is free and simple. 🙌

If you've already subscribed, thank you so much—I appreciate it! 🙏

As always, if you'd like to drop me a note, you can email me at chris@harveyesq.com, reach me at my law firm’s website or find me on Twitter at @chrisharveyesq.

Thanks,

Chris Harvey

See, e.g., 1. Increase the Number of LPs Allowed Per Fund and increase capital limits for Section 3(c)(1) funds by doubling the current 100 beneficial owner limits for private funds > $150M and increasing the limits to 600 beneficial owners for funds < $150M (the ICAN Act).

See, e.g., 3. Ease Restrictions on “Qualifying Investments” in VC Funds. This would allow fund-of-funds and secondary funds

Importantly, the proposed exam would not require an annual license or registration, unlike the current accredited investor rules which require a “license in good standing” after passing one of the Series 7, Series 65 or Series 82 exams, which many people are unaware of. Apparently, the likelihood of this law passing is extremely low and I have not seen the NVCA actively campaigning for it to pass.

See SEC’s notice to proceed to a final vote on Wednesday, August 23, 2023 (“The Commission will consider whether to adopt rules and amendments under the Investment Advisers Act of 1940 (‘Advisers Act’) for private fund advisers and whether to adopt amendments to the compliance rule under the Advisers Act.”)

The terms “Fund Managers,” “GPs” and “Emerging Managers” are used interchangeably throughout this article. However, none of these terms are legal terms.

The Advisers Act describes GPs as:

“as an investment adviser [that acts] solely to 1 or more venture capital funds”. Section 203(l).

As Chris Addy noted on LinkedIn:

In a 342-page proposal—in the most significant VC regulations since the Great Financial Crisis in ‘08—the SEC uses “limited partner” once; GPs are barely mentioned

Instead, “investors” is mentioned 1,187 times; “adviser” is mentioned 2,507 times.

VCs are subject to the same regs designed for service providers and wealth advisers

For example, at one point, the Staff complains about normal LPAC setups, see here:

“Private funds also do not have comprehensive mechanisms for private fund investors to exercise effective governance, which is exacerbated by the fact that private fund advisers often provide certain investors with preferential terms that can create potential conflicts among the fund’s investors...

To the extent investors are afforded governance or similar rights, such as LPAC representation, certain fund agreements permit such investors to exercise their rights in a manner that places their interests ahead of the private fund or the investors as a whole.

For example, certain fund agreements state that, subject to applicable law, LPAC members owe no duties to the private fund or to any of the other investors in the private fund and are not obligated to act in the interests of the private fund or the other investors as a whole."

But the LP fund is legally a passive structure without active governance rights or management rights. Even assuming that the power imbalance should be more aligned in favor of LPs, if LPAC members are making fund-level decisions, aren't they acting as fiduciaries to other LPs? If they are making decisions that impact other investors, should LPAC members continue to keep their “limited partner” legal status? Should LPs be responsible for their own decision-making, or are they more akin to shareholders in a corporation? Is it any different than corporate directors making company-level decisions? Corporate directors are fiduciaries - should LPAC and LP members be fiduciaries by default? Do LPACs survive in tact if the PFA rules are passed as they were proposed?

The ILPA has a great summary of the rules and their responses. See The Future of Private Equity Regulation: Insight Into the Limited Partner Experience & the SEC's Proposed Private Fund Advisers Rule (2023), Institutional Limited Partners Association (ILPA), at page 6.

While the new PFA rules will apply to both exempt reporting advisers (“ERAs”) and registered investment advisers (“RIAs”), the focus of this article will be on ERAs.

The statutory definition of “investment adviser” is broad and under Section 202(a)(11) of the Advisers Act, an “investment adviser” is a person who:

• Is engaged in the business of providing advice to others.

• Provides advice on buying or selling securities; and,

• Provides such advice for compensation.

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (“Dodd-Frank Act”) expanded the SEC’s oversight for private fund advisers following the 2008 Great Financial Crisis. The Dodd-Frank Act setup very light rules for venture capital advisers to private funds but private funds had more scrutiny, particularly over certain thresholds and mandating $150M AUM to register with the SEC, enhancing regulation and accountability.

Rulemaking Authority: Section 211(h) was added to the Advisers Act by the Dodd-Frank Act, directing the SC to facilitate simple and clear disclosures to investors about the terms of their relationships with investment advisers. This authority is part of the basis the SEC is using for passing the first meaningful regulatory change since the Dodd-Frank Act came into effect after the 2008 Great Financial Crisis.

Chevron deference is a principle in administrative law that stems from Chevron U.S.A., Inc. v. Natural Resources Defense Council, Inc., 468 U.S. 837 (1984) which grants judicial deference to administrative interpretations of statutes they administer by applying a two-part test. The test first asks “whether Congress has spoken directly to the precise issue?,” and second, if not, “whether the agency's interpretation is a permissible construction of the statute?” (Cornell Law School - LII).

The first part of the test will almost always pass, because there is only a very finite amount of space that Congress can use to legislate and Congress will often not speak directly to most issues. Therefore, if the statute is ambiguous, courts must only determine if the agency’s interpretation is “permissible” (i.e., based on a reasonable construction of the law).

While Chevron deference only applies to agency interpretations in proceedings with legal force, such as adjudications or notice-and-comment rulemaking, interpretations without the force of law may receive different treatment—eg, Skidmore deference or Auer deference.

There are exceptions to this general rule because the Administrative Procedure Act (APA) requires courts to set aside agency action that is “arbitrary, capricious, an abuse of discretion, or otherwise not in accordance with law.” And some courts will exercise their judicial scrutiny. See, for example, the 5th Circuit’s reversal of the CFTC’s sudden decision to rescind a no-action letter granted to PredictIt. But by and large it’s a high bar to overrule.

Even though these rules (Rule 204A-1; Rule 206(4)-7) only apply to registered advisers, I have seen institutional LPs require them as a matter of good business practices.

The SEC indicated that in 2022, the SEC filed a total of 760 enforcement actions — a 9% increase from 2021. The SEC filed an average of 768 actions per year between 2017 and 2022, with the most actions (862) filed in FY19. In addition, over $6 billion in monetary relief was ordered by the SEC in 2021, including civil penalties and disgorgement — the most in SEC history. This compares with an annual average of approximately $4.5 billion in penalties and disgorgement from FY17 to FY22.

SEC 2023 Examination Priorities Report: The Division will focus its examination on private fund RIA’s conflicts of interest, calculation and allocation of post-commitment period management fees, policies regarding the use of data under Section 204A of the Advisers Act, compliance with Advisers Act Rule 206(4)-2 (the Custody Rule), as well as the Marketing Rule discussed above.

A crucial factor lies in avoiding the SEC adviser limitations, which provide that no more than 20% of any fund can have “non-qualifying investments,” which is any asset that is not startup equity or equity-like securities. (See graphic below). There are also state rules too many to go over, but generally found here: Guide to State Investment Adviser Registration Exemptions for Private Fund Advisers (2023).

See Footnote #4. https://www.sec.gov/

See Footnote #6. https://roamresearch.com/#/app/Funds/page/RPTn-VO5I

See Footnote #7. https://roamresearch.com/#/app/Funds/page/rD8e13jqy

While these analogies don’t perfectly map to the actual conduct standards, they do provide a generalized understanding. Also none of these terms are defined in the new PSA rules.

Ordinary Negligence: The parking ticket analogy represents a minor oversight or failure to exercise the care that a reasonably prudent person would use in a similar situation. It’s an example for ordinary negligence, where the neglect may not be intentional but stems from a lack of due care.

Gross Negligence: Running over the meter and parking on the sidewalk conveys a more severe disregard for standard conduct or the well-being of others. Gross negligence typically involves a substantial lack of concern for the risk or consequences.

Intentional Wrongdoing: The act of hitting a person or pet out of road rage illustrates a willful and deliberate action that causes harm. Intentional wrongdoing in legal terms refers to actions done with a purpose to cause harm or with the knowledge that harm is highly likely.

thank you so much for compiling and summarizing all this information! It's rare that I ever read an entire article about regulation, but this was just so, so helpful